Form 966 Rev June , Fill in Version

Understanding Form 966

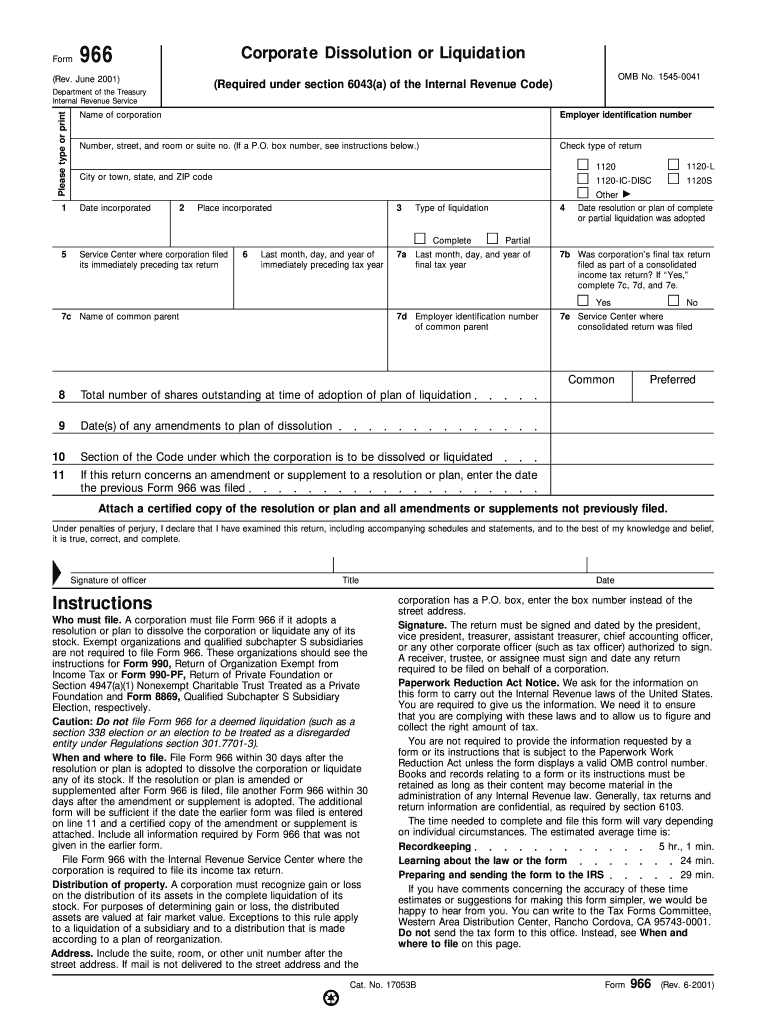

Form 966, also known as the IRS Form 966, is a crucial document used for corporate dissolution in the United States. This form is specifically designed for corporations that wish to formally dissolve their business entity. The completion of Form 966 is essential for ensuring that the dissolution process is recognized by the IRS and that all tax obligations are settled. It is important to understand the legal implications of this form, as it serves as a formal notification of the corporation's intent to dissolve.

Steps to Complete Form 966

Completing Form 966 involves several steps to ensure accuracy and compliance. Begin by gathering necessary information about the corporation, including its name, address, and Employer Identification Number (EIN). Next, indicate the date of the resolution to dissolve the corporation. This resolution must be adopted by the board of directors and shareholders, and it should be documented in the corporate minutes. After filling in the required information, review the form for any errors before submission. It is advisable to keep a copy of the completed form for your records.

Legal Use of Form 966

The legal use of Form 966 is paramount for ensuring that the dissolution of a corporation is recognized by the IRS. Filing this form correctly helps prevent potential legal issues in the future. It is essential to comply with all federal and state regulations regarding corporate dissolution. This includes ensuring that all outstanding taxes are paid and that any necessary final tax returns are filed. The timely submission of Form 966 can protect the corporation's officers and directors from personal liability associated with the business's debts.

Filing Deadlines for Form 966

Filing deadlines for Form 966 are critical to ensure compliance with IRS regulations. Generally, Form 966 must be filed within thirty days of the resolution to dissolve the corporation. Missing this deadline can result in complications, such as penalties or delays in the dissolution process. It is advisable to check for any specific state requirements or additional deadlines that may apply. Keeping track of these dates is essential for a smooth dissolution process.

Obtaining Form 966

Form 966 can be obtained directly from the IRS website or through various tax preparation software. It is available in a fillable PDF format, making it easy to complete electronically. Users can also request a paper copy by contacting the IRS directly. Ensuring that you have the most recent version of the form is important, as updates may occur that could affect the filing process.

Examples of Using Form 966

Form 966 is commonly used in various scenarios involving corporate dissolution. For instance, a corporation that has decided to cease operations due to financial difficulties may use this form to formally dissolve its entity. Additionally, businesses that have merged or been acquired may also need to file Form 966 to notify the IRS of their dissolution. Understanding these examples can help clarify the form's purpose and importance in the corporate lifecycle.

Required Documents for Form 966

When filing Form 966, certain documents may be required to support the dissolution process. These typically include the corporate resolution to dissolve, minutes from the board of directors' meeting, and any final tax returns that need to be submitted. Having these documents prepared in advance can streamline the filing process and ensure that all necessary information is included with the form submission.

Quick guide on how to complete form 966 rev june 2001 fill in version

Effortlessly complete Form 966 Rev June , Fill in Version on any device

Digital document management has gained signNow traction among organizations and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Access Form 966 Rev June , Fill in Version on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 966 Rev June , Fill in Version with ease

- Obtain Form 966 Rev June , Fill in Version and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 966 Rev June , Fill in Version and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

When do I have to fill out forms for the CPT, June 2018?

Usually, ICAI announces for CPT exam form during April (for June attempt)Accordingly, for June 2018 attempt, ICAI will come out with exam form on april month and you have around 20–25days to submit it.Wait for the preceding attempts result i.e. Dec. 2017 which will be announce on Mid. January 2018, and in around April 2018, Exam Form windows may be open for exam form.(PS - by Form, you would meant to be Exam form for the attempt)Hope, it helps.Thanks.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

Is it possible to apply or fill out a form for the CPT June attempt 2018 now or tomorrow?

Dear friend,The time is up for registration for CPT June attempt.If you already attempted cpt and this is second time ( orpre than that) then you can apply for CPT December exam.Through ICAI official website.Thank you.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Which form will be out in June? would it be filled out after the 12th?

There are many exams forms will be out in June 2017 likeNDA exam, CPT Exam, CS Exam, CAT exam etc……..Good Luck…..Please visit us……..Read, learn and practice MCQ and answers with explanation on Current Affairs, GK, Education, Aptitude, Verbal ability & Computer science for interview & Govt. ExamsGeneral Knowledge, TET, Aptitude Questions Answers - Indiagkonline

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the form 966 rev june 2001 fill in version

How to make an eSignature for your Form 966 Rev June 2001 Fill In Version in the online mode

How to create an electronic signature for the Form 966 Rev June 2001 Fill In Version in Chrome

How to make an eSignature for putting it on the Form 966 Rev June 2001 Fill In Version in Gmail

How to make an eSignature for the Form 966 Rev June 2001 Fill In Version right from your smart phone

How to make an electronic signature for the Form 966 Rev June 2001 Fill In Version on iOS devices

How to make an eSignature for the Form 966 Rev June 2001 Fill In Version on Android

People also ask

-

What are form 966 instructions?

Form 966 instructions provide the necessary guidelines for filing a dissolution or liquidation of a corporation. This form is essential for ensuring compliance with the IRS, and following these instructions can help prevent potential penalties or delays in processing.

-

How can airSlate SignNow assist with completing form 966?

AirSlate SignNow simplifies the process of completing form 966 by offering customizable templates and eSigning capabilities. Our platform ensures that all parties can easily fill out and sign the form securely, streamlining your filing process.

-

Are there any costs associated with using airSlate SignNow for form 966 instructions?

Yes, airSlate SignNow offers various pricing plans to cater to businesses of all sizes. Each plan provides access to features designed to assist with processes like completing form 966 instructions, ensuring you receive the best value for your needs.

-

What features does airSlate SignNow offer for businesses working with form 966?

AirSlate SignNow includes features such as document storage, template creation, and eSignature capabilities, all designed to facilitate the completion of form 966 instructions. These tools enhance productivity and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other applications when working on form 966 instructions?

Absolutely! AirSlate SignNow offers integrations with various applications, allowing you to streamline workflows when completing form 966 instructions. This ensures that data from other systems can easily be included in your forms.

-

What are the benefits of using airSlate SignNow for form 966 processing?

Using airSlate SignNow for form 966 processing can increase efficiency and reduce errors by providing a user-friendly interface and collaborative features. It helps your team manage documents securely while ensuring that all necessary signatures are obtained promptly.

-

How do I get started with airSlate SignNow for form 966 instructions?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin utilizing our resources, including templates and guides for form 966 instructions, to ensure a smooth filing process.

Get more for Form 966 Rev June , Fill in Version

- Professional development request form 2018 19

- Lim college 1098 t form

- Colfax school district form

- Springdale high school transcript request form

- Children s center payment receipt inside jjay cuny form

- Nido qubein scholarship form

- Substitutionrequirementwaiverformdoc lasell

- Scba youth education grant application form

Find out other Form 966 Rev June , Fill in Version

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer