Aw2 15 Form

What is the Aw2 15

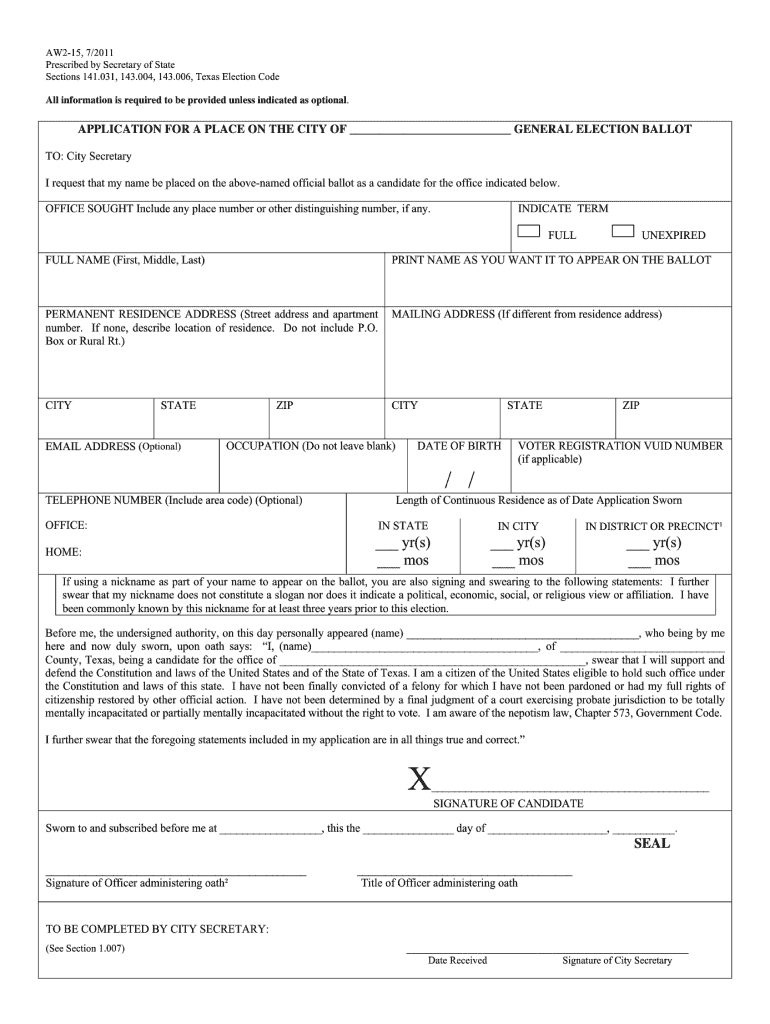

The Aw2 15 form is a specific document used primarily in the context of employment and taxation in the United States. It serves as a record of wages paid to employees and the taxes withheld throughout the year. This form is essential for both employers and employees as it provides crucial information for tax filing purposes. Understanding the details contained in the Aw2 15 is vital for accurate reporting and compliance with IRS regulations.

How to use the Aw2 15

Using the Aw2 15 form involves several steps to ensure that the information is completed accurately. First, employers must gather all relevant wage and tax data for each employee. This includes total earnings, federal and state tax withholdings, and any other deductions. Once the data is compiled, it can be entered into the Aw2 15 form. Employees should review the completed form for accuracy, as discrepancies can lead to complications during tax filing. It is also important to retain a copy of the form for personal records.

Steps to complete the Aw2 15

Completing the Aw2 15 form requires careful attention to detail. Follow these steps:

- Collect all necessary payroll records for the year.

- Fill in the employee’s personal information, including name, address, and Social Security number.

- Enter total wages, tips, and other compensation in the appropriate fields.

- Document federal, state, and local tax withholdings accurately.

- Double-check all entries for accuracy before submission.

Once completed, the form should be distributed to employees and filed with the appropriate tax authorities.

Legal use of the Aw2 15

The Aw2 15 form must be used in compliance with federal and state tax laws. It is legally binding and serves as proof of income and tax withholdings for employees. Employers are required to provide this form to employees by January 31 of each year for the previous tax year. Failure to issue the Aw2 15 form correctly can result in penalties for employers. Accurate completion and timely distribution are essential to ensure legal compliance and avoid potential legal issues.

Key elements of the Aw2 15

The Aw2 15 form contains several key elements that are crucial for both employers and employees. These include:

- Employee identification information, such as name and Social Security number.

- Total earnings for the year, including wages, tips, and bonuses.

- Details of federal and state tax withholdings.

- Any additional deductions, such as retirement contributions or health insurance premiums.

Each of these elements plays a significant role in the overall tax reporting process and must be accurately reported to ensure compliance with tax regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use and submission of the Aw2 15 form. Employers must adhere to these guidelines to avoid penalties. Key points include:

- Timely submission of the form to both employees and the IRS.

- Accurate reporting of all wage and tax information.

- Compliance with deadlines, including the January 31 distribution date.

Following IRS guidelines is essential for maintaining compliance and ensuring that both employers and employees fulfill their tax obligations.

Quick guide on how to complete aw2 15

Complete Aw2 15 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Aw2 15 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Aw2 15 with ease

- Find Aw2 15 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Aw2 15 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aw2 15

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the aw2 15 document, and how does airSlate SignNow help with it?

The aw2 15 document is essential for reporting income and ensuring tax compliance. airSlate SignNow simplifies the process by enabling businesses to eSign and send aw2 15 forms securely, making it easy to manage important financial documents.

-

How much does airSlate SignNow cost for managing aw2 15 forms?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when handling aw2 15 forms. Customers can choose plans based on features and usage, ensuring they get the best value while efficiently managing document workflows.

-

What features does airSlate SignNow provide for aw2 15 processing?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and automated document routing specifically for aw2 15. These tools streamline management, reduce errors, and enhance compliance for businesses handling tax documents.

-

Can I integrate airSlate SignNow with other software for aw2 15 document processing?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing businesses to manage aw2 15 forms more efficiently. This integration enhances productivity by connecting workflows and ensuring faster processing of documents.

-

What are the benefits of using airSlate SignNow for aw2 15 documents?

Using airSlate SignNow for aw2 15 documents increases efficiency, security, and compliance. The platform simplifies the eSignature process, reducing turnaround times and enabling businesses to focus on their core operations without worrying about document management.

-

Is airSlate SignNow secure for sending and signing aw2 15 documents?

Absolutely! airSlate SignNow employs top-notch security protocols to ensure that your aw2 15 documents are protected. Our platform uses encryption and complies with industry standards, giving businesses peace of mind when handling sensitive information.

-

How can I get started with airSlate SignNow for aw2 15 documents?

Getting started with airSlate SignNow is easy! Simply sign up for a free trial, choose the appropriate plan, and begin creating and managing your aw2 15 documents. Our user-friendly interface guides you through the setup process.

Get more for Aw2 15

Find out other Aw2 15

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement