Vat123 Form

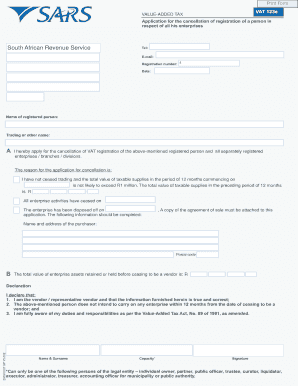

What is the Vat123?

The Vat123 is a specific form utilized primarily for the deregistration of Value Added Tax (VAT) in the United States. This form is essential for businesses that have ceased operations or no longer meet the threshold for VAT registration. By submitting the Vat123, businesses can officially notify the tax authorities of their intention to deregister, ensuring compliance with tax regulations.

How to use the Vat123

Using the Vat123 involves several key steps. First, gather all necessary information regarding your business and VAT registration. Next, accurately fill out the form, ensuring that all details are correct and complete. After completing the form, submit it to the appropriate tax authority, either online or via mail, depending on your jurisdiction's requirements. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Vat123

Completing the Vat123 requires careful attention to detail. Follow these steps:

- Gather all required documentation, including your VAT registration number and business details.

- Fill out the Vat123 form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the completed Vat123 to the relevant tax authority.

- Retain a copy of the submitted form for your records.

Legal use of the Vat123

The legal use of the Vat123 is governed by specific tax regulations. It is important to ensure that the form is filled out correctly to avoid any legal complications. The form serves as an official notification to the tax authority, and failure to comply with the deregistration process can result in penalties. Therefore, understanding the legal implications and ensuring proper submission is vital for businesses.

Required Documents

When preparing to submit the Vat123, certain documents are typically required. These may include:

- Your business's VAT registration number.

- Proof of business closure or cessation of VAT obligations.

- Any relevant financial statements that support your deregistration request.

Having these documents ready will facilitate a smoother submission process.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines associated with the Vat123. Typically, businesses should submit the form as soon as they decide to deregister from VAT. Missing deadlines can lead to complications, including potential fines. Always check with your local tax authority for specific dates and deadlines relevant to your situation.

Form Submission Methods

The Vat123 can be submitted through various methods, depending on the regulations of your local tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the completed form.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete vat123

Fill out Vat123 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the correct template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Vat123 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Vat123 with ease

- Find Vat123 and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Select how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Modify and eSign Vat123 and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat123

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is vat123 and how does it relate to airSlate SignNow?

Vat123 is an essential compliance tool that helps businesses manage VAT obligations efficiently. With airSlate SignNow, integrating vat123 can simplify the process of eSigning VAT-related documents, ensuring legal compliance while reducing administrative burden.

-

How much does airSlate SignNow cost for businesses needing vat123 functionality?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains an affordable option for businesses looking to manage VAT documents like those related to vat123. Contact our sales team to explore pricing tailored to your specific needs.

-

What features does airSlate SignNow offer for users with vat123 requirements?

AirSlate SignNow provides various features suitable for vat123, including customizable templates, real-time tracking, and secure document storage. These features enable users to effortlessly prepare and sign VAT documents while maintaining compliance.

-

How can airSlate SignNow benefit my business in handling vat123 documents?

Leveraging airSlate SignNow for vat123 allows your business to streamline the signing process, reducing turnaround time and improving efficiency. This can lead to enhanced compliance with VAT regulations and signNow cost savings.

-

Can I integrate other software with airSlate SignNow for vat123 purposes?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage vat123 documentation alongside your existing tools. This helps create more efficient workflows and promotes seamless document handling.

-

Is it easy to use airSlate SignNow for clients unfamiliar with vat123?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it simple for clients even if they're not familiar with vat123. The intuitive interface ensures users can quickly learn how to send and eSign documents with ease.

-

What security measures does airSlate SignNow have in place for vat123-related documents?

Security is a priority at airSlate SignNow, especially for sensitive vat123 documents. We utilize advanced encryption and secure cloud storage to protect all information, ensuring your compliance documents are safe from unauthorized access.

Get more for Vat123

- H105 102 form

- Justinian code worksheet answer key form

- Sample recommendation letter for graduate school admission pdf form

- Cycles worksheet answers pdf form

- Iowa sales tax exemption certificate fillable form

- Vienna lte system level simulator v1 6r885 pdf form

- Employee safety suggestion shasta county office of education form

- Fillable workplace inspection checklist pdf form

Find out other Vat123

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe