Form W 9

What is the Form W-9

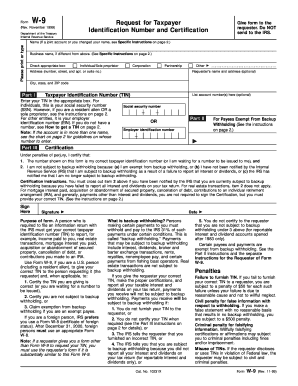

The Form W-9 is an official document issued by the Internal Revenue Service (IRS) in the United States. It is primarily used by individuals and businesses to provide their taxpayer identification number (TIN) to entities that are required to file information returns with the IRS. This form is essential for various purposes, including reporting income paid to independent contractors, freelancers, and other service providers. By completing the Form W-9, the requester can ensure accurate reporting of payments made to the individual or business on their tax returns.

How to Use the Form W-9

Using the Form W-9 involves several straightforward steps. First, the individual or business must fill out the form with their legal name, business name (if applicable), address, and TIN, which can be either a Social Security number (SSN) or an Employer Identification Number (EIN). After completing the form, it should be submitted to the requester, not the IRS. The requester will then use the information provided on the W-9 to prepare tax documents such as Form 1099, which reports income to the IRS. It is important to ensure that the information on the W-9 is accurate to avoid any issues with tax reporting.

Steps to Complete the Form W-9

Completing the Form W-9 requires careful attention to detail. Here are the steps to follow:

- Download the Form: Obtain the latest version of the Form W-9 from the IRS website.

- Fill in Your Information: Enter your name and business name, if applicable, in the appropriate fields.

- Provide Your Address: Include your mailing address where you can receive correspondence.

- Enter Your TIN: Provide your SSN or EIN in the designated section.

- Sign and Date the Form: Sign the form to certify that the information provided is correct and date it.

- Submit the Form: Send the completed W-9 to the requester, ensuring you keep a copy for your records.

Legal Use of the Form W-9

The Form W-9 is a legally binding document that must be completed accurately to comply with IRS regulations. It serves as a declaration of the taxpayer's TIN and is used by the requester to report payments made to the taxpayer. Failure to provide a correct W-9 can result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes. It is important to understand that the information provided on the W-9 may be subject to verification by the IRS, so accuracy is crucial.

IRS Guidelines

The IRS has established clear guidelines regarding the use of the Form W-9. These guidelines outline who should complete the form, the information required, and the responsibilities of both the requester and the taxpayer. The IRS emphasizes the importance of providing accurate information to avoid penalties and issues with tax reporting. Taxpayers should refer to the IRS instructions for the W-9 for detailed information on compliance and any updates to the form or its usage.

Form Submission Methods

The completed Form W-9 can be submitted through various methods depending on the requester's preferences. Common submission methods include:

- Email: The form can be scanned and emailed to the requester.

- Fax: The completed form can be faxed directly to the requester.

- Mail: A physical copy of the form can be mailed to the requester’s address.

It is essential to choose a submission method that ensures the security and confidentiality of your personal information.

Quick guide on how to complete form w 9 1999

Complete Form W 9 seamlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with all the resources you require to create, amend, and eSign your documents quickly without delays. Manage Form W 9 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign Form W 9 with ease

- Locate Form W 9 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in mere clicks from any device you choose. Modify and eSign Form W 9 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 1999

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the form W 9 1999 and why is it important?

The form W 9 1999 is a tax form used by businesses to request the Taxpayer Identification Number (TIN) of a contractor or vendor. It's crucial for ensuring proper tax reporting and compliance with IRS regulations. By accurately filling out this form, businesses can avoid potential penalties and ensure timely processing of payments.

-

How does airSlate SignNow simplify the process of filling out the form W 9 1999?

airSlate SignNow simplifies the process of filling out the form W 9 1999 by providing an intuitive interface for both sending and receiving documents. Users can easily input information, save templates, and eSign quickly. This streamlines the workflow and reduces the time spent on administrative tasks.

-

Is there a cost associated with using airSlate SignNow for the form W 9 1999?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features for sending and eSigning documents, including the form W 9 1999. You can choose the plan that best fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with other apps while using the form W 9 1999?

Absolutely! airSlate SignNow offers integrations with a variety of apps and platforms. This means you can easily connect your workflow tools to seamlessly handle the form W 9 1999, making document management even more efficient.

-

What are the key benefits of using airSlate SignNow for my form W 9 1999 submissions?

Using airSlate SignNow for your form W 9 1999 submissions offers several benefits, including enhanced security, faster processing times, and convenient access from any device. Additionally, the ability to track document status ensures you never miss deadlines or important signatures.

-

How does airSlate SignNow ensure the security of my form W 9 1999 data?

airSlate SignNow employs robust security measures, including encryption and secure storage, to protect the confidentiality of your form W 9 1999 data. Regular security audits and compliance with industry standards ensure that your sensitive information is safe during transmission and storage.

-

Is it easy to resend the form W 9 1999 if corrections are needed?

Yes, airSlate SignNow allows users to quickly resend the form W 9 1999 if corrections are needed. The user-friendly interface makes it simple to edit information and send updated documents with just a few clicks, ensuring that all parties have the correct version.

Get more for Form W 9

Find out other Form W 9

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF