Irs Milage Form

What is the IRS Mileage?

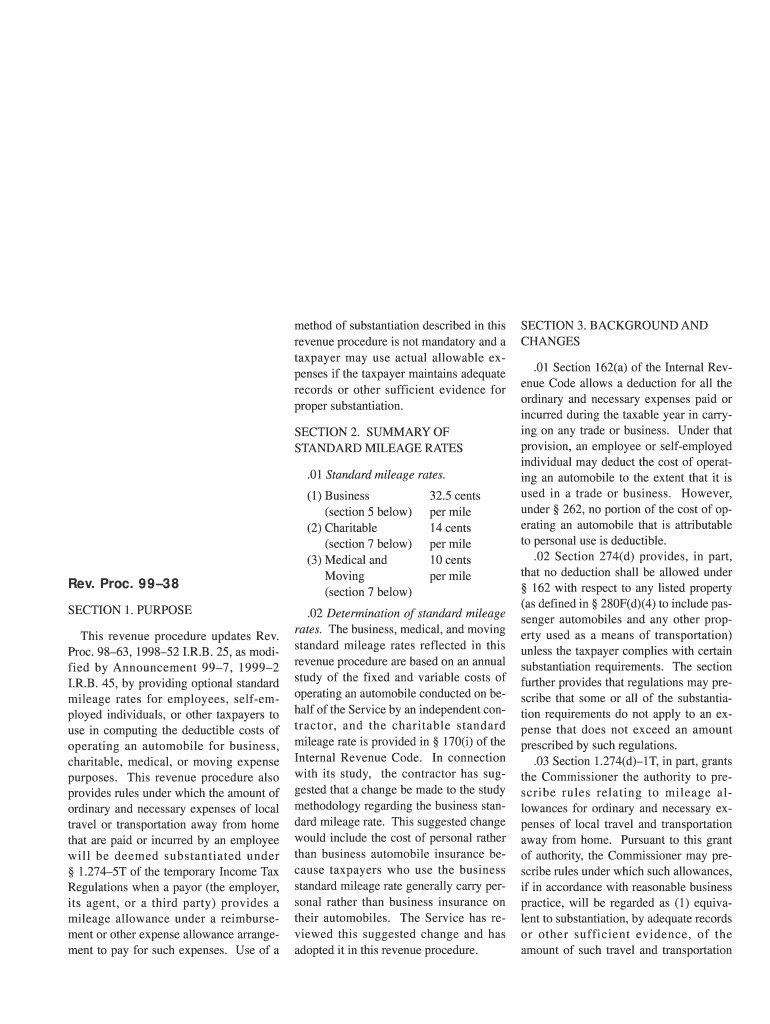

The IRS mileage standard refers to the rate set by the Internal Revenue Service for the reimbursement of business-related travel expenses. This rate is updated annually and is used to calculate the deductible costs of operating a vehicle for business purposes. The mileage rate encompasses various costs, including fuel, maintenance, and depreciation. Understanding this rate is crucial for individuals and businesses looking to accurately report their travel expenses on tax returns.

How to Use the IRS Mileage?

To utilize the IRS mileage standard effectively, individuals should keep detailed records of their business-related travel. This includes noting the date, purpose of the trip, starting and ending odometer readings, and any related expenses. When filing taxes, taxpayers can apply the standard mileage rate to the total business miles driven. This method simplifies the process of calculating deductions, as it eliminates the need for itemizing specific vehicle expenses.

Steps to Complete the IRS Mileage

Completing the IRS mileage calculation involves several straightforward steps:

- Maintain a log of all business-related trips, including dates, destinations, and purposes.

- Record the starting and ending odometer readings for each trip to determine total miles driven.

- Multiply the total business miles by the current IRS mileage rate to calculate the deductible amount.

- Include this amount in your tax return under business expenses.

Legal Use of the IRS Mileage

To ensure the legal use of the IRS mileage standard, taxpayers must adhere to the guidelines set forth by the IRS. This includes using the mileage rate only for legitimate business travel and maintaining accurate records. Misuse of the mileage deduction can lead to penalties and audits. It is essential to differentiate between personal and business mileage, as only the latter qualifies for deductions.

Key Elements of the IRS Mileage

The key elements of the IRS mileage standard include:

- The established mileage rate, which is updated annually.

- Requirements for keeping detailed travel logs.

- The distinction between personal and business mileage.

- Documentation needed to support mileage claims, such as receipts and trip logs.

Filing Deadlines / Important Dates

Understanding the deadlines for filing tax returns is crucial for claiming mileage deductions. Typically, individual taxpayers must file their returns by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to stay informed about any changes to filing dates, as these can impact the ability to claim deductions for the previous tax year.

Quick guide on how to complete mileage rate 325 form

Uncover the easiest method to complete and sign your Irs Milage

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your Irs Milage and similar forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle documents swiftly and in accordance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing tools all available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Irs Milage:

- Incorporate the fillable template into the editor using the Get Form button.

- Check what information must be provided in your Irs Milage.

- Move between the fields utilizing the Next option to ensure nothing is missed.

- Employ Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Redact sections that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using any method you prefer.

- Add the Date alongside your signature and finalize your work with the Done button.

Store your finished Irs Milage in the Documents folder of your profile, download it, or send it to your choice of cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your forms when you can send them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

If you left a survey for burglars to fill out the next time they ransacked your home, how would they rate the experience?

How did you learn about us?Rumors about rural houses having little Security.Location: 5/10Location was alright. Around 500 meters to the nearest neighbor. But unfortunately an hour away from any sizable population (20,000 plus being a sizable population.)Transportation: 10/10Transportation was top notch. The owners of the property never lock their Minivan or Pick-up truck. The keys are always left in the vehicles. Both are moderately new and somewhat non-descriptive so a perfect getaway vehicle. Not only did they provide vehicles they also kept trailers in a easily accessible unlocked shed.Security: 9/10Security was lax. There is a gate but it isn’t locked. Doors aren’t locked unless the house is left unoccupied for more than 2 weeks. No cameras made it really easy. They did have a dog which made it a bit of a pain. He was easily disposed of as he was just a Labrador Retriever puppy. Owners are very light sleepers don’t rob if they’re around.Products: 10/10No place has better selection. The place had 3 DSLR cameras, 3 Workstation class desktops, 3 tablets, 4 drones, 6 Smartphones, 9 external monitors and 11 laptops. All of the items were of premium design and value (aka Apples or equivalent). The freezers and shelves were well stocked the rest of the property was much more appealing though.They also had a shop on the property with many tools ranging from mechanics to carpentry to fabrication. The tools were of medium quality. The shop also stored 2 ATV for added convenience. The shop wasn’t the jackpot though.The shed was the real treasure trove. This drive in shed held heavy equipment all with the keys in the ignition for easy accessibility. The average equipment’s value was around $100,000, with a combined value of around $1.5 Million. Unfortunately the heavy equipment is hard to transport and the market is too small to get away with it.The products all seemed gift wrapped for the taking. Everything was easy to find as it looked organized.Laws in the area: 10/10Owners aren’t allowed to use lethal force or even have a premeditated weapon for self defense. A robber in the area once accidentally locked himself into the garage place he was robbing. As the owners did not come home for a couple days he resorted to eating dog food. The end result was the owners were charged for negligence of the robber. Laws almost protect us. Owners are not supposed to attack us in any way or they may be charged.Would you recommend to your friends?If everybody is gone a resounding yes. Unfortunately that’s not very often as the house is occupied by Home-schooling kids, a Writer and the owner is a farmer who mostly works on property. Also if you intend to use brute force, bring a weapon. All the occupants are big. The average height is around 6 feet.BTW bring friends to help loot. It really requires a team of people to loot the place.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the mileage rate 325 form

How to generate an eSignature for the Mileage Rate 325 Form online

How to create an eSignature for the Mileage Rate 325 Form in Google Chrome

How to create an eSignature for signing the Mileage Rate 325 Form in Gmail

How to create an electronic signature for the Mileage Rate 325 Form from your mobile device

How to create an eSignature for the Mileage Rate 325 Form on iOS

How to generate an electronic signature for the Mileage Rate 325 Form on Android

People also ask

-

What is IRS mileage and how does it relate to airSlate SignNow?

IRS mileage refers to the standard rate set by the IRS for business-related travel expenses. airSlate SignNow helps businesses streamline document signing and management for mileage reimbursement forms, making it easy to track and submit IRS mileage claims efficiently.

-

How can airSlate SignNow assist in managing IRS mileage reimbursements?

With airSlate SignNow, businesses can create, send, and eSign mileage reimbursement forms quickly. This ensures that employees can get their IRS mileage reimbursed without hassle, improving overall workflow and compliance with IRS guidelines.

-

What are the pricing options for using airSlate SignNow for IRS mileage documentation?

airSlate SignNow offers flexible pricing plans that cater to various business needs. By investing in airSlate SignNow, you can enhance your IRS mileage documentation process without incurring excessive costs, making it a cost-effective choice for businesses.

-

Are there any features in airSlate SignNow specifically for IRS mileage tracking?

Yes, airSlate SignNow includes features that allow users to create customized templates for IRS mileage tracking. This helps in accurately documenting travel details and ensures that all necessary information is captured for IRS mileage claims.

-

Can airSlate SignNow integrate with other tools for IRS mileage management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and expense management software, enhancing your IRS mileage tracking process. This integration allows for automatic data transfer, reducing manual entry and increasing accuracy.

-

How does airSlate SignNow improve efficiency for IRS mileage claims?

airSlate SignNow improves efficiency for IRS mileage claims by allowing users to eSign documents digitally, eliminating the need for physical signatures. This speeds up the approval process and ensures that your IRS mileage claims are processed quickly and accurately.

-

Is airSlate SignNow secure for handling IRS mileage documents?

Yes, airSlate SignNow prioritizes security and compliance, utilizing advanced encryption to protect sensitive IRS mileage documents. This ensures that your business information remains confidential while you manage and submit mileage claims.

Get more for Irs Milage

- Art club application form

- New pta membership form for 2013 2014 nichols elementary pta mynicholspta

- Sequoya elementary school 20132014 student council behavior contract name grade date 1 form

- Major works data sheet form

- Science prefixes and suffixes form

- Fob mmu fyp form

- Prerequisite document template form

- Huron school of nursing form

Find out other Irs Milage

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online