Name of Individual Subject to Additional Tax Married Filing Jointly 5329 Form

Understanding the 5329 T Form

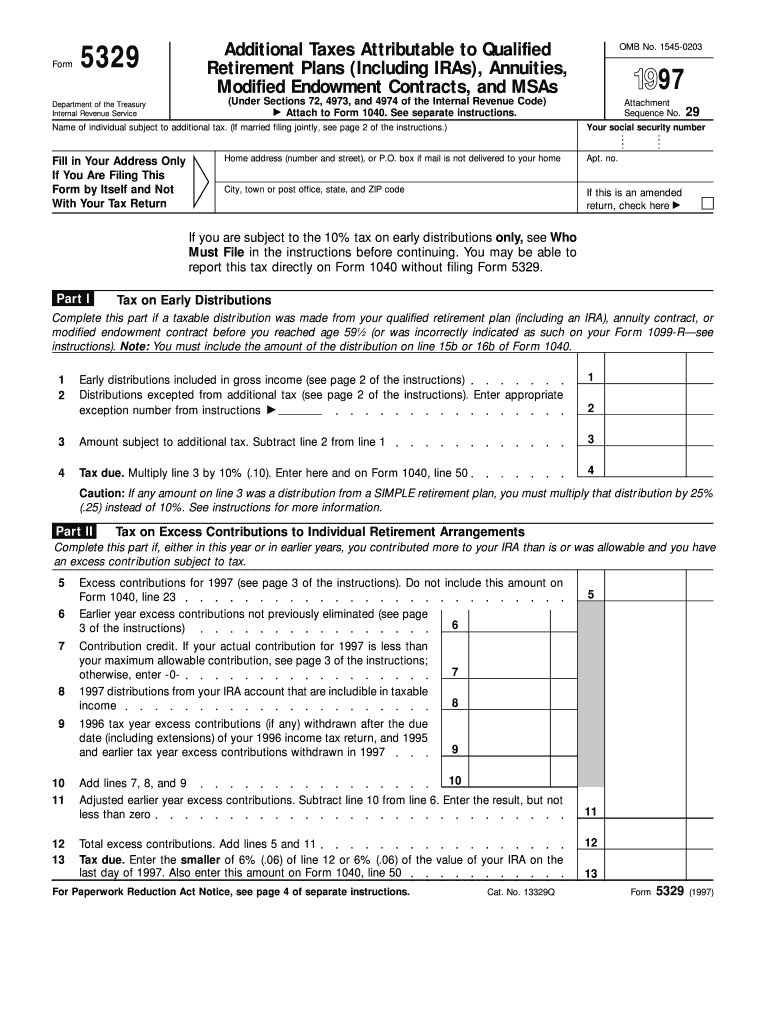

The 5329 T form, officially known as the Name of Individual Subject to Additional Tax Married Filing Jointly 5329 Form, is a tax document used by individuals who are filing jointly with their spouse. This form is specifically designed to report additional taxes on certain distributions from retirement accounts, ensuring compliance with IRS regulations. It is essential for married couples to accurately complete this form to avoid potential penalties and ensure their tax filings are correct.

Steps to Complete the 5329 T Form

Completing the 5329 T form involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including the names and Social Security numbers of both spouses. Next, identify the specific distributions that require reporting on the form. Carefully fill out each section, providing detailed explanations where necessary. Once completed, review the form for any errors or omissions before submission. It is advisable to keep a copy for your records.

How to Obtain the 5329 T Form

The 5329 T form can be obtained directly from the IRS website, where it is available for download in PDF format. Alternatively, you may request a physical copy by contacting the IRS or visiting a local IRS office. Ensure that you have the most current version of the form to comply with the latest tax regulations. Having the correct form is crucial for accurate reporting and compliance with tax obligations.

IRS Guidelines for the 5329 T Form

The IRS provides specific guidelines for completing the 5329 T form, which include instructions on what qualifies as an additional tax and how to report it. It is important to follow these guidelines closely to avoid errors that could result in penalties. The IRS also outlines the necessary documentation required to support the information reported on the form, such as statements from retirement accounts. Familiarizing yourself with these guidelines can help ensure a smooth filing process.

Filing Deadlines for the 5329 T Form

The filing deadline for the 5329 T form generally aligns with the standard tax return deadline, which is typically April 15th of each year. However, if you file for an extension, you may have additional time to submit this form. It is essential to be aware of these deadlines to avoid late penalties and ensure compliance with IRS requirements. Keeping track of important dates can help streamline your tax preparation process.

Penalties for Non-Compliance with the 5329 T Form

Failure to file the 5329 T form or inaccuracies in reporting can lead to significant penalties from the IRS. These penalties may include fines and interest on unpaid taxes. It is crucial to understand the implications of non-compliance and to ensure that all information reported is accurate and complete. Seeking professional assistance or using reliable electronic tools can help mitigate the risk of errors when filing.

Quick guide on how to complete name of individual subject to additional tax married filing jointly 5329 form

Complete Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form with ease

- Locate Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form and then click Get Form to begin.

- Use the provided tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools available in airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I want to fill my US taxes as Married Filing Jointly. My spouse is a non-resident alien who has never been to US. How do I accomplish this?

First, make sure your marriage is recognized by the U.S. The U.S. recognizes most foreign marriages if it was legal in the country where you got married. But check with the Attorney General’s office of the state where you live. Interestingly enough, if you have a legal common law marriage in the U.S., and move to a state where common law marriages are not recognized, you may find yourself suddenly no longer married. If your marriage is recognized, get an ITIN (IRS ID number) for your spouse, and then just file jointly. However, you must include your spouses worldwide income on your tax return.

-

How do I make the first year choice as a resident and file taxes as married filing jointly? Is there a standard format of statement to make the first year choice?

If you are a US citizen, resident is assumed.Just use the regular tax 1040 — Assuming United States—Fill out both names and info and under filing status—check the box Married filing Joint. Complete the form—LINE BY LINE. Read the instructions carefully. Many software packages are available for a fee. Simple forms W2, minimal other income, or tax credits are not rocket science. Good Luck. If your state has Income tax, don’t forget to do it. File on time. Electronic has fees usually, but paper works. Refunds are prompt regardless. Good Luck

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the name of individual subject to additional tax married filing jointly 5329 form

How to make an electronic signature for your Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form in the online mode

How to generate an electronic signature for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form in Chrome

How to generate an eSignature for signing the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form in Gmail

How to generate an electronic signature for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form from your mobile device

How to make an electronic signature for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form on iOS

How to make an eSignature for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form on Android

People also ask

-

What is the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

The Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form is used by taxpayers who are subject to additional taxes on certain distributions from retirement accounts. This form helps report such taxes when filing jointly with a spouse, ensuring compliance with IRS regulations. It's essential for couples filing jointly to accurately complete this form to avoid penalties.

-

How can airSlate SignNow assist with completing the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form. With customizable templates and document sharing capabilities, you can collaborate with your spouse to ensure all necessary information is included. This streamlines the process, making tax time less stressful.

-

Is there a cost associated with using airSlate SignNow for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including those needing to complete the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form. Our pricing is competitive and provides great value for businesses and individuals looking to simplify their document management. Check our website for details on subscription options.

-

What features does airSlate SignNow offer for managing tax documents like the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage that are beneficial for managing tax documents like the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form. These features enhance accuracy and ensure that your documents are easily accessible when needed. Additionally, our platform allows for easy tracking of document status.

-

Can airSlate SignNow integrate with other tax software for filing the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

Yes, airSlate SignNow can integrate with various tax software solutions, making it easy to file the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form. This integration allows for seamless data transfer and ensures that you have all necessary information at your fingertips. By using our platform, you can enhance your overall tax preparation efficiency.

-

How secure is airSlate SignNow when handling sensitive documents like the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to ensure that your sensitive documents, including the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form, are protected. You can have peace of mind knowing that your information is safe while using our platform.

-

What benefits does airSlate SignNow provide for couples filing jointly with the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form?

Using airSlate SignNow for the Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form offers several benefits for couples filing jointly. It simplifies the process by allowing both partners to collaborate on the document seamlessly, reducing errors and saving time. Our intuitive interface ensures that both individuals can easily complete and submit their forms with confidence.

Get more for Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form

Find out other Name Of Individual Subject To Additional Tax Married Filing Jointly 5329 Form

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free