Publication 1 PL Rev 9 Your Rights as a Taxpayer Polish Version Form

What is the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

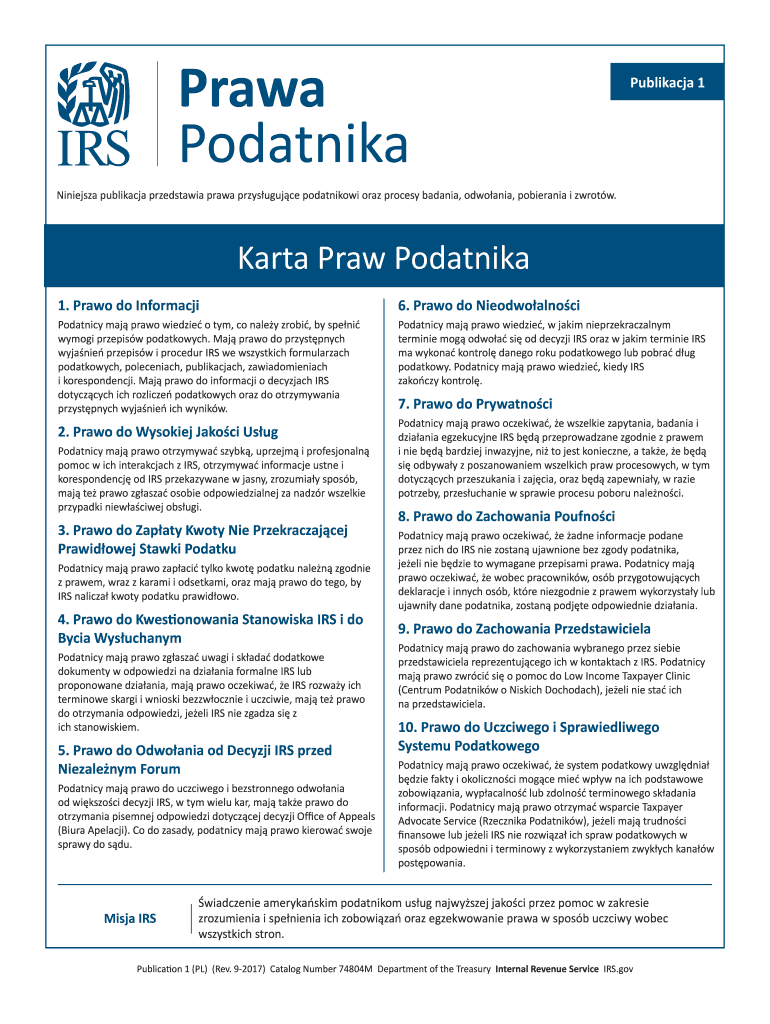

The Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version is a crucial document that outlines the rights of taxpayers in the United States. This publication serves as a guide for individuals to understand their entitlements when dealing with tax matters, including the right to appeal and the right to privacy. It is specifically tailored for Polish-speaking taxpayers, ensuring that language barriers do not hinder their understanding of tax rights and responsibilities. This publication is essential for promoting awareness and compliance among taxpayers, helping them navigate the complexities of the tax system.

How to use the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

Using the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version involves several steps to ensure that taxpayers can effectively understand and utilize their rights. First, individuals should read through the publication thoroughly to familiarize themselves with the content. It is advisable to take notes on key points, especially those that pertain to personal tax situations. Additionally, taxpayers can refer to this publication when communicating with tax authorities, ensuring they are aware of their rights during audits or disputes. Keeping a copy of this publication accessible can serve as a valuable reference during tax-related discussions.

Steps to complete the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

Completing the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version does not involve filling out forms but rather understanding its content. Taxpayers should follow these steps:

- Read the publication in its entirety to grasp the various rights outlined.

- Highlight or note down sections that are particularly relevant to your situation.

- Consider discussing the publication with a tax professional for personalized advice.

- Keep the publication handy for future reference during tax filing or inquiries.

Legal use of the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

The legal use of the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version is significant for ensuring that taxpayers are informed of their rights under U.S. tax law. This publication is recognized by the Internal Revenue Service (IRS) and serves as an official resource. Taxpayers can rely on the information provided to advocate for themselves in tax matters, ensuring compliance with legal standards. Understanding these rights can also help taxpayers avoid potential penalties and disputes with tax authorities.

Key elements of the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

Several key elements define the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version. These include:

- The right to be informed about tax laws and procedures.

- The right to privacy and confidentiality concerning tax information.

- The right to challenge the IRS’s position and appeal decisions.

- The right to representation by a qualified individual during tax disputes.

Understanding these elements is essential for taxpayers to effectively navigate their rights and responsibilities.

Examples of using the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

Taxpayers can utilize the Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version in various scenarios. For instance, if a taxpayer receives a notice from the IRS regarding an audit, they can refer to this publication to understand their rights during the audit process. Additionally, if a taxpayer believes they have been treated unfairly by the IRS, they can use the information in the publication to file a complaint or seek assistance. This publication serves as a vital resource for ensuring that taxpayers are aware of their rights and can act accordingly.

Quick guide on how to complete publication 1 pl rev 9 2017 your rights as a taxpayer polish version

Complete Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers a flawless eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without interruptions. Handle Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version without hassle

- Locate Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, monotonous form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 1 pl rev 9 2017 your rights as a taxpayer polish version

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version'?

'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version' is an essential document that outlines the rights and responsibilities of taxpayers in Poland. It provides clarity on tax obligations and available taxpayer rights, ensuring that all individuals understand their entitlements and duties under the Polish tax system.

-

How can airSlate SignNow assist with 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version'?

airSlate SignNow streamlines the process of signing and sending the 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version' digitally. Our platform allows you to securely eSign and share important tax documents, making it easier for you to manage your rights as a taxpayer without any hassle.

-

Is there a cost associated with using airSlate SignNow for this document?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different user needs. Our plans provide flexibility and outstanding value, ensuring you can efficiently manage the signing of documents like 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version' while staying within budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow features an intuitive interface, customizable templates, and robust eSignature capabilities. These features make it simple to handle documents, such as 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version', ensuring you maintain compliance and efficiency throughout the signing process.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, enhancing your workflow. This capability allows you to connect tools to efficiently manage documents like 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version' and further enhance productivity.

-

What advantages does eSigning provide for taxpayer rights documents?

eSigning enhances the security and efficiency of handling taxpayer rights documents, including 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version'. It reduces turnaround time and eliminates paperwork, allowing for a faster and more secure process that protects your sensitive information.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Yes, airSlate SignNow is designed with user-friendliness in mind. The platform enables individuals of all tech levels to easily navigate and utilize features to manage important documents like 'Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version', ensuring that everyone can benefit.

Get more for Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

Find out other Publication 1 PL Rev 9 Your Rights As A Taxpayer Polish Version

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online