5420 a Form

What is the 5420 A

The 5420 A form, also known as the IRS 5420 return, is a tax document used by individuals and businesses in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is particularly relevant for those who are eligible for certain tax credits or benefits. Understanding the purpose and requirements of the 5420 A is essential for ensuring compliance with federal tax regulations.

Steps to complete the 5420 A

Completing the 5420 A form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, providing accurate information in each section. It is important to review the form for any errors before submission. Finally, submit the completed form to the IRS by the designated deadline to avoid penalties.

Legal use of the 5420 A

The legal use of the 5420 A form hinges on its compliance with IRS regulations. This form must be filled out accurately and submitted on time to be recognized as valid. Electronic signatures, when used in conjunction with a trusted eSigning solution, can enhance the legal standing of the document, ensuring that it meets all necessary legal requirements. Understanding these legal aspects is crucial for taxpayers to protect their rights and obligations.

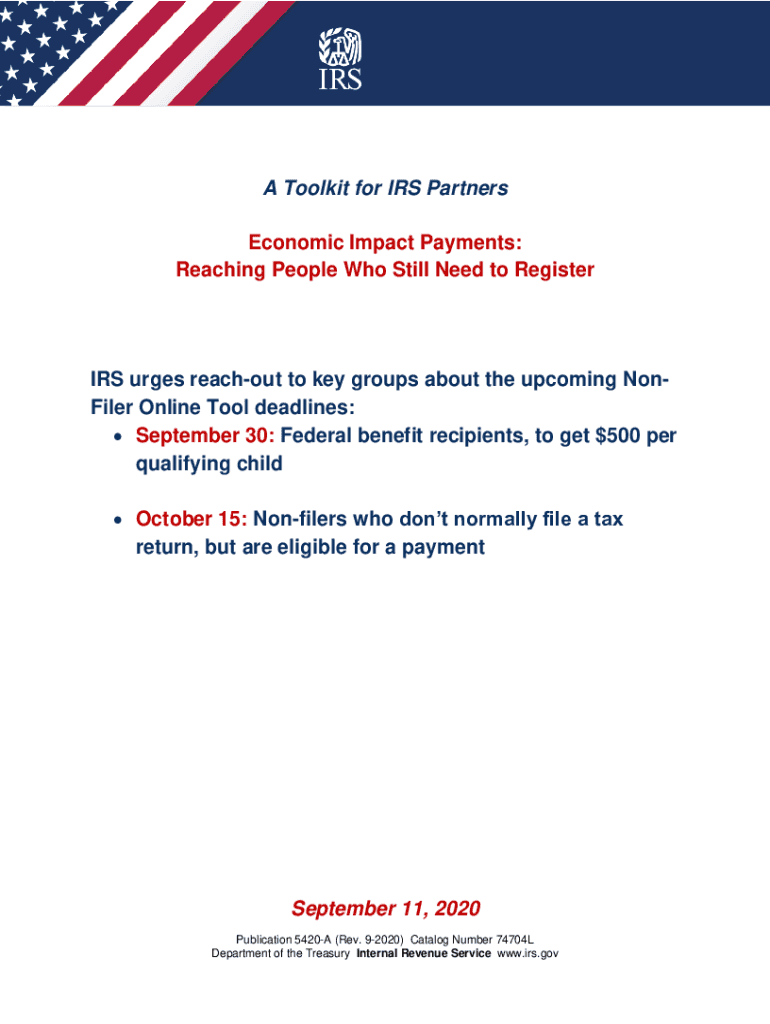

Filing Deadlines / Important Dates

Filing deadlines for the 5420 A form are critical for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for individuals. However, specific circumstances, such as extensions or special provisions, may alter these dates. Staying informed about these deadlines helps taxpayers avoid late fees and penalties associated with non-compliance.

Eligibility Criteria

Eligibility for using the 5420 A form is determined by various factors, including income level, filing status, and specific tax credits or benefits for which the taxpayer may qualify. It is essential for individuals and businesses to review these criteria carefully to ensure they meet the requirements before filing. Understanding eligibility can help maximize potential tax benefits and ensure compliance with IRS regulations.

Form Submission Methods

The 5420 A form can be submitted through various methods, including online filing, mailing a paper copy, or in-person submission at designated IRS offices. Each method has its advantages and considerations, such as processing times and documentation requirements. Choosing the appropriate submission method based on individual circumstances can facilitate a smoother filing experience.

Quick guide on how to complete 5420 a

Prepare 5420 A seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 5420 A on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign 5420 A effortlessly

- Find 5420 A and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searching, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 5420 A and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5420 a

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow 5420?

airSlate SignNow 5420 is a comprehensive electronic signature solution that allows businesses to send, sign, and manage documents efficiently. With its user-friendly interface, airSlate SignNow 5420 simplifies the signing process, ensuring quick and secure document transactions for all users.

-

How much does airSlate SignNow 5420 cost?

Pricing for airSlate SignNow 5420 varies based on the plan you choose, catering to different business needs. Typically, subscriptions start at an affordable rate, offering signNow savings over traditional paper-based processes while providing a robust set of features and unlimited signing capabilities.

-

What features does airSlate SignNow 5420 offer?

airSlate SignNow 5420 includes a variety of powerful features such as document templates, reminders, and cloud storage integration. Additionally, it supports in-person signing and allows for real-time tracking of document status, streamlining business workflows and enhancing productivity.

-

Is airSlate SignNow 5420 secure?

Yes, airSlate SignNow 5420 prioritizes security by implementing industry-standard encryption protocols to protect your documents. The platform also adheres to compliance regulations, ensuring that your data and signatures are legally valid and safe from unauthorized access.

-

Can I integrate airSlate SignNow 5420 with other software?

Absolutely! airSlate SignNow 5420 integrates seamlessly with various third-party applications, including CRM systems and cloud storage services. This capability not only enhances functionality but also helps businesses streamline their operations by keeping all tools connected and accessible.

-

How can airSlate SignNow 5420 improve my business operations?

By utilizing airSlate SignNow 5420, businesses can signNowly reduce the time spent on document management and signing processes. The efficiency gained allows teams to focus on core activities, leading to improved productivity and quicker turnaround on agreements and contracts.

-

What types of documents can I sign with airSlate SignNow 5420?

airSlate SignNow 5420 allows you to eSign a wide range of documents, including contracts, agreements, and forms. The flexibility of the platform means you can handle nearly any document type electronically, making it a versatile solution for various business needs.

Get more for 5420 A

Find out other 5420 A

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast