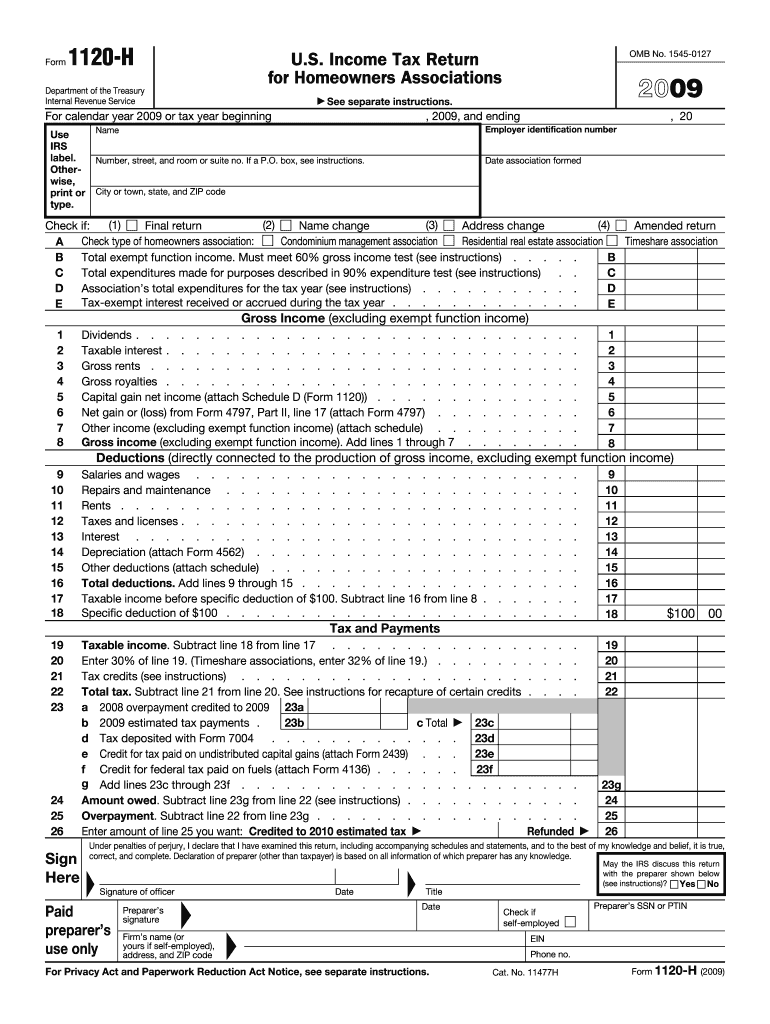

Online Form Us Income Tax Return for Homeowners Associations

What is the 2009 Form 1120?

The 2009 Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations operating in the United States, as it provides the Internal Revenue Service (IRS) with a comprehensive overview of the corporation's financial activities for the tax year. Corporations must file this form annually, detailing their earnings and tax obligations.

Key Elements of the 2009 Form 1120

The 2009 Form 1120 includes several key sections that are crucial for accurate reporting. These sections cover:

- Income: This section details all sources of income, including sales, dividends, and interest.

- Deductions: Corporations can list various deductions, such as operating expenses, salaries, and benefits.

- Tax Computation: This part calculates the tax owed based on taxable income.

- Signature: The form must be signed by an authorized officer of the corporation to validate the information provided.

Steps to Complete the 2009 Form 1120

Completing the 2009 Form 1120 involves several steps to ensure accuracy and compliance. The following steps outline the process:

- Gather all necessary financial records, including income statements and expense reports.

- Fill out the income section, ensuring all sources of revenue are accurately reported.

- List all allowable deductions in the appropriate section.

- Calculate the total taxable income and the corresponding tax owed.

- Review the completed form for accuracy and ensure all required signatures are included.

- File the form with the IRS, either electronically or by mail, by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the 2009 Form 1120 are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the deadline would be April 15, 2010. Extensions may be available, but they must be requested in advance.

Legal Use of the 2009 Form 1120

The 2009 Form 1120 must be completed accurately to ensure its legal validity. It serves as an official document for the IRS, and any discrepancies can lead to audits or penalties. Corporations are encouraged to maintain thorough records and consult with tax professionals to ensure compliance with all tax laws and regulations.

Form Submission Methods

The 2009 Form 1120 can be submitted through various methods. Corporations may choose to file electronically using approved software or submit a paper form by mail. Each method has its own requirements and processing times, so it is important to select the one that best suits the corporation's needs.

Quick guide on how to complete online form us 2009 income tax return for homeowners associations

Complete Online Form Us Income Tax Return For Homeowners Associations effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the needed form and safely archive it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents swiftly without interruptions. Manage Online Form Us Income Tax Return For Homeowners Associations on any device using airSlate SignNow apps for Android or iOS and simplify any document-centric process today.

How to adjust and eSign Online Form Us Income Tax Return For Homeowners Associations easily

- Find Online Form Us Income Tax Return For Homeowners Associations and click Get Form to commence.

- Utilize the resources we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Online Form Us Income Tax Return For Homeowners Associations and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

May I work for non-government jobs. Do I have to fill the income tax return form?

I do not understand your first question. Regarding your second question everyone who has invome above the threhhold exempt limit of 2.5 lakhs has to file an income tax return exceot if you are a farmer and your sole source of income is farming, or if you belong to a list of people who have been exempted from income tax as per the Act.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

Create this form in 5 minutes!

How to create an eSignature for the online form us 2009 income tax return for homeowners associations

How to make an eSignature for your Online Form Us 2009 Income Tax Return For Homeowners Associations in the online mode

How to make an eSignature for the Online Form Us 2009 Income Tax Return For Homeowners Associations in Chrome

How to create an electronic signature for putting it on the Online Form Us 2009 Income Tax Return For Homeowners Associations in Gmail

How to make an eSignature for the Online Form Us 2009 Income Tax Return For Homeowners Associations from your mobile device

How to generate an eSignature for the Online Form Us 2009 Income Tax Return For Homeowners Associations on iOS

How to generate an electronic signature for the Online Form Us 2009 Income Tax Return For Homeowners Associations on Android OS

People also ask

-

What is the Online Form US Income Tax Return For Homeowners Associations?

The Online Form US Income Tax Return For Homeowners Associations is a specialized document designed for homeowners associations to file their income tax returns electronically. This form simplifies the tax filing process, ensuring compliance with IRS regulations while maximizing efficiency. With airSlate SignNow, you can easily access and eSign this form online.

-

How can airSlate SignNow help with the Online Form US Income Tax Return For Homeowners Associations?

airSlate SignNow streamlines the completion and submission of the Online Form US Income Tax Return For Homeowners Associations by providing an intuitive interface for filling out and eSigning documents. Our platform enables users to manage their tax forms efficiently, reducing paperwork and saving time. Plus, you can collaborate with board members seamlessly.

-

What features does airSlate SignNow offer for filing the Online Form US Income Tax Return For Homeowners Associations?

With airSlate SignNow, you gain access to features like customizable templates, real-time tracking, and secure cloud storage for the Online Form US Income Tax Return For Homeowners Associations. Additionally, our platform supports multi-party signing and integrates with popular accounting software, making tax filing more organized and efficient.

-

Is airSlate SignNow suitable for all homeowners associations?

Yes, airSlate SignNow is suitable for all homeowners associations, regardless of size or complexity. Our solution for the Online Form US Income Tax Return For Homeowners Associations is designed to accommodate various organizational needs, making it an ideal choice for both large and small communities. The user-friendly interface ensures that anyone can navigate the tax filing process with ease.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans suitable for any budget, allowing homeowners associations to choose the best option for their needs. You can select from monthly or annual subscriptions, with features tailored for managing the Online Form US Income Tax Return For Homeowners Associations. Our goal is to provide a cost-effective solution without compromising on quality.

-

How secure is the data when using airSlate SignNow for the Online Form US Income Tax Return For Homeowners Associations?

Data security is a top priority at airSlate SignNow. When using our platform for the Online Form US Income Tax Return For Homeowners Associations, all information is encrypted and securely stored in compliance with industry standards. We implement robust security measures to protect your sensitive data throughout the tax filing process.

-

Can I integrate airSlate SignNow with other tools for managing tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various tools and software, enhancing your experience when managing the Online Form US Income Tax Return For Homeowners Associations. Popular integrations include accounting software, CRM systems, and cloud storage services, allowing for a more comprehensive approach to document management.

Get more for Online Form Us Income Tax Return For Homeowners Associations

- Additional assistance in examinations and alternative examination arrangements supporting medical documentation additional form

- Philippine business registry form

- Bmbe form

- Pnu online application form

- Philippine sinter corporation application form

- Philippine embassy malaysia invitation letter form

- Trademark application form

- Dti renewal form

Find out other Online Form Us Income Tax Return For Homeowners Associations

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online