Montana Articles of Incorporation for Domestic Nonprofit Corporation 2006-2026

What is the Montana Articles of Incorporation for Domestic Nonprofit Corporation

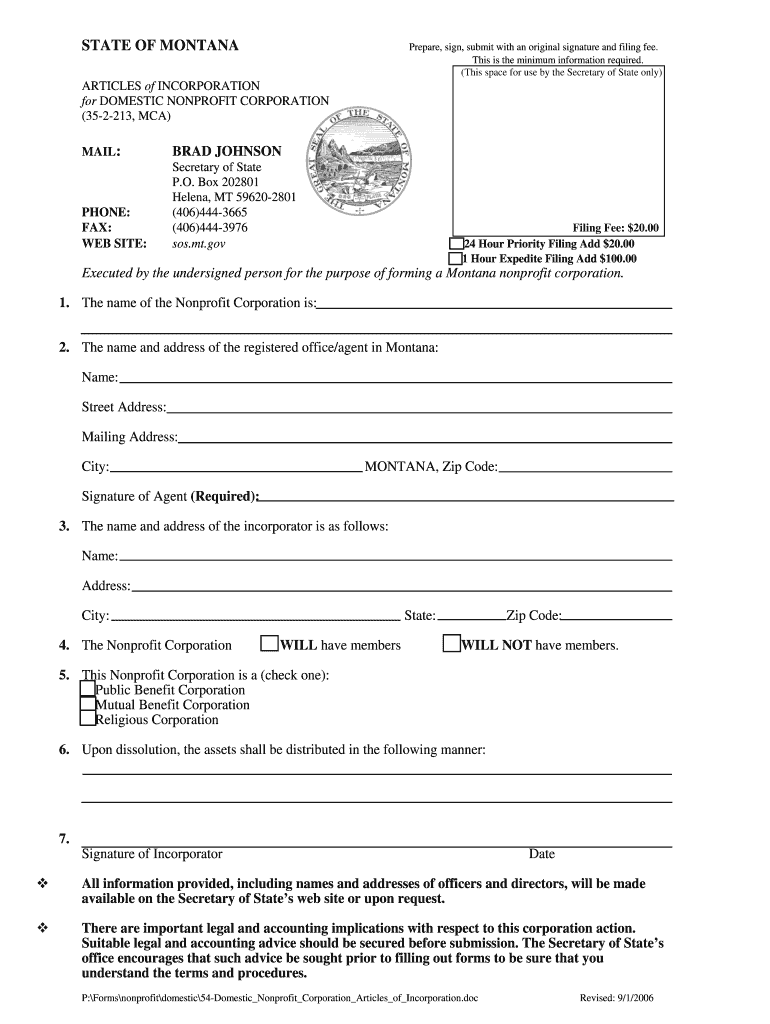

The Montana Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that establishes a nonprofit organization within the state of Montana. This form outlines the organization's purpose, structure, and governance. It is essential for any group seeking to operate as a nonprofit entity, as it provides the necessary legal recognition and framework for operation. The articles must comply with Montana state laws and include specific information such as the organization's name, registered agent, and the address of the principal office.

Key Elements of the Montana Articles of Incorporation for Domestic Nonprofit Corporation

When preparing the Montana Articles of Incorporation, several key elements must be included to ensure compliance and legal validity. These elements typically encompass:

- Name of the Organization: The proposed name must be unique and include a designation indicating its nonprofit status.

- Purpose: A clear statement outlining the nonprofit's mission and objectives.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the organization.

- Principal Office Address: The primary location where the organization conducts its business.

- Incorporators: Names and addresses of individuals responsible for filing the articles.

Steps to Complete the Montana Articles of Incorporation for Domestic Nonprofit Corporation

Completing the Montana Articles of Incorporation involves a series of steps to ensure accuracy and compliance with state regulations. The following steps can guide you through the process:

- Choose a unique name for your nonprofit that complies with Montana naming requirements.

- Draft the articles, including all necessary information as outlined in state guidelines.

- Review the completed document for accuracy and completeness.

- File the articles with the Montana Secretary of State, either online or by mail.

- Pay the required filing fee, which is typically outlined on the Secretary of State's website.

How to Obtain the Montana Articles of Incorporation for Domestic Nonprofit Corporation

To obtain the Montana Articles of Incorporation, individuals can access the form through the Montana Secretary of State's website. The form is available for download in PDF format, allowing for easy completion. Additionally, the website provides guidelines and instructions on how to fill out the form correctly. If preferred, individuals can also request a physical copy of the form by contacting the Secretary of State's office directly.

Filing Deadlines / Important Dates

Filing deadlines for the Montana Articles of Incorporation can vary based on the organization's specific circumstances. It is crucial to submit the articles promptly to avoid any penalties or delays in legal recognition. Generally, there are no strict deadlines for filing; however, it is advisable to complete the process as soon as the organization is ready to operate. Keeping track of any state-specific requirements or changes in regulations is also important to ensure compliance.

Legal Use of the Montana Articles of Incorporation for Domestic Nonprofit Corporation

The legal use of the Montana Articles of Incorporation is fundamental for establishing a nonprofit organization. Once filed and approved, the articles serve as the foundational document that legitimizes the organization’s existence. This legal recognition allows the nonprofit to operate, apply for tax-exempt status, and enter into contracts. It is essential to keep the articles updated and compliant with state laws to maintain good standing.

Quick guide on how to complete montana articles of incorporation for domestic nonprofit corporation

Complete and submit your Montana Articles Of Incorporation For Domestic Nonprofit Corporation swiftly

Essential tools for digital document transfer and verification are crucial for enhancing processes and the continuous advancement of your forms. When managing legal documents and signing a Montana Articles Of Incorporation For Domestic Nonprofit Corporation, the right signing solution can signNowly reduce your time and paper consumption with each submission.

Search, fill out, modify, sign, and distribute your legal documents using airSlate SignNow. This platform provides everything necessary to streamline your paper submission processes. Its vast library of legal forms and user-friendly navigation will assist you in locating your Montana Articles Of Incorporation For Domestic Nonprofit Corporation promptly, and the editor that includes our signature capability will enable you to finalize and authorize it instantly.

Sign your Montana Articles Of Incorporation For Domestic Nonprofit Corporation in a few straightforward steps

- Locate the Montana Articles Of Incorporation For Domestic Nonprofit Corporation you need in our library utilizing search or catalog options.

- Review the form details and preview it to ensure it meets your requirements and state regulations.

- Click Obtain form to open it for modifications.

- Fill out the form using the all-inclusive toolbar.

- Examine the information you input and click the Sign option to validate your document.

- Select one of three methods to incorporate your signature.

- Complete your edits and save the document in your collection, then download it to your device or share it directly.

Streamline every phase of your document creation and validation with airSlate SignNow. Experience a more effective online solution that encompasses all aspects of managing your paperwork.

Create this form in 5 minutes or less

FAQs

-

New York (state): How long does it typically take for a Certificate of Change on a domestic corporation's Certificate of Incorporation to go through in NY?

I used the standard service. I received a certificate of incorporation in New York within 10-12 days. You can use expedited services to get it in a few days. Don't forget that the second option is more expensive. Getting a certificate of change on a domestic corporation's Certificate of Incorporation is pretty much the same.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the montana articles of incorporation for domestic nonprofit corporation

How to create an eSignature for your Montana Articles Of Incorporation For Domestic Nonprofit Corporation online

How to make an electronic signature for the Montana Articles Of Incorporation For Domestic Nonprofit Corporation in Chrome

How to create an electronic signature for signing the Montana Articles Of Incorporation For Domestic Nonprofit Corporation in Gmail

How to generate an electronic signature for the Montana Articles Of Incorporation For Domestic Nonprofit Corporation right from your smart phone

How to generate an eSignature for the Montana Articles Of Incorporation For Domestic Nonprofit Corporation on iOS devices

How to make an eSignature for the Montana Articles Of Incorporation For Domestic Nonprofit Corporation on Android

People also ask

-

What are Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

Montana Articles Of Incorporation For Domestic Nonprofit Corporation are legal documents required to establish a nonprofit organization in Montana. This document outlines the organization's purpose, structure, and governance. Filing these articles is a crucial step in ensuring your nonprofit is recognized and compliant with state laws.

-

How do I file Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

To file Montana Articles Of Incorporation For Domestic Nonprofit Corporation, you need to complete the appropriate forms and submit them to the Montana Secretary of State. This process can be simplified using airSlate SignNow, which allows you to fill out, eSign, and submit your documents online efficiently.

-

What information is required in Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

The Montana Articles Of Incorporation For Domestic Nonprofit Corporation typically require details such as the organization's name, purpose, registered agent information, and the names of the initial directors. Ensuring all required information is included will help expedite the incorporation process.

-

How much does it cost to file Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

The filing fee for Montana Articles Of Incorporation For Domestic Nonprofit Corporation varies, but it is generally around $20. Using airSlate SignNow can further reduce overall costs by streamlining the documentation process, making it easier and more affordable to complete your filing.

-

What are the benefits of using airSlate SignNow for filing Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

Using airSlate SignNow for filing Montana Articles Of Incorporation For Domestic Nonprofit Corporation offers several benefits, including easy document creation, eSigning capabilities, and secure storage. The platform's user-friendly interface helps ensure that your documents are accurately completed and submitted on time.

-

Can I track the status of my Montana Articles Of Incorporation For Domestic Nonprofit Corporation filing?

Yes, you can track the status of your Montana Articles Of Incorporation For Domestic Nonprofit Corporation filing through the Montana Secretary of State's website. Additionally, when you use airSlate SignNow, you can keep a detailed record of your filings and receive notifications for any updates.

-

Are there any integrations available with airSlate SignNow for managing Montana Articles Of Incorporation For Domestic Nonprofit Corporation?

Yes, airSlate SignNow offers various integrations with popular business tools, such as Google Workspace and Dropbox, that can assist in managing your Montana Articles Of Incorporation For Domestic Nonprofit Corporation. These integrations make it easier to organize and share important documents across your team.

Get more for Montana Articles Of Incorporation For Domestic Nonprofit Corporation

Find out other Montana Articles Of Incorporation For Domestic Nonprofit Corporation

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT