Form 4506 a Rev August Request for Public Inspection or Copy of Exempt Organization IRS Form

What is the Form 4506-A?

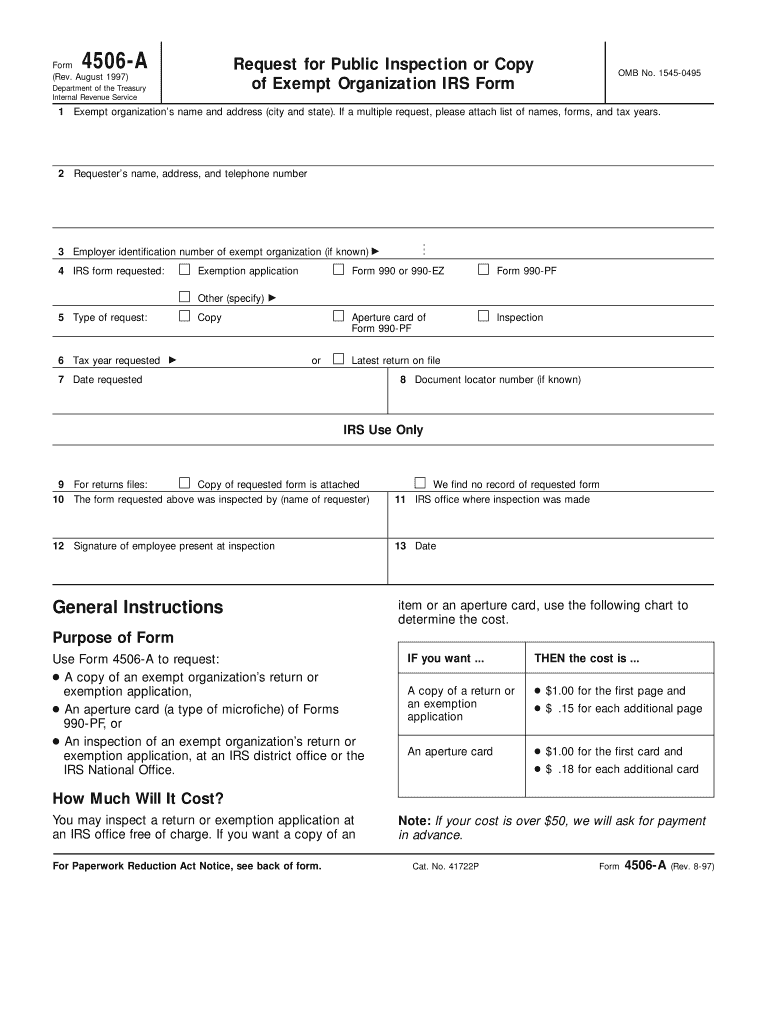

The Form 4506-A, officially known as the Request for Public Inspection or Copy of Exempt Organization IRS Form, is a document used to request copies of specific tax documents from the IRS. This form is particularly relevant for organizations that are exempt from federal income tax under section 501(c) of the Internal Revenue Code. By submitting this form, individuals or entities can obtain copies of certain documents that the IRS has on file, which can include applications for tax-exempt status and annual returns.

Steps to Complete the Form 4506-A

Completing the Form 4506-A involves several straightforward steps. First, ensure that you have the correct version of the form, as updates may occur. Next, provide your contact information, including your name, address, and phone number. Then, specify the name of the exempt organization and its Employer Identification Number (EIN). Indicate the specific documents you are requesting, and be sure to sign and date the form. Finally, submit the completed form to the appropriate IRS address, which can vary based on your location.

Legal Use of the Form 4506-A

The legal use of the Form 4506-A is primarily to facilitate transparency regarding tax-exempt organizations. By allowing individuals and entities to access these documents, the IRS promotes accountability among tax-exempt organizations. It is important to use the form correctly to ensure compliance with IRS regulations and to avoid any potential legal issues. Misuse of the form, such as requesting documents without a legitimate purpose, could lead to penalties or denial of the request.

Form Submission Methods

The Form 4506-A can be submitted through various methods, including mail and, in some cases, online submission. For most users, mailing the completed form to the IRS is the standard procedure. Ensure that you check the IRS website for the correct mailing address based on your state. While electronic submission options may be available for certain requests, it is essential to verify the current submission methods as they can change over time.

Eligibility Criteria

To request documents using the Form 4506-A, you must meet specific eligibility criteria. Typically, the requester must have a legitimate interest in the documents, such as being a member of the organization or having a professional relationship with it. Additionally, the organization must be recognized as tax-exempt by the IRS. Understanding these criteria is crucial to ensure that your request is valid and likely to be fulfilled.

Required Documents

When submitting the Form 4506-A, you may need to provide additional documentation to support your request. This could include proof of identity or a statement of your relationship to the exempt organization. Ensure that all required documents are included with your submission to avoid delays in processing your request. Review the IRS guidelines for any specific requirements related to the documents you are requesting.

Quick guide on how to complete form 4506 a rev august 1997 request for public inspection or copy of exempt organization irs form

Effortlessly prepare Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without hassle. Manage Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The simplest way to modify and eSign Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form with ease

- Locate Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 a rev august 1997 request for public inspection or copy of exempt organization irs form

How to make an eSignature for your Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form in the online mode

How to generate an electronic signature for your Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form in Google Chrome

How to generate an electronic signature for signing the Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form in Gmail

How to create an eSignature for the Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form from your mobile device

How to generate an electronic signature for the Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form on iOS

How to generate an eSignature for the Form 4506 A Rev August 1997 Request For Public Inspection Or Copy Of Exempt Organization Irs Form on Android OS

People also ask

-

What is the Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form?

The Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form is a request used by individuals or organizations to obtain a copy of tax-exempt organization documents held by the IRS. This form allows you to access essential information about the financial activities of exempt organizations, ensuring transparency and accountability.

-

How can airSlate SignNow help with the Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form?

airSlate SignNow provides a seamless platform to eSign and send your Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form. With our easy-to-use interface, you can quickly prepare and submit the form electronically, ensuring that your request is processed efficiently.

-

Is there a cost associated with using airSlate SignNow for the Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there may be fees associated with the service, using airSlate SignNow to submit your Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form can save you time and enhance your document management process.

-

What features does airSlate SignNow offer for managing forms like the Form 4506 A Rev August?

airSlate SignNow includes features such as electronic signatures, document tracking, and cloud storage, which are particularly useful when handling forms like the Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form. These features enhance collaboration and streamline the submission process.

-

Can I integrate airSlate SignNow with other applications for submitting the Form 4506 A Rev August?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to sync your data and streamline workflows when submitting the Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form. Check our integration options to see how we can fit into your existing processes.

-

What benefits does using airSlate SignNow provide for the Form 4506 A Rev August submission?

Using airSlate SignNow for your Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form submission provides numerous benefits, including enhanced security, faster processing times, and improved user experience. Our platform ensures that your documents are handled securely and efficiently.

-

Is it easy to track the status of my Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking capabilities for your Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form. You can easily monitor the status of your request, ensuring you stay informed throughout the process.

Get more for Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form

- Entrance examination paper year 9 mathematics mathconsult form

- Request to remove academic enrollment restrictiondocx auk edu form

- Name date of birth current grade form

- Field trip permission form isd 511 isd511

- Lincoln way high school district 210 auto regulations and lw210 form

- Specific learning disability observation form

- Academic letter of appraisal form memorial university

- Bible registration form

Find out other Form 4506 A Rev August Request For Public Inspection Or Copy Of Exempt Organization IRS Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation