Form433 B OIC Rev 4 Collection Information Statement for Businesses

What is the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

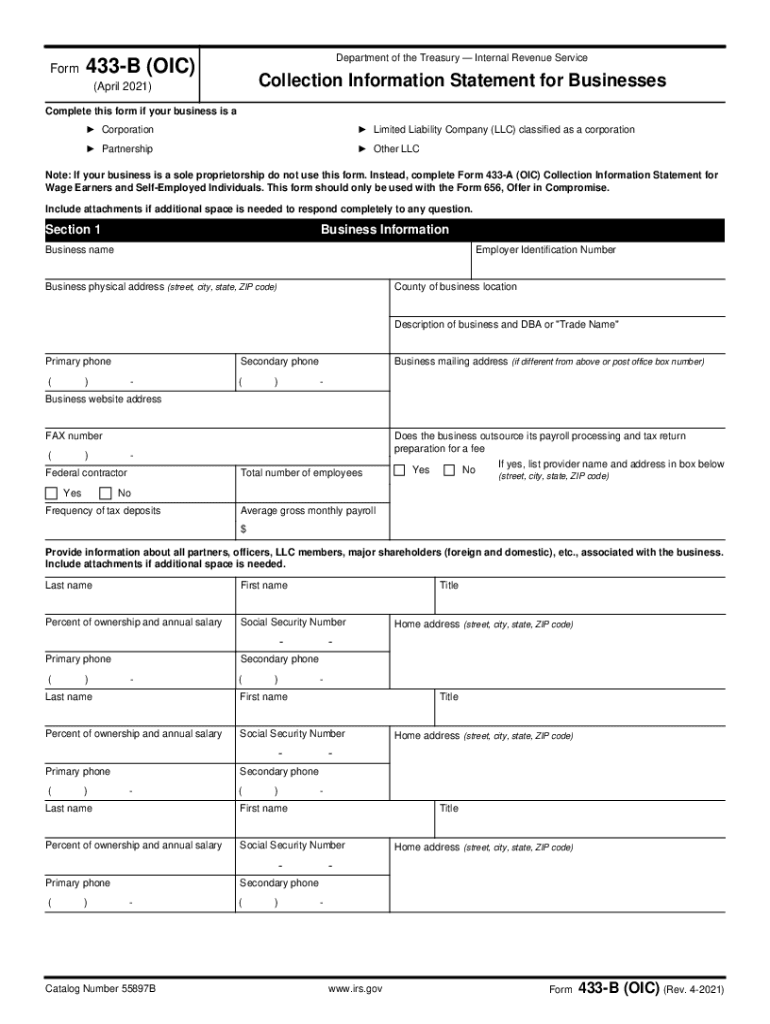

The Form 433 B OIC Rev 4 is a crucial document used by businesses to provide the Internal Revenue Service (IRS) with detailed financial information. This form is specifically designed for businesses that are seeking to settle their tax liabilities through an Offer in Compromise (OIC). By completing this form, business owners can present their financial situation, including income, expenses, assets, and liabilities, allowing the IRS to evaluate their ability to pay the owed taxes. Understanding the purpose and requirements of this form is essential for businesses looking to negotiate their tax debts effectively.

How to use the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

Using the Form 433 B OIC Rev 4 involves several steps that ensure accurate and complete submission. First, gather all necessary financial documents, including income statements, bank statements, and records of assets and liabilities. Next, fill out the form meticulously, providing detailed information about the business's financial status. It is important to be honest and thorough, as inaccuracies can lead to delays or denials of the OIC request. Once completed, the form should be submitted to the IRS along with any required supporting documentation, such as the OIC application and payment, if applicable.

Steps to complete the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

Completing the Form 433 B OIC Rev 4 requires a systematic approach. Follow these steps for successful completion:

- Gather financial documents: Collect all relevant financial information, including profit and loss statements, balance sheets, and bank statements.

- Provide business information: Fill in the business name, address, and Employer Identification Number (EIN).

- Detail assets: List all business assets, including real estate, vehicles, and equipment, along with their estimated values.

- Outline liabilities: Include all outstanding debts and obligations, specifying amounts owed to creditors.

- Report income: Document all sources of income, including sales, investments, and any other revenue streams.

- List expenses: Provide a detailed account of regular business expenses, such as rent, utilities, and payroll.

- Review and sign: Ensure all information is accurate, then sign and date the form before submission.

Legal use of the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

The legal use of the Form 433 B OIC Rev 4 is critical for businesses seeking to resolve tax debts with the IRS. This form serves as a formal declaration of the business's financial condition and is legally binding. When submitted, it allows the IRS to assess the legitimacy of the OIC request. Accurate completion of the form is essential, as any misrepresentation can lead to legal consequences, including penalties or denial of the offer. Businesses must ensure compliance with IRS regulations when using this form to avoid potential legal issues.

Eligibility Criteria for the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

Eligibility for using the Form 433 B OIC Rev 4 is determined by several criteria set forth by the IRS. Businesses must demonstrate an inability to pay their tax liabilities in full. This includes showing that the total amount owed exceeds the business's ability to pay based on its financial condition. Additionally, the business must be current on all required tax filings and payments to qualify for an OIC. Understanding these eligibility requirements is essential for businesses to effectively navigate the process of settling tax debts.

Form Submission Methods (Online / Mail / In-Person)

The Form 433 B OIC Rev 4 can be submitted to the IRS through various methods, providing flexibility for businesses. The primary submission methods include:

- Online: Businesses can submit the form electronically through the IRS e-Services platform, which offers a convenient and efficient option.

- Mail: The completed form can be mailed to the appropriate IRS address, as specified in the form instructions. It is advisable to use certified mail for tracking purposes.

- In-Person: Businesses may also choose to deliver the form in person at their local IRS office, allowing for direct interaction with IRS representatives.

Quick guide on how to complete form433 b oic rev 4 2021 collection information statement for businesses

Complete Form433 B OIC Rev 4 Collection Information Statement For Businesses effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Handle Form433 B OIC Rev 4 Collection Information Statement For Businesses on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Form433 B OIC Rev 4 Collection Information Statement For Businesses with ease

- Find Form433 B OIC Rev 4 Collection Information Statement For Businesses and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form433 B OIC Rev 4 Collection Information Statement For Businesses and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form433 b oic rev 4 2021 collection information statement for businesses

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 433 b IRS form and why is it important?

The 433 b IRS form is a financial statement used by the IRS to collect information about an individual's financial situation. This information is essential for determining their ability to pay taxes and for setting up payment plans. Completing the 433 b IRS form accurately is critical to ensure a smooth process with the IRS.

-

How does airSlate SignNow help with the eSigning of the 433 b IRS form?

airSlate SignNow offers an intuitive platform that simplifies the eSigning of the 433 b IRS form. Users can easily upload their form, add necessary signatures, and send it securely to the IRS or relevant parties. This streamlines the process, ensuring that documents are handled efficiently and legally.

-

Is airSlate SignNow compliant with IRS regulations when handling the 433 b IRS form?

Yes, airSlate SignNow ensures compliance with IRS regulations while managing the 433 b IRS form. This includes secure data handling, encryption, and adherence to legal standards for eSignature use. Users can trust that their sensitive information is protected throughout the process.

-

What pricing plans does airSlate SignNow offer for users preparing the 433 b IRS form?

airSlate SignNow provides various pricing plans designed to accommodate individuals and businesses preparing the 433 b IRS form. Users can choose from basic to advanced features, depending on their needs. With competitive pricing and flexible options, customers can easily find a package that suits their requirements.

-

Can airSlate SignNow integrate with other platforms for enhancing the 433 b IRS form submission process?

Yes, airSlate SignNow seamlessly integrates with several platforms to enhance the submission process of the 433 b IRS form. Users can connect with popular cloud storage services and document management systems, making it easier to access and share the form with necessary parties. This integration ensures a smooth and efficient workflow.

-

What are the benefits of using airSlate SignNow for the 433 b IRS form eSigning?

Using airSlate SignNow for the 433 b IRS form eSigning offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and provides users with real-time tracking of their forms. Additionally, the user-friendly interface facilitates a hassle-free experience.

-

Is there a mobile app available for signing the 433 b IRS form using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to sign the 433 b IRS form on-the-go. The app is designed for convenience and provides all the necessary tools to manage, sign, and send documents directly from a mobile device. This flexibility helps users stay productive, even when they are away from their desks.

Get more for Form433 B OIC Rev 4 Collection Information Statement For Businesses

Find out other Form433 B OIC Rev 4 Collection Information Statement For Businesses

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors