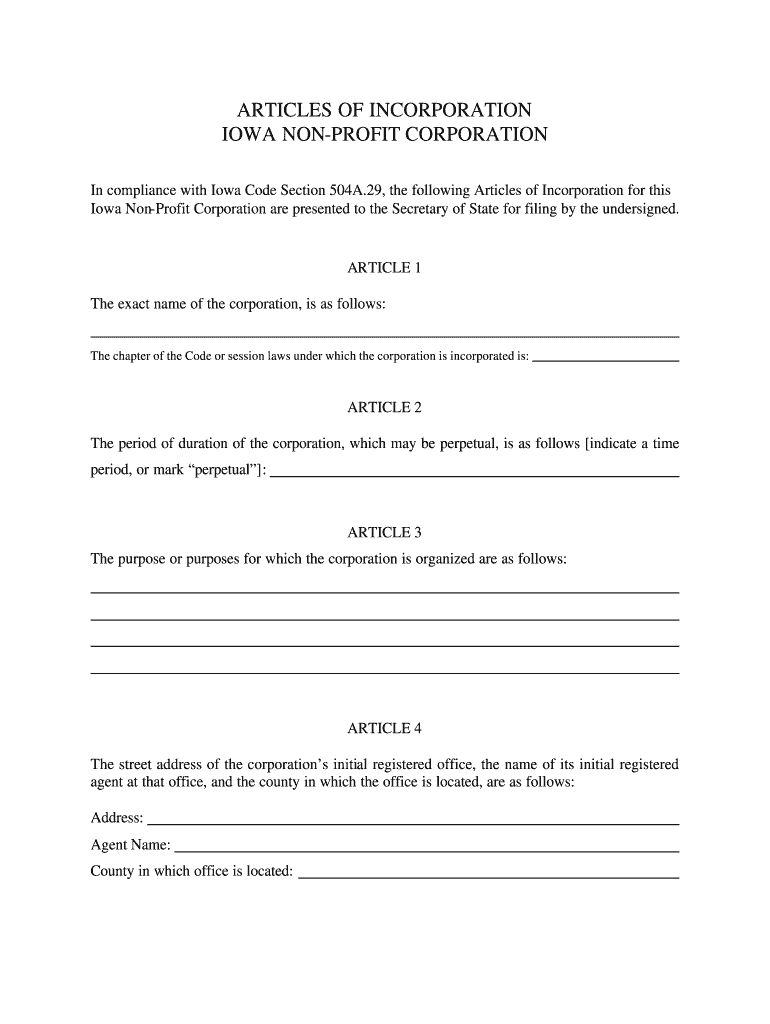

Articles of Incorporation Nonprofit Form

Understanding the Iowa Certificate of Organization

The Iowa certificate of organization is a crucial document for businesses, particularly for limited liability companies (LLCs). This form serves as the official record of the establishment of an LLC in Iowa. It outlines essential details such as the business name, registered agent, and the principal office address. Understanding this document is vital for compliance with state regulations and for the legal recognition of your business entity.

Steps to Complete the Iowa Certificate of Organization

Completing the Iowa certificate of organization involves several key steps:

- Choose a unique business name that complies with Iowa naming requirements.

- Select a registered agent who will receive legal documents on behalf of the LLC.

- Provide the principal office address where the business will operate.

- Fill out the certificate of organization form accurately, ensuring all required information is included.

- Submit the form to the Iowa Secretary of State, either online or via mail, along with the necessary filing fee.

Key Elements of the Iowa Certificate of Organization

When preparing the Iowa certificate of organization, it is essential to include specific key elements:

- Business Name: Must be distinguishable from other registered entities in Iowa.

- Registered Agent: Name and address of the individual or business designated to receive legal documents.

- Principal Office Address: The primary location where the business operates.

- Effective Date: Optionally, you can specify when the LLC will officially commence operations.

Filing Methods for the Iowa Certificate of Organization

The Iowa certificate of organization can be filed using various methods:

- Online Submission: The Iowa Secretary of State's website allows for electronic filing, which is often quicker and more efficient.

- Mail Submission: You can print the completed form and send it to the Secretary of State's office via postal service.

- In-Person Submission: For those who prefer face-to-face interactions, you can also submit the form directly at the Secretary of State's office.

Legal Use of the Iowa Certificate of Organization

The Iowa certificate of organization is legally binding once filed and approved by the Secretary of State. It provides the necessary legal framework for the LLC to operate within Iowa. This document ensures that the business is recognized as a separate legal entity, offering liability protection to its owners. Compliance with state laws regarding the filing and maintenance of this document is crucial for the ongoing legitimacy of the business.

Required Documents for Filing

When filing the Iowa certificate of organization, certain documents and information are required:

- The completed certificate of organization form.

- Payment for the filing fee, which can vary based on the method of submission.

- Any additional documents that may be required depending on the nature of the business or specific circumstances.

Quick guide on how to complete iowa articles of incorporation for domestic nonprofit corporation

Complete Articles Of Incorporation Nonprofit seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to draft, modify, and electronically sign your documents promptly without any hold-ups. Manage Articles Of Incorporation Nonprofit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Articles Of Incorporation Nonprofit with ease

- Obtain Articles Of Incorporation Nonprofit and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature utilizing the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Articles Of Incorporation Nonprofit and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

New York (state): How long does it typically take for a Certificate of Change on a domestic corporation's Certificate of Incorporation to go through in NY?

I used the standard service. I received a certificate of incorporation in New York within 10-12 days. You can use expedited services to get it in a few days. Don't forget that the second option is more expensive. Getting a certificate of change on a domestic corporation's Certificate of Incorporation is pretty much the same.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the iowa articles of incorporation for domestic nonprofit corporation

How to create an eSignature for the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation in the online mode

How to make an electronic signature for the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation in Chrome

How to generate an electronic signature for putting it on the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation in Gmail

How to create an eSignature for the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation straight from your smartphone

How to generate an electronic signature for the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation on iOS devices

How to generate an eSignature for the Iowa Articles Of Incorporation For Domestic Nonprofit Corporation on Android OS

People also ask

-

What are Articles of Incorporation for a nonprofit organization?

Articles of Incorporation for a nonprofit organization are legal documents that establish the existence of the nonprofit in a specific state. They outline the organization's purpose, structure, and governance. Having properly filed Articles of Incorporation for a nonprofit is essential for attaining tax-exempt status and ensuring compliance with state regulations.

-

How can airSlate SignNow help with filing Articles of Incorporation for a nonprofit?

airSlate SignNow simplifies the process of filing Articles of Incorporation for a nonprofit by allowing users to create, edit, and eSign documents electronically. This streamlines the submission process and ensures that all necessary signatures are obtained quickly and securely. With airSlate SignNow, you can manage your nonprofit's paperwork efficiently and effectively.

-

What features does airSlate SignNow offer for managing nonprofit documentation?

airSlate SignNow offers a variety of features tailored to managing nonprofit documentation, including customizable templates for Articles of Incorporation and other essential forms. Users can easily collaborate on documents, track changes, and receive notifications when documents are signed. These features enhance organization and ensure compliance with nonprofit regulations.

-

Is airSlate SignNow affordable for nonprofits looking to file Articles of Incorporation?

Yes, airSlate SignNow offers affordable pricing plans specifically designed for nonprofits. These plans provide essential features at a reduced rate, making it cost-effective for organizations to manage their Articles of Incorporation and other documentation. Nonprofits can benefit from streamlined workflows without breaking their budget.

-

Can airSlate SignNow integrate with other software to assist with nonprofit management?

Absolutely! airSlate SignNow integrates seamlessly with various nonprofit management software, allowing organizations to streamline their operations. These integrations enable nonprofits to link their Articles of Incorporation and other documents with their management tools, fostering better collaboration and efficiency in managing their organization.

-

What are the benefits of using airSlate SignNow for eSigning Articles of Incorporation for a nonprofit?

Using airSlate SignNow for eSigning Articles of Incorporation for a nonprofit provides numerous benefits, including faster turnaround times and increased security. The platform ensures that all signatures are legally binding and that documents are stored securely in the cloud. This allows nonprofits to focus more on their mission rather than paperwork.

-

How secure is airSlate SignNow for handling sensitive nonprofit documents?

airSlate SignNow is highly secure, employing bank-level encryption and robust security protocols to protect sensitive nonprofit documents, including Articles of Incorporation. Users can rest assured that their information is safe from unauthorized access. The platform also complies with industry standards for data protection, ensuring peace of mind for all users.

Get more for Articles Of Incorporation Nonprofit

- Fraser health authority fha specific forms oscar canada

- Sucro can canada form

- Details pba canada pba canada form

- Frank findlay form

- Emergency health services commission first responder report frontlinefirstaid form

- Canada hockey player registration form

- Chiropractic intake form complete balance health

- Application for supplementary letters patent form 3 corporations act

Find out other Articles Of Incorporation Nonprofit

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter