4 48 4 Business Valuation GuidelinesInternal Revenue Service Form

Understanding the 4 48 4 Business Valuation Guidelines

The 4 48 4 Business Valuation Guidelines are essential for businesses seeking to establish a fair market value for their assets. These guidelines provide a structured approach to valuation, focusing on four key aspects: income, market, asset, and cost approaches. Each method offers a different perspective, allowing businesses to select the most appropriate valuation strategy based on their unique circumstances. Understanding these guidelines can help businesses comply with IRS requirements while ensuring a transparent valuation process.

Steps to Complete the 4 48 4 Business Valuation Guidelines

Completing the 4 48 4 Business Valuation Guidelines involves several critical steps. First, gather all relevant financial documents, including income statements, balance sheets, and tax returns. Next, choose the appropriate valuation approach based on the business's characteristics and the purpose of the valuation. After selecting a method, apply the necessary calculations to determine the value. Finally, compile the findings into a comprehensive report that outlines the valuation process and justifies the chosen methods.

Legal Use of the 4 48 4 Business Valuation Guidelines

The legal use of the 4 48 4 Business Valuation Guidelines is crucial for compliance with IRS regulations. When businesses follow these guidelines, they can substantiate their asset values during audits or disputes. Adhering to these standards not only strengthens the credibility of the valuation but also protects the business from potential penalties associated with misreporting asset values. It is advisable to consult with a qualified professional to ensure compliance with all legal requirements.

Required Documents for the 4 48 4 Business Valuation Guidelines

To effectively utilize the 4 48 4 Business Valuation Guidelines, specific documents are required. Essential documents include financial statements, tax returns, and any relevant contracts or agreements that may impact the business's valuation. Additionally, supporting documentation such as market analysis reports and asset appraisals can enhance the valuation's accuracy. Collecting these documents in advance streamlines the valuation process and ensures a thorough analysis.

Filing Deadlines and Important Dates

Understanding filing deadlines and important dates related to the 4 48 4 Business Valuation Guidelines is vital for compliance. Businesses must be aware of the timelines for submitting valuations to the IRS, particularly during tax season. Staying informed about these deadlines helps avoid penalties and ensures timely reporting. It is beneficial to create a calendar that outlines all relevant dates to keep the valuation process organized and efficient.

Examples of Using the 4 48 4 Business Valuation Guidelines

Real-world examples of applying the 4 48 4 Business Valuation Guidelines can provide valuable insights. For instance, a small business owner may use the income approach to determine the value of their company based on projected earnings. Alternatively, a partnership may utilize the asset approach to evaluate the worth of their collective assets before a buyout. These examples illustrate how different valuation methods can be tailored to meet specific business needs.

Quick guide on how to complete 4484 business valuation guidelinesinternal revenue service

Easily Prepare 4 48 4 Business Valuation GuidelinesInternal Revenue Service on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can quickly locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 4 48 4 Business Valuation GuidelinesInternal Revenue Service on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign 4 48 4 Business Valuation GuidelinesInternal Revenue Service effortlessly

- Find 4 48 4 Business Valuation GuidelinesInternal Revenue Service and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 4 48 4 Business Valuation GuidelinesInternal Revenue Service and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4484 business valuation guidelinesinternal revenue service

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

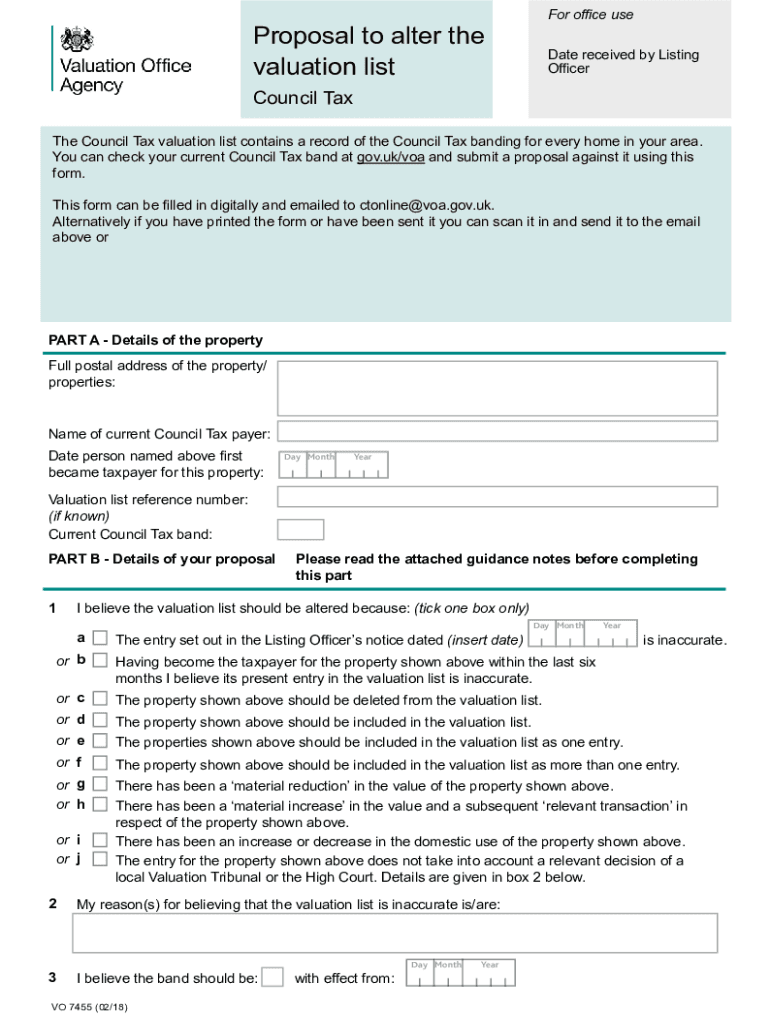

What is a council tax proposal form?

A council tax proposal form is a document used to request a review or reduction of your council tax bill. This form allows residents to propose changes based on their current circumstances, which can help alleviate financial burdens. With airSlate SignNow, you can easily create and submit your council tax proposal form online.

-

How can airSlate SignNow help with my council tax proposal form?

airSlate SignNow offers an intuitive platform that simplifies the process of completing your council tax proposal form. You can fill out the form electronically, eSign it, and send it directly to your local council, all in one seamless workflow. This saves you time and ensures your proposal is submitted correctly.

-

What are the pricing options for using airSlate SignNow for council tax proposal forms?

airSlate SignNow provides flexible pricing plans designed to fit various business needs, including handling council tax proposal forms. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. The platform's cost-effective solution allows you to manage all your document needs without breaking the bank.

-

Is it easy to eSign my council tax proposal form with airSlate SignNow?

Yes, eSigning your council tax proposal form with airSlate SignNow is remarkably easy. Our user-friendly interface allows you to sign documents electronically in just a few clicks. You can also invite others to eSign, ensuring all necessary parties are involved in the council tax proposal process.

-

Can I track the status of my council tax proposal form after submission?

Absolutely! With airSlate SignNow, you can easily track the status of your submitted council tax proposal form. The platform provides real-time notifications and updates, so you always know where your proposal stands. This feature helps you stay informed and plan your next steps accordingly.

-

What integrations does airSlate SignNow offer for managing council tax proposal forms?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, enhancing your ability to manage council tax proposal forms. These integrations allow you to streamline workflows, access documents easily, and improve collaboration across teams. You can efficiently process your proposals without switching between different applications.

-

What are the benefits of using airSlate SignNow for council tax proposal forms?

Using airSlate SignNow for your council tax proposal forms provides numerous benefits. It offers a secure and efficient way to fill out, sign, and manage documents electronically. Additionally, you save time on paperwork and reduce the risk of errors, making the process of submitting your council tax proposal straightforward and hassle-free.

Get more for 4 48 4 Business Valuation GuidelinesInternal Revenue Service

- Travel booking form 383581010

- Pregnancy notification form wellcare of georgia

- Administrativna zabrana form

- Imm5832e form

- Client skin analysisconsultation form name todays date

- 00dp102311862 nh department of revenue administration form

- Ps form 8161 mms samplingpostage adjustment worksheet presorted and carrier route bound printed matter mailings note for

- State of louisiana application for certificate of marriage rapides parish groom 1a rapidesclerk form

Find out other 4 48 4 Business Valuation GuidelinesInternal Revenue Service

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document