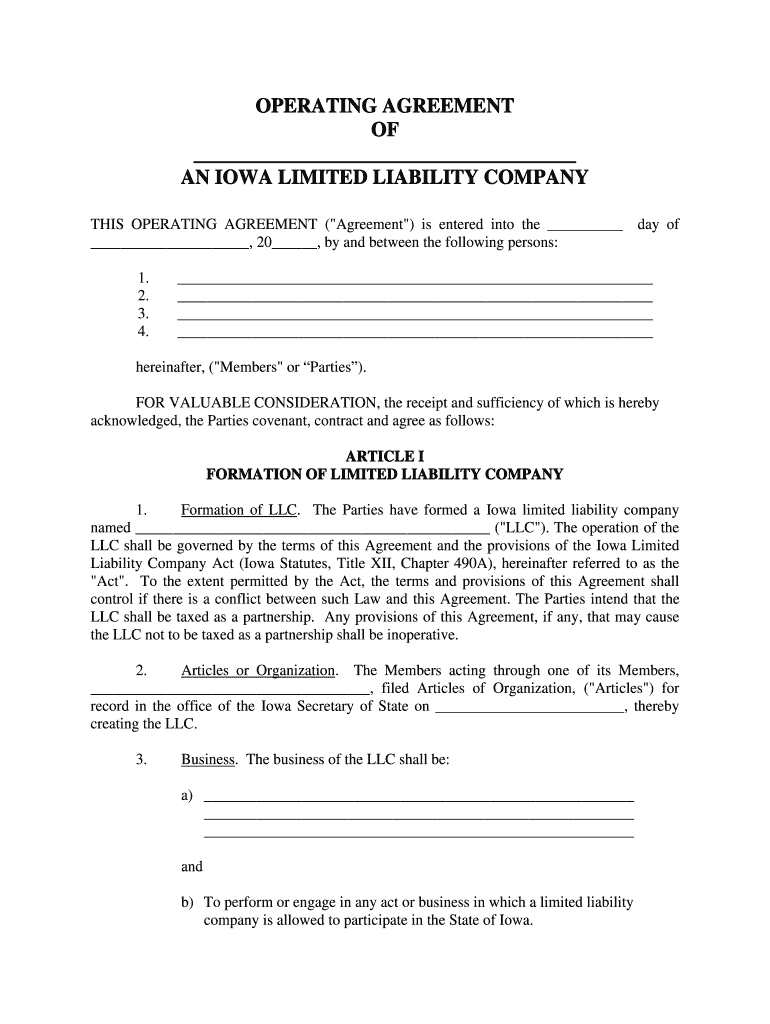

Operating Agreement Llc Form

What is the Operating Agreement for an LLC?

An operating agreement is a crucial document for a Limited Liability Company (LLC) that outlines the management structure and operating procedures of the business. This agreement serves as an internal guideline for the members, detailing their rights, responsibilities, and the distribution of profits and losses. It is essential for establishing the rules that govern the LLC, ensuring clarity among members and protecting the business's limited liability status. Without a well-defined operating agreement, disputes may arise, and the default state laws may apply, which may not align with the members' intentions.

Key Elements of the Operating Agreement for an LLC

A comprehensive operating agreement should include several key elements to ensure it meets the needs of the LLC and its members. These elements typically encompass:

- Member Information: Names and addresses of all members.

- Management Structure: Details on whether the LLC is member-managed or manager-managed.

- Capital Contributions: Information on initial contributions made by members and any future contributions.

- Profit and Loss Distribution: Guidelines on how profits and losses will be allocated among members.

- Voting Rights: Specifications on voting procedures and member rights.

- Transfer of Membership Interests: Rules governing the transfer or sale of membership interests.

- Dissolution Procedures: Steps to be taken if the LLC needs to be dissolved.

Steps to Complete the Operating Agreement for an LLC

Completing an operating agreement involves several important steps. First, members should gather to discuss and agree on the terms that will govern the LLC. Next, they should draft the agreement, ensuring all key elements are included. After drafting, it is advisable to review the document for clarity and completeness. Once all members are satisfied, they should sign the agreement to make it legally binding. Finally, each member should keep a copy of the signed agreement for their records.

Legal Use of the Operating Agreement for an LLC

The operating agreement is legally significant as it helps establish the LLC's structure and operational guidelines. It is not typically filed with the state but should be kept on record. In legal disputes, having a well-drafted operating agreement can provide clarity and serve as evidence of the members' intentions. Additionally, it can help protect the limited liability status of the LLC by demonstrating that the business is a separate legal entity.

How to Use the Operating Agreement for an LLC

Using the operating agreement effectively involves adhering to the guidelines set within the document. Members should reference the agreement when making decisions related to management, profit distribution, or any changes in membership. Regularly reviewing the agreement can ensure that it remains relevant and reflects any changes in the business or its members. Amendments can be made as necessary, following the procedures outlined in the agreement itself.

State-Specific Rules for the Operating Agreement for an LLC

Each state has its own regulations regarding LLCs and operating agreements. While most states do not require an operating agreement to be filed, having one is highly recommended. Members should be aware of their state's specific requirements, such as whether certain provisions must be included or if there are recommended formats. Consulting with a legal professional familiar with state laws can help ensure compliance and address any unique considerations.

Quick guide on how to complete photography llc operating agreement form

Prepare Operating Agreement Llc seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Operating Agreement Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Operating Agreement Llc effortlessly

- Obtain Operating Agreement Llc and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive content with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns of lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Operating Agreement Llc and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

How does an LLC adopt a new operating agreement?

Good question as an administrative task like this can have drastic effects if it’s not completed properly. Operating agreements often include language addressing how the LLC may alter or revoke the agreement. If not, the rule for adopting a new operating agreement is governed by the default rule in your state. The default rule for the State of Washington is approval by all members, which is easy for your single member LLC.I agree with Dana and and Stephen that you should clearly note in your new operating agreement that this one replaces the former. I also agree with the Anonymous post that recommends seeking counsel on the tax implications that your amendment may have.We’ve helped countless startups with making changes like this at LawTrades. Our platform connects bootstrapping entrepreneurs to a vast network of experienced and affordable startups attorneys. Also, feel free to message me if you have any other questions regarding your operating agreement!

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

Create this form in 5 minutes!

How to create an eSignature for the photography llc operating agreement form

How to generate an eSignature for your Photography Llc Operating Agreement Form online

How to create an electronic signature for your Photography Llc Operating Agreement Form in Google Chrome

How to generate an eSignature for putting it on the Photography Llc Operating Agreement Form in Gmail

How to make an eSignature for the Photography Llc Operating Agreement Form straight from your smart phone

How to create an electronic signature for the Photography Llc Operating Agreement Form on iOS devices

How to generate an electronic signature for the Photography Llc Operating Agreement Form on Android

People also ask

-

What is an Operating Agreement LLC and why is it important?

An Operating Agreement LLC is a legal document that outlines the ownership and operating procedures of a Limited Liability Company. It is crucial for defining roles, responsibilities, and profit distribution among members, ensuring smooth operations and legal protection.

-

How can airSlate SignNow help me create an Operating Agreement LLC?

airSlate SignNow provides easy-to-use templates and tools for drafting an Operating Agreement LLC. With our platform, you can customize your agreement quickly, ensuring it meets your specific business needs while remaining compliant with state laws.

-

What features does airSlate SignNow offer for managing my Operating Agreement LLC?

With airSlate SignNow, you can securely store, share, and eSign your Operating Agreement LLC. Our platform also offers collaboration tools, so all members can review and sign documents seamlessly, enhancing efficiency in your business operations.

-

Is there a cost associated with creating an Operating Agreement LLC using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs when creating an Operating Agreement LLC. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning and document management features.

-

Can I integrate airSlate SignNow with other tools for my Operating Agreement LLC?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when creating and managing your Operating Agreement LLC. This integration capability enhances productivity and ensures all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my Operating Agreement LLC?

Using airSlate SignNow for your Operating Agreement LLC offers numerous benefits, including time-saving features, secure document management, and easy eSigning. Our platform simplifies the process, making it efficient and hassle-free for you and your business partners.

-

How does airSlate SignNow ensure the security of my Operating Agreement LLC?

airSlate SignNow prioritizes the security of your documents, including your Operating Agreement LLC, by implementing advanced encryption and secure storage. We comply with industry standards to protect your sensitive information from unauthorized access.

Get more for Operating Agreement Llc

- For formulary information and to download additional forms please visit httpwww

- 2011 il 718c form

- Form name form number ywca lake county

- Blood cancer report form

- Mail from illinois medicaid redetermination form

- Indiana medicaid reunburrsment for home health companies form

- Indiana medicaid appeal form

- Wellcare letter of intent form

Find out other Operating Agreement Llc

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now