Tax Alaska Form

What is the Tax Alaska

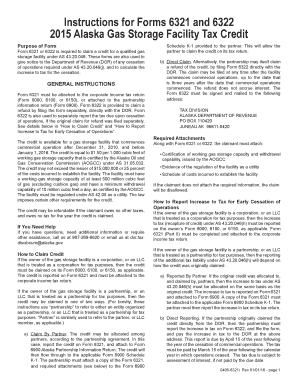

The Tax Alaska form is a specific document used for various tax-related purposes in the state of Alaska. It is essential for individuals and businesses to accurately report their income, deductions, and credits to ensure compliance with state tax regulations. This form may involve different sections that cater to various taxpayer categories, including individuals, self-employed persons, and businesses. Understanding the purpose and requirements of the Tax Alaska form is crucial for effective tax management and compliance.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements, W-2 forms, and any relevant deduction receipts. Next, carefully fill out each section of the form, providing accurate information as required. It is important to double-check all entries for errors or omissions. Once completed, sign and date the form to validate it. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the submission methods available for the Tax Alaska form.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. To be considered valid, the form must be filled out accurately and submitted within designated deadlines. Compliance with these legal requirements ensures that the form is recognized by tax authorities and can withstand scrutiny in case of audits or disputes. Utilizing a reliable electronic signature solution can further enhance the legal standing of the form, as it provides a secure method for signing and submitting documents while adhering to eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for taxpayers to keep in mind. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, it is essential to verify specific state guidelines, as there may be variations based on individual circumstances or extensions. Missing these deadlines can result in penalties or interest on unpaid taxes, making timely submission vital for compliance.

Required Documents

To successfully complete the Tax Alaska form, several documents are typically required. Taxpayers should gather their income statements, such as W-2s or 1099s, which report earnings for the tax year. Additionally, any documentation related to deductions or credits, such as receipts for charitable contributions or business expenses, should be collected. Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Examples of using the Tax Alaska

Examples of using the Tax Alaska form can vary based on individual taxpayer scenarios. For instance, a self-employed individual may use the form to report income from freelance work, while a business owner might use it to declare profits from their corporation. Each example highlights the importance of accurately reporting income and claiming applicable deductions to minimize tax liability. Understanding these scenarios can help taxpayers navigate their specific tax situations more effectively.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to assist individuals and businesses in understanding their tax obligations, including the issuance of necessary forms and instructions for proper completion and submission.

Quick guide on how to complete tax alaska 6967308

Complete Tax Alaska effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage Tax Alaska on any device with airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to alter and eSign Tax Alaska without exertion

- Locate Tax Alaska and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow portions of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Tax Alaska and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967308

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska?

airSlate SignNow is an eSignature solution that allows businesses to send and sign documents electronically. For those dealing with Tax Alaska, it streamlines the process of sending tax documents for signatures, ensuring compliance and efficiency. This can save valuable time during tax season.

-

Is airSlate SignNow affordable for small businesses handling Tax Alaska?

Yes, airSlate SignNow provides a cost-effective solution for businesses of all sizes, including small businesses managing Tax Alaska. With various pricing plans available, you can choose one that fits your budget while still accessing powerful eSignature features. This ensures you get great value without compromising on functionality.

-

What features does airSlate SignNow offer for managing Tax Alaska documents?

airSlate SignNow offers features like customizable templates, automated workflows, and secure cloud storage to help manage Tax Alaska documents efficiently. These features facilitate a smooth signing process and help maintain a proper record of all tax-related documents. This makes filing and tracking much easier for businesses.

-

Are there integrations available for airSlate SignNow with tax software to assist with Tax Alaska?

Yes, airSlate SignNow integrates seamlessly with various tax software, enhancing your experience managing Tax Alaska. These integrations allow for easy data transfer and document submissions directly within your tax software, thereby improving productivity. This means you can handle everything you've got from one central platform.

-

How does airSlate SignNow ensure compliance with Tax Alaska regulations?

airSlate SignNow ensures compliance with Tax Alaska regulations by adhering to industry standards for electronic signatures. E-signatures are legally binding and meet the requirements set forth by the IRS for tax documents. This provides peace of mind as you manage your tax filing processes.

-

Can I access airSlate SignNow on mobile for Tax Alaska documents?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your Tax Alaska documents on the go. With the mobile app, you can send, sign, and track documents from your smartphone or tablet, making it easy to stay on top of your tax obligations regardless of your location.

-

What are the benefits of using airSlate SignNow for Tax Alaska?

The primary benefits of using airSlate SignNow for Tax Alaska include increased efficiency, reduced turnaround times, and enhanced document security. By digitizing your document signing process, you can save on printing and mailing costs while ensuring that sensitive tax documents remain secure. This adds signNow value to your tax management efforts.

Get more for Tax Alaska

- Transcr acte mariage form 141 17 a ambafrance id

- Dar 4082 form

- Medical exam report for mass hoisting license fitness determination form

- Pengkinian data bca form

- Delivery certificate 14720555 form

- Homeless verification letter florida form

- George mason university mail services metered mail form mailservices gmu

- Course performance summary york university 414436973

Find out other Tax Alaska

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF