$ Annual Withholding Reconciliation Form

What is the $ Annual Withholding Reconciliation

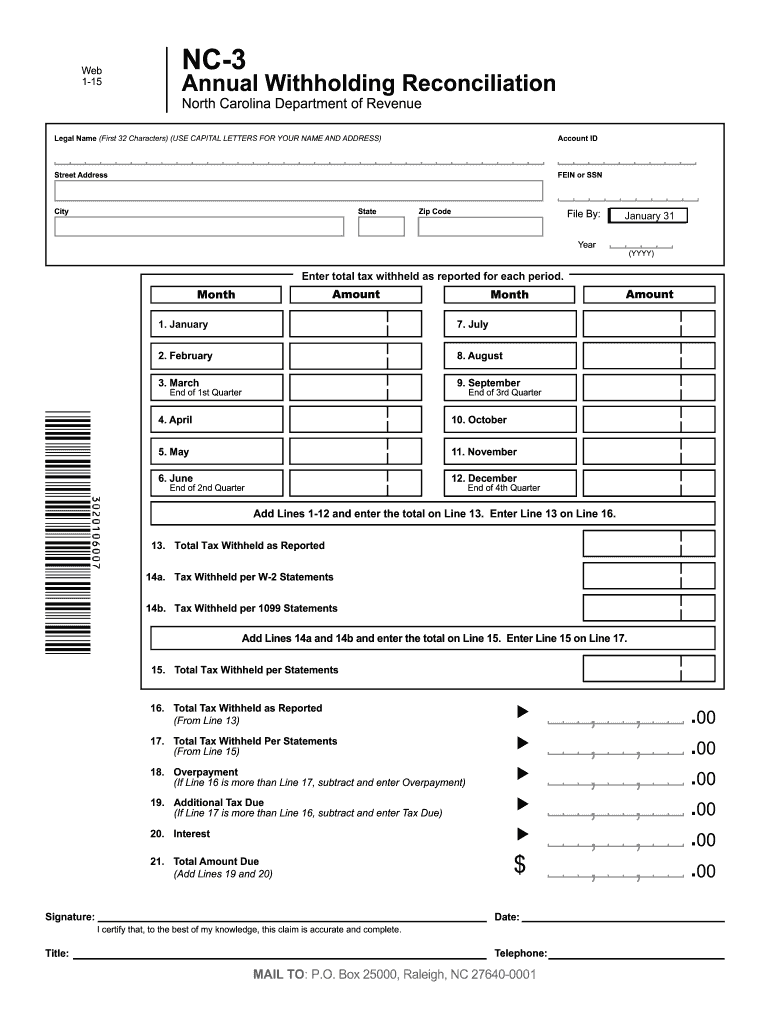

The $ Annual Withholding Reconciliation is a crucial tax form used by employers in the United States to reconcile the amounts withheld from employees' wages throughout the year. This form ensures that the total withholding aligns with the actual tax liability of the employees. It serves as a summary of all federal, state, and local taxes that have been deducted from employee paychecks, providing a comprehensive overview for both the employer and the IRS.

Steps to complete the $ Annual Withholding Reconciliation

Completing the $ Annual Withholding Reconciliation involves several key steps:

- Gather all payroll records for the year, including pay stubs and tax withholding statements.

- Calculate the total amount withheld for federal, state, and local taxes.

- Compare the total with the amounts reported on the quarterly payroll tax returns.

- Complete the reconciliation form, ensuring all figures are accurate and reflect the correct tax liabilities.

- Review the form for any discrepancies and make necessary adjustments.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the $ Annual Withholding Reconciliation

The legal use of the $ Annual Withholding Reconciliation is essential for compliance with federal and state tax regulations. This form must be accurately completed and submitted to avoid penalties. It acts as a formal declaration of the taxes withheld and ensures that both employers and employees meet their tax obligations. Proper documentation and adherence to filing deadlines are crucial to maintain legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the $ Annual Withholding Reconciliation typically fall at the end of the tax year. Employers should be aware of the following important dates:

- The form is generally due by January 31 of the following year.

- Employers must provide employees with their W-2 forms by January 31.

- Any corrections to the form must be submitted promptly to avoid penalties.

Required Documents

To complete the $ Annual Withholding Reconciliation, employers need several documents, including:

- Payroll records showing total wages paid and taxes withheld.

- Quarterly payroll tax returns (Form 941 or equivalent).

- W-2 forms issued to employees for the tax year.

- Any relevant state tax forms if applicable.

IRS Guidelines

The IRS provides specific guidelines for completing the $ Annual Withholding Reconciliation. Employers should refer to the IRS instructions for the form, which detail the following:

- How to calculate total withholding accurately.

- Requirements for reporting corrections or adjustments.

- Information on penalties for non-compliance and how to avoid them.

Quick guide on how to complete annual withholding reconciliation

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to $ Annual Withholding Reconciliation

Create this form in 5 minutes!

How to create an eSignature for the annual withholding reconciliation

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is $ Annual Withholding Reconciliation?

$ Annual Withholding Reconciliation is a process where businesses reconcile their annual tax withholdings to ensure accuracy and compliance with federal and state tax regulations. Using tools like airSlate SignNow, this can be streamlined by electronically signing and sending documents required for submission. This process helps mitigate errors and reduce the risk of penalties.

-

How does airSlate SignNow facilitate $ Annual Withholding Reconciliation?

airSlate SignNow offers an intuitive platform for creating, sending, and eSigning the necessary documents for $ Annual Withholding Reconciliation. It provides a cost-effective solution that simplifies document management, allowing businesses to focus on compliance without the hassle of paper-based processes. With real-time tracking and notifications, you stay updated on document status to ensure timely filing.

-

What are the key features of airSlate SignNow that help with $ Annual Withholding Reconciliation?

Key features of airSlate SignNow include customizable templates, audit trails, and secure cloud storage. These features support businesses in preparing accurate documents for $ Annual Withholding Reconciliation while ensuring compliance and accountability. Additionally, the platform enables easy integrations with existing accounting and payroll systems, making data management even smoother.

-

Is airSlate SignNow affordable for small businesses handling $ Annual Withholding Reconciliation?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including small businesses managing $ Annual Withholding Reconciliation. The pricing is designed to be cost-effective, ensuring that even smaller companies can access essential eSigning features without breaking the bank. Moreover, with lower operational costs, users can maximize their efficiency.

-

Can airSlate SignNow integrate with accounting software for $ Annual Withholding Reconciliation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and payroll systems, which streamlines the $ Annual Withholding Reconciliation process. This integration allows users to import data directly from their financial software, ensuring accuracy and reducing the chances of manual entry errors. This connectivity enhances overall productivity and compliance.

-

What benefits can businesses expect from using airSlate SignNow for $ Annual Withholding Reconciliation?

By using airSlate SignNow for $ Annual Withholding Reconciliation, businesses can expect improved accuracy, faster processing times, and enhanced compliance. The electronic signature feature expedites document approval, while automated reminders help keep submissions on track. Resulting in less time spent on paperwork, businesses can focus on their core operations.

-

How secure is airSlate SignNow when handling $ Annual Withholding Reconciliation documents?

Security is a top priority at airSlate SignNow. The platform uses bank-level encryption to protect sensitive information during the $ Annual Withholding Reconciliation process. Additionally, built-in audit trails provide an extra layer of accountability, ensuring that users can trace the history of document interactions. This level of security fosters trust and compliance.

Get more for $ Annual Withholding Reconciliation

- Legal last will and testament for married person with minor children from prior marriage utah form

- Legal last will and testament form for married person with adult children from prior marriage utah

- Legal last will and testament form for divorced person not remarried with adult children utah

- Legal last will and testament form for divorced person not remarried with no children utah

- Legal last will and testament form for divorced person not remarried with minor children utah

- Legal last will and testament form for divorced person not remarried with adult and minor children utah

- Mutual wills package with last wills and testaments for married couple with adult children utah form

- Mutual wills package with last wills and testaments for married couple with no children utah form

Find out other $ Annual Withholding Reconciliation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document