Il 4852 Form 2019

What is the Il 4852 Form

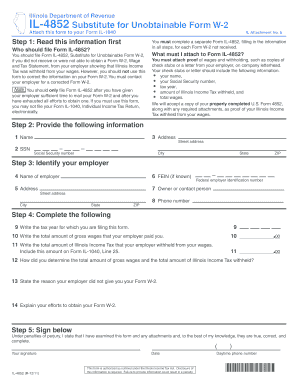

The Il 4852 Form is a tax document used by individuals in the United States to report income when they have not received a Form W-2 from their employer. This form is particularly relevant for those who may have worked for an employer that did not issue the required wage reporting form, allowing taxpayers to accurately report their earnings to the Internal Revenue Service (IRS). It serves as a substitute for the W-2 and provides essential information about the taxpayer's income, withholding, and any taxes owed.

How to use the Il 4852 Form

Using the Il 4852 Form involves several steps to ensure accurate reporting of income. First, gather all relevant information, including your personal details, the employer's information, and your income details for the tax year. Next, complete the form by entering the required information in the designated fields. It is important to provide accurate figures to avoid discrepancies with the IRS. Once completed, the form should be submitted alongside your tax return, ensuring that all necessary documents are included for processing.

Steps to complete the Il 4852 Form

Completing the Il 4852 Form requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Provide the name and address of the employer who did not issue a W-2.

- Report your total earnings for the year, including any tips or bonuses.

- Indicate any federal income tax withheld, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the Il 4852 Form

The Il 4852 Form is legally recognized as a valid substitute for the W-2 when certain conditions are met. Taxpayers must ensure that they have made a reasonable effort to obtain the W-2 from their employer before using this form. Additionally, it is crucial to comply with IRS guidelines regarding the completion and submission of the form to ensure it is accepted as a legitimate document for reporting income. Failure to adhere to these guidelines may result in penalties or delays in tax processing.

Filing Deadlines / Important Dates

Filing deadlines for the Il 4852 Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due by April 15 of each year. If you are using the Il 4852 Form, it is essential to submit it along with your tax return by this deadline to avoid penalties. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed are still due by the original deadline to avoid interest and penalties.

Who Issues the Form

The Il 4852 Form is issued by the Internal Revenue Service (IRS). It is important for taxpayers to ensure they are using the most current version of the form as provided by the IRS to guarantee compliance with tax regulations. The form can be obtained directly from the IRS website or through authorized tax preparation services. Ensuring that the correct form is used is crucial for accurate tax reporting and compliance.

Quick guide on how to complete il 4852 form

Accomplish Il 4852 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents rapidly without interruptions. Handle Il 4852 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Il 4852 Form with ease

- Locate Il 4852 Form and click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or conceal sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Modify and eSign Il 4852 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 4852 form

Create this form in 5 minutes!

How to create an eSignature for the il 4852 form

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Il 4852 Form and why is it important?

The Il 4852 Form is a tax document used for reporting and recouping overpaid income taxes. It's important for individuals seeking refunds on taxes they believe they have overpaid during the tax year. Properly completing the Il 4852 Form can help individuals recover their funds efficiently.

-

How can airSlate SignNow help with the Il 4852 Form?

airSlate SignNow enables users to easily eSign and send the Il 4852 Form securely. Our platform simplifies the document management process and ensures that your form is completed accurately and on time, reducing the stress of tax filing.

-

What features does airSlate SignNow offer for Il 4852 Form processing?

With airSlate SignNow, you can enjoy features like customizable templates, real-time tracking, and cloud storage when handling the Il 4852 Form. These features help streamline the signing process and provide peace of mind as you manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Il 4852 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can handle your Il 4852 Form without incurring hefty fees, allowing you to budget effectively for document management.

-

Can I integrate airSlate SignNow with other tools for managing the Il 4852 Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications such as CRM, project management tools, and cloud storage services. This makes it easier to manage your Il 4852 Form and other documents all in one place.

-

How does airSlate SignNow ensure the security of my Il 4852 Form?

airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. Your Il 4852 Form and other personal documents are protected, ensuring that your sensitive information remains confidential throughout the signing process.

-

Can I track the status of my Il 4852 Form with airSlate SignNow?

Yes, you can track the status of your Il 4852 Form in real time. airSlate SignNow provides notifications and updates, so you will always know where your document is in the signing process, ensuring you never miss a deadline.

Get more for Il 4852 Form

- Scouts de argentina asociacion civil form

- Risk assessment template word form

- Form b strata

- Massachusetts residential lease agreement property management landlord tenant law state specific residential lease agreement form

- Name date grammar worksheet collocations have form

- Specimen id 360 992 9201 0 form

- Hold harmless affidavit web01 dps louisiana form

- Cjsf ad5 form

Find out other Il 4852 Form

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile