An X Form

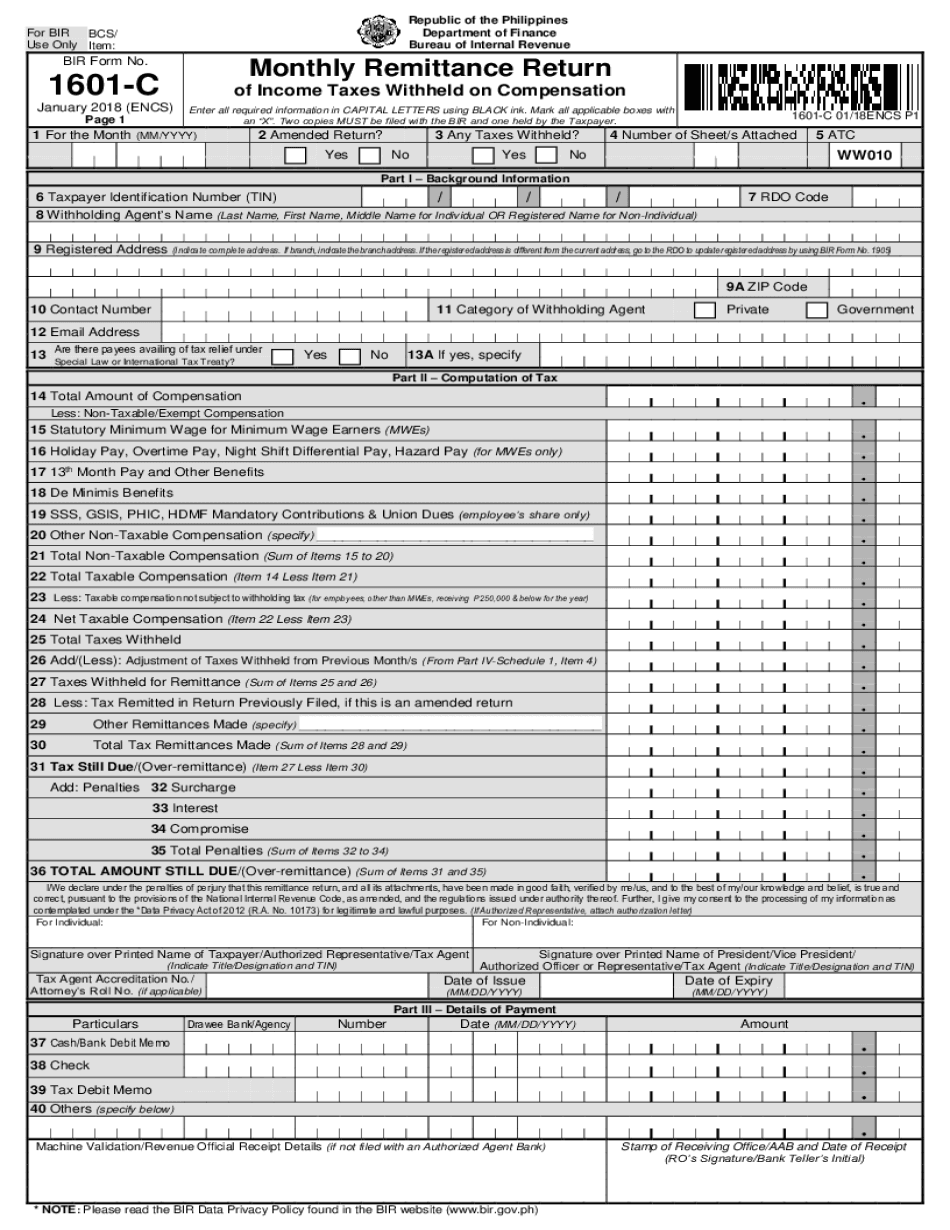

What is the 1601c form?

The 1601c form, also known as the BIR Form 1601-C, is a tax-related document used in the Philippines for the remittance of income taxes withheld on compensation. It is essential for employers and businesses to accurately report and remit taxes withheld from employee salaries to the Bureau of Internal Revenue (BIR). This form ensures compliance with tax regulations and helps maintain transparency in financial dealings.

How to use the 1601c form

To effectively use the 1601c form, employers must gather necessary information about their employees, including names, Tax Identification Numbers (TIN), and the amount of income tax withheld. The form can be filled out electronically or manually. Once completed, it should be submitted to the BIR along with the payment for the withheld taxes. Utilizing digital tools can streamline this process, making it easier to manage and submit the form accurately.

Steps to complete the 1601c form

Completing the 1601c form involves several key steps:

- Gather employee information: Collect names, TINs, and income details.

- Fill out the form: Input the required data accurately in the designated fields.

- Calculate tax withheld: Ensure the correct amount of tax is calculated based on the employees' earnings.

- Review the form: Check for any errors or omissions before submission.

- Submit the form: File the completed form with the BIR, either online or through physical submission.

Legal use of the 1601c form

The 1601c form is legally binding when filled out correctly and submitted on time. Compliance with tax laws is crucial for businesses to avoid penalties. The form serves as proof of tax remittance, which is essential for both the employer and the employee. Understanding the legal implications of this form helps ensure that businesses adhere to tax regulations and maintain good standing with the BIR.

Filing deadlines / Important dates

Filing deadlines for the 1601c form are critical for compliance. Typically, employers must submit this form on or before the tenth day of the month following the month in which the taxes were withheld. Staying informed about these deadlines helps prevent late submissions, which can result in penalties and interest charges. Regularly checking the BIR's announcements can assist in keeping track of important dates.

Who issues the 1601c form

The 1601c form is issued by the Bureau of Internal Revenue (BIR) in the Philippines. The BIR is responsible for tax collection and enforcement of tax laws in the country. Employers must ensure they are using the most current version of the form, as updates may occur to reflect changes in tax regulations or requirements.

Quick guide on how to complete an x

Effortlessly Prepare An X on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without hassle. Manage An X across any platform using the airSlate SignNow applications available for Android or iOS, and enhance any document-centric process today.

The Easiest Way to Modify and eSign An X with Ease

- Locate An X and then click Get Form to begin.

- Make use of the provided tools to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details thoroughly and then hit the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all of your document management needs with just a few clicks from any device of your choice. Modify and eSign An X and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the an x

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is a 1601c form and how is it used?

The 1601c form is a document required for specific tax reporting purposes. It is often used by businesses to disclose certain financial information to government authorities. Understanding how to fill out and submit the 1601c form is crucial for staying compliant with tax regulations.

-

Does airSlate SignNow support electronic signing of the 1601c form?

Yes, airSlate SignNow allows users to electronically sign the 1601c form securely and efficiently. Our platform ensures that all signatures are legally binding and compliant with regulations. You can easily send the 1601c form to multiple recipients for signing.

-

What features does airSlate SignNow offer for managing the 1601c form?

airSlate SignNow provides a range of features designed to streamline the management of the 1601c form. Users can create templates, customize fields, and automate approval processes. Additionally, our platform offers tracking capabilities to monitor the signing status of the 1601c form.

-

Is airSlate SignNow a cost-effective solution for handling the 1601c form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to handle the 1601c form. Our pricing plans are competitive, and you can save time and resources by streamlining your document signing process. This efficiency translates to cost savings for your organization.

-

How does airSlate SignNow ensure the security of the 1601c form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure storage solutions to protect your data while handling the 1601c form. Our platform is compliant with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other tools for managing the 1601c form?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enabling you to manage the 1601c form alongside your existing systems. Whether you’re using CRM software or accounting tools, our platform can be tailored to fit your workflow.

-

What are the benefits of using airSlate SignNow for the 1601c form?

Using airSlate SignNow for the 1601c form provides numerous benefits, including faster turnaround times and enhanced tracking capabilities. The platform allows for easy collaboration among team members, ensuring all necessary parties can review and sign the document promptly. Additionally, the user-friendly interface simplifies the entire process.

Get more for An X

- Lic995a form

- Maths mate 7 answers pdf form

- Dic 23 43671437 form

- Scientific notation word problems worksheet with answers pdf 361928630 form

- Form c see rule 14 arrival report of foreigner in ernakulamrural keralapolice gov

- Test ipp r gratis form

- Account opening form 26676790

- Authorization to use andor disclose educational and form

Find out other An X

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form