Sales Use and Withholding Payment Voucher Instructions for Michigan Form

What is the Sales Use And Withholding Payment Voucher Instructions For Michigan

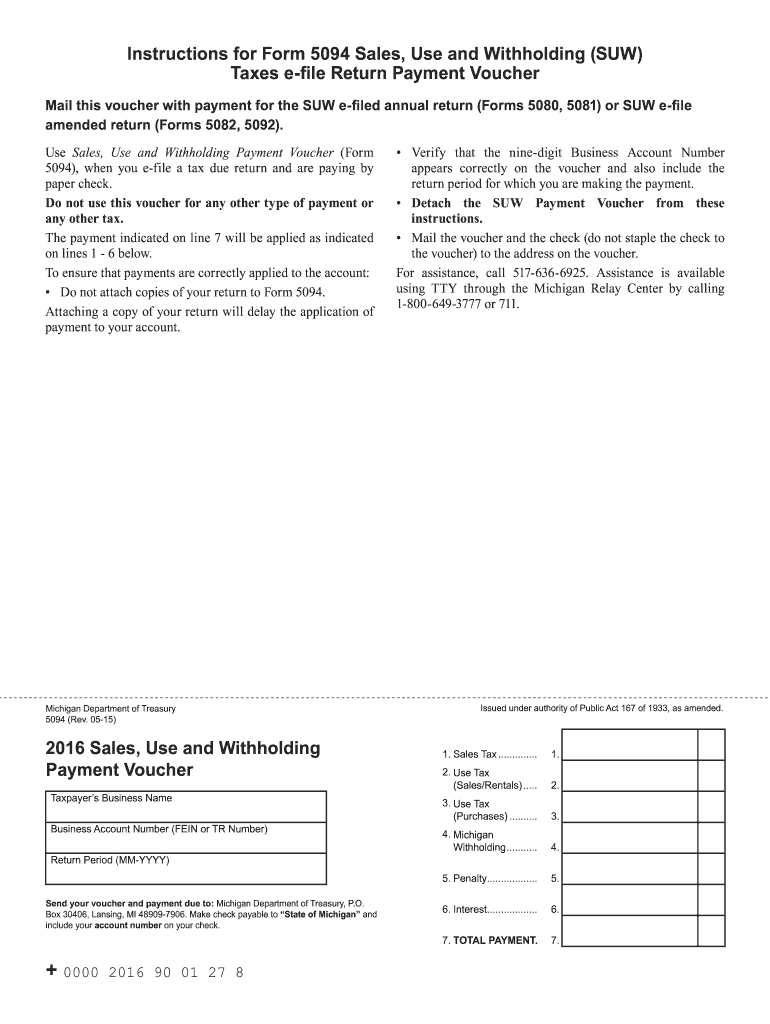

The Sales Use and Withholding Payment Voucher Instructions for Michigan is a crucial document used by businesses to report and remit sales and use taxes to the state. This form provides guidance on how to accurately complete the payment voucher, ensuring compliance with state tax regulations. It is essential for businesses operating in Michigan to understand the requirements outlined in this document to avoid penalties and ensure proper tax remittance.

Steps to Complete the Sales Use And Withholding Payment Voucher Instructions For Michigan

Completing the Sales Use and Withholding Payment Voucher requires careful attention to detail. Here are the key steps:

- Gather all necessary financial records, including sales receipts and tax calculations.

- Fill in the business information, including the name, address, and tax identification number.

- Calculate the total sales and use tax due based on your records.

- Complete the payment section, indicating the amount being remitted.

- Review the form for accuracy before submission.

Key Elements of the Sales Use And Withholding Payment Voucher Instructions For Michigan

The Sales Use and Withholding Payment Voucher includes several key elements that must be completed:

- Business Information: This section requires the name, address, and tax identification number of the business.

- Tax Period: Indicate the specific period for which the payment is being made.

- Sales and Use Tax Calculation: Accurate calculations of the total tax owed based on sales data.

- Payment Information: Specify the amount being paid and the method of payment.

Legal Use of the Sales Use And Withholding Payment Voucher Instructions For Michigan

The Sales Use and Withholding Payment Voucher is legally binding when completed correctly. It serves as an official record of tax payment to the state of Michigan. Compliance with the instructions is crucial to avoid legal issues, including fines or audits. Businesses must ensure that all information is accurate and that the form is submitted by the required deadlines.

Filing Deadlines / Important Dates

Timely submission of the Sales Use and Withholding Payment Voucher is essential. Key deadlines include:

- Quarterly filing deadlines for sales and use taxes.

- Annual reporting deadlines for businesses with specific tax obligations.

- Penalties for late submissions, which may include interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Sales Use and Withholding Payment Voucher can be submitted through various methods:

- Online Submission: Many businesses opt for electronic filing through the Michigan Department of Treasury's online portal.

- Mail: The completed form can be mailed to the designated address provided in the instructions.

- In-Person: Businesses may also choose to submit the form in person at their local tax office.

Quick guide on how to complete 2016 sales use and withholding payment voucher instructions for michigan

Effortlessly Prepare Sales Use And Withholding Payment Voucher Instructions For Michigan on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your files swiftly without delays. Manage Sales Use And Withholding Payment Voucher Instructions For Michigan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign Sales Use And Withholding Payment Voucher Instructions For Michigan with Ease

- Find Sales Use And Withholding Payment Voucher Instructions For Michigan and click on Get Form to initiate.

- Use the tools at your disposal to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device of your choice. Modify and eSign Sales Use And Withholding Payment Voucher Instructions For Michigan to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2016 sales use and withholding payment voucher instructions for michigan

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What are Sales Use And Withholding Payment Voucher Instructions For Michigan?

Sales Use And Withholding Payment Voucher Instructions For Michigan provide guidelines on how to correctly complete the payment voucher for state sales use and withholding taxes. These instructions are essential for ensuring compliance with Michigan tax laws, making the tax filing process smooth and straightforward.

-

How can airSlate SignNow assist with Sales Use And Withholding Payment Voucher Instructions For Michigan?

airSlate SignNow simplifies the process by allowing users to electronically sign and send the Sales Use And Withholding Payment Voucher Instructions For Michigan documents. This user-friendly platform ensures that your documents are completed accurately and sent on time, enhancing your efficiency.

-

Are there any costs associated with using airSlate SignNow for Sales Use And Withholding Payment Voucher Instructions For Michigan?

airSlate SignNow offers a range of pricing plans suitable for different business needs, including a free trial to explore its features. This cost-effective solution allows businesses to manage their Sales Use And Withholding Payment Voucher Instructions For Michigan without hefty expenses.

-

What features does airSlate SignNow offer for handling Sales Use And Withholding Payment Voucher Instructions For Michigan?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSignature capabilities. These tools greatly enhance the way users handle Sales Use And Withholding Payment Voucher Instructions For Michigan, ensuring timely submissions and compliance.

-

Can I integrate airSlate SignNow with other software for Sales Use And Withholding Payment Voucher Instructions For Michigan?

Yes, airSlate SignNow integrates seamlessly with various business applications such as Google Drive, Box, and Microsoft 365. This integration capability allows users to easily access and manage their Sales Use And Withholding Payment Voucher Instructions For Michigan alongside other essential business documents.

-

What benefits can I expect from using airSlate SignNow for Sales Use And Withholding Payment Voucher Instructions For Michigan?

Using airSlate SignNow for Sales Use And Withholding Payment Voucher Instructions For Michigan can save time, reduce errors, and ensure compliance with state regulations. Its electronic signing process eliminates the need for physical paperwork and speeds up the filing process.

-

Is there customer support available for help with Sales Use And Withholding Payment Voucher Instructions For Michigan?

airSlate SignNow provides robust customer support to assist users with any questions regarding Sales Use And Withholding Payment Voucher Instructions For Michigan. Whether you need technical assistance or guidance on document preparation, the support team is readily available to help.

Get more for Sales Use And Withholding Payment Voucher Instructions For Michigan

Find out other Sales Use And Withholding Payment Voucher Instructions For Michigan

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word