400 D D Schedule Form

What is the 400 D D Schedule

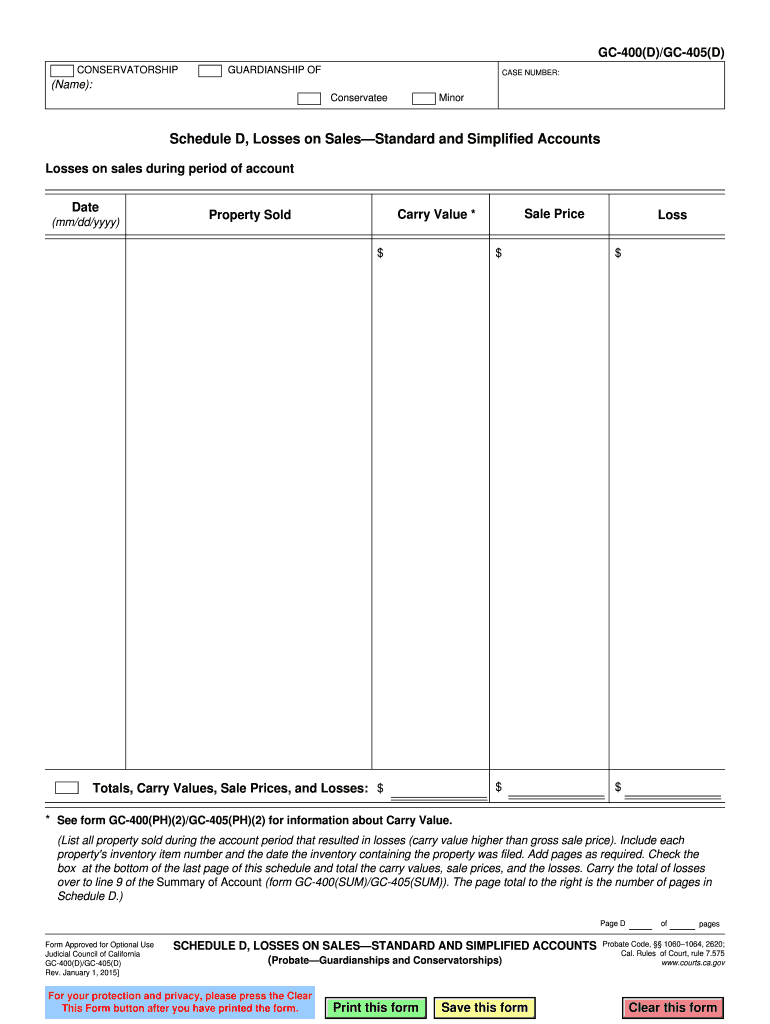

The 400 D D Schedule is a specific tax form used in the United States for reporting certain types of income and deductions related to capital gains and losses. This form is particularly relevant for individuals and businesses that need to disclose their financial activities concerning the sale of assets, investments, or property. It helps taxpayers calculate their capital gains tax obligations accurately and ensures compliance with IRS regulations.

Steps to complete the 400 D D Schedule

Completing the 400 D D Schedule involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, such as records of asset purchases, sales, and any associated costs. Follow these steps:

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- List each asset sold during the tax year, including the date of acquisition and sale, the sale price, and the cost basis.

- Calculate the gain or loss for each asset by subtracting the cost basis from the sale price.

- Summarize your total capital gains and losses, ensuring to account for any applicable deductions.

- Review the completed form for accuracy before submission.

Legal use of the 400 D D Schedule

The legal use of the 400 D D Schedule is essential for ensuring that taxpayers meet their obligations under U.S. tax law. Submitting this form accurately helps avoid potential penalties and legal issues with the IRS. It is crucial to adhere to the guidelines set forth by the IRS, including maintaining proper documentation and records to support the information reported on the form.

IRS Guidelines

The IRS provides specific guidelines for completing the 400 D D Schedule, which must be followed to ensure compliance. Taxpayers should refer to the IRS instructions for the form, which detail how to report various types of capital gains and losses. Understanding these guidelines is vital for accurately calculating tax liabilities and ensuring that all required information is included.

Filing Deadlines / Important Dates

Filing deadlines for the 400 D D Schedule align with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file timely to avoid penalties.

Required Documents

To complete the 400 D D Schedule, taxpayers should gather several key documents, including:

- Records of asset purchases and sales.

- Documentation of any improvements made to the assets.

- Statements from brokerage accounts or financial institutions.

- Previous tax returns, if applicable, to reference prior gains or losses.

Examples of using the 400 D D Schedule

Understanding how to use the 400 D D Schedule can be enhanced by reviewing examples. For instance, if an individual sells a stock for a profit, they would report the sale on this schedule, detailing the purchase price and sale price to calculate the capital gain. Similarly, if a property is sold at a loss, the taxpayer would document this on the form to offset other capital gains, potentially reducing their overall tax liability.

Quick guide on how to complete 400 d d schedule

Complete 400 D D Schedule effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage 400 D D Schedule on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign 400 D D Schedule effortlessly

- Find 400 D D Schedule and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign 400 D D Schedule and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 400 d d schedule

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the significance of 400 gc d d in electronic signatures?

The term 400 gc d d refers to a specific electronic signature standard that ensures the integrity and authenticity of signed documents. By using airSlate SignNow, you can meet these standards easily, providing peace of mind that your eSignatures adhere to legal requirements.

-

How does airSlate SignNow support the 400 gc d d requirement?

airSlate SignNow supports the 400 gc d d standard by providing secure, legally binding electronic signatures. This ensures that all documents signed through our platform maintain compliance, giving users confidence in their digital transactions.

-

Is there a pricing model for businesses looking to use 400 gc d d with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Our plans are designed to be cost-effective while ensuring that the features necessary for complying with standards like 400 gc d d are included.

-

What features does airSlate SignNow offer related to 400 gc d d?

airSlate SignNow includes features such as secure document storage, user authentication, and a user-friendly interface, all conducive to meeting the 400 gc d d requirements. These features work together to enhance document security and streamline the signing process.

-

Can I integrate airSlate SignNow with other applications to ensure 400 gc d d compliance?

Absolutely! airSlate SignNow offers seamless integrations with popular applications and CRMs, which can help automate your workflows while maintaining 400 gc d d compliance. Our API allows businesses to incorporate electronic signatures into their existing systems effectively.

-

What benefits does using airSlate SignNow provide for meeting 400 gc d d standards?

Using airSlate SignNow provides several benefits for meeting 400 gc d d standards, including increased efficiency, lower processing costs, and enhanced security. You'll be able to eSign documents quickly and securely, thus expediting your business processes.

-

How can I get started with airSlate SignNow and 400 gc d d?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and our intuitive setup will guide you through the process of ensuring that you're compliant with 400 gc d d standards. Our support team is also available to assist you every step of the way.

Get more for 400 D D Schedule

Find out other 400 D D Schedule

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now