How to Withdraw Funds from RRSPs under the Home Buyers Form

Understanding the T1036E Form for RRSP Withdrawals

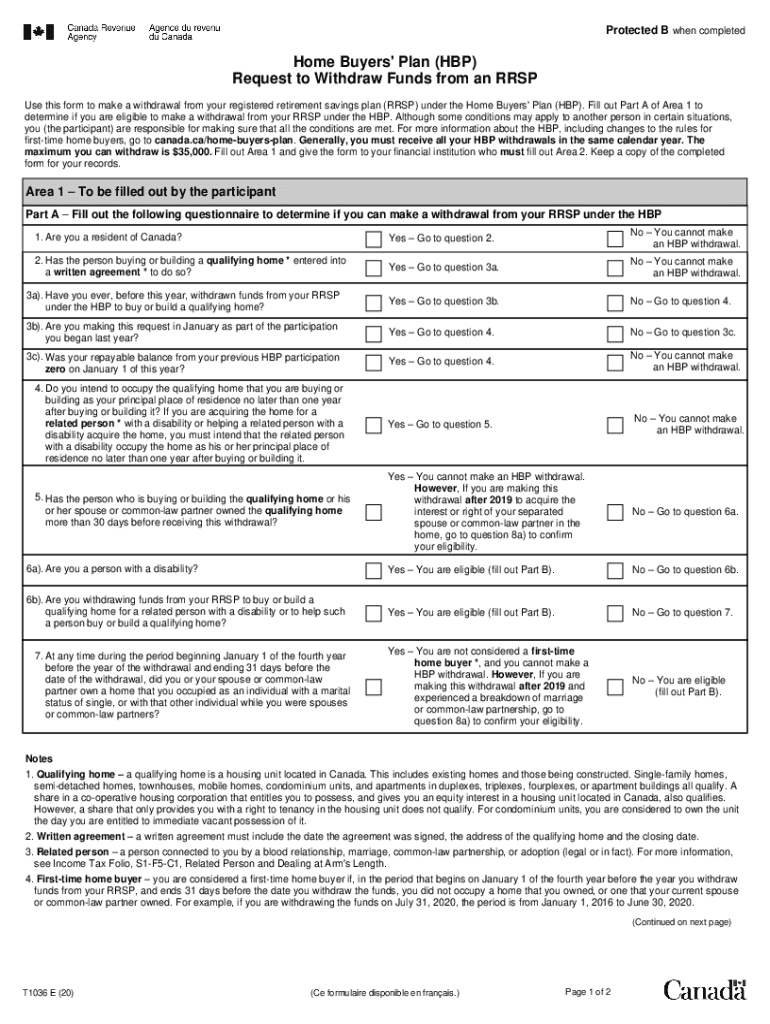

The T1036E form is essential for individuals looking to withdraw funds from their Registered Retirement Savings Plans (RRSPs) under the Home Buyers' Plan (HBP). This program allows first-time home buyers to withdraw up to $35,000 from their RRSPs to purchase or build a home. Understanding the specifics of the T1036E form is crucial for ensuring compliance and successful withdrawal.

Steps to Complete the T1036E Form

Filling out the T1036E form requires careful attention to detail to ensure all information is accurate. Here are the primary steps involved:

- Gather Required Information: Collect personal details, including your social security number, RRSP account information, and details about the property you intend to purchase.

- Complete the Form: Fill in all sections of the T1036E form, ensuring that all entries are clear and legible. Pay special attention to the eligibility criteria.

- Sign and Date: Ensure that you sign and date the form to validate your request for withdrawal.

- Submit the Form: Send the completed T1036E form to your RRSP issuer for processing.

Eligibility Criteria for the T1036E Form

To qualify for the Home Buyers' Plan and utilize the T1036E form, certain eligibility criteria must be met:

- You must be a first-time home buyer, which generally means you have not owned a home in the last five years.

- The funds withdrawn must be used to buy or build a qualifying home.

- You must be a resident of Canada and at least eighteen years old.

Legal Use of the T1036E Form

The T1036E form is legally binding when completed correctly and submitted through the appropriate channels. Compliance with the regulations set forth by the Canada Revenue Agency (CRA) ensures that the withdrawal is recognized legally. It is essential to retain copies of the form and any related documents for your records.

Required Documents for T1036E Submission

When submitting the T1036E form, certain documents are necessary to support your application. These may include:

- A copy of the purchase agreement for the home.

- Proof of RRSP contributions made prior to the withdrawal.

- Identification documents, such as a driver's license or passport.

Form Submission Methods

The T1036E form can be submitted through various methods, depending on your RRSP issuer's policies. Common submission methods include:

- Online Submission: Many financial institutions allow for electronic submission through their online platforms.

- Mail: You can send a physical copy of the completed form to your RRSP issuer via postal service.

- In-Person: Some institutions may allow you to submit the form directly at a branch location.

Quick guide on how to complete how to withdraw funds from rrsps under the home buyers

Complete How To Withdraw Funds From RRSPs Under The Home Buyers seamlessly on any platform

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the resources you need to generate, adjust, and eSign your documents quickly and without delays. Manage How To Withdraw Funds From RRSPs Under The Home Buyers on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to revise and eSign How To Withdraw Funds From RRSPs Under The Home Buyers effortlessly

- Locate How To Withdraw Funds From RRSPs Under The Home Buyers and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Revise and eSign How To Withdraw Funds From RRSPs Under The Home Buyers and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to withdraw funds from rrsps under the home buyers

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is t1036e and how does it benefit my business?

The t1036e is a comprehensive electronic signature solution that allows businesses to streamline the signing process for documents. By utilizing t1036e, businesses can save time and resources while ensuring compliance and security in document handling.

-

How much does t1036e cost?

The pricing for t1036e varies based on the plan selected, offering flexible options to suit different business needs. Each plan typically includes features designed to enhance user experience and maximize efficiency in electronic signing.

-

What features does t1036e offer?

t1036e includes features such as customizable templates, real-time tracking, and comprehensive security measures. These features help businesses manage documents effectively while ensuring that the e-signing process is smooth and reliable.

-

Can t1036e integrate with other software I use?

Yes, t1036e is designed to integrate seamlessly with various software applications that businesses commonly use, such as CRMs and productivity suites. This integration enhances workflow efficiency, allowing users to sign documents directly within their preferred tools.

-

Is t1036e secure and compliant with regulations?

Absolutely. t1036e is built with security in mind, employing encryption and secure storage practices to protect sensitive information. It also adheres to regulatory standards, ensuring that your e-signature processes are compliant with legal requirements.

-

What industries can benefit from using t1036e?

t1036e is versatile and can benefit a wide range of industries, including real estate, healthcare, and finance. Any business that requires document signing can leverage t1036e to improve efficiency and reduce turnaround times.

-

How does t1036e enhance the signing experience for users?

The t1036e platform enhances the signing experience by providing an intuitive interface that is easy to navigate. Users can sign documents quickly and efficiently, which helps businesses reduce delays and improves overall customer satisfaction.

Get more for How To Withdraw Funds From RRSPs Under The Home Buyers

- Army agr application form

- Redemption letter sample form

- Hyundai azera repair manual pdf form

- Loan application form corporate borrowers neogrowth

- Fillable month to month rental agreement form

- Dr 15nr 06 24 1 pdf form

- Treasury forms search and instructions

- Mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals 718971255 form

Find out other How To Withdraw Funds From RRSPs Under The Home Buyers

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile