DR 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations Form

What is the DR 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations

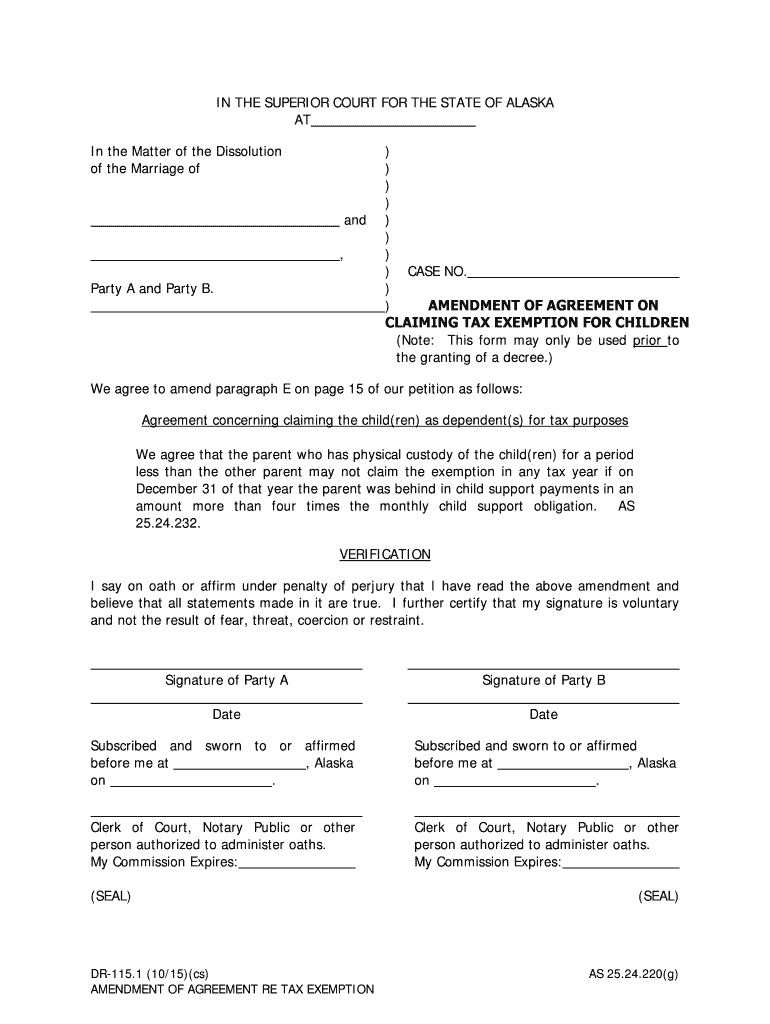

The DR 1151 form is an important legal document used in domestic relations cases. It specifically addresses the claiming of tax exemptions for children aged ten to fifteen. This form is typically utilized by parents who are navigating custody arrangements and financial responsibilities related to their children. By completing the DR 1151, parents can formally agree on which parent will claim the tax exemption for their children, ensuring clarity and compliance with tax regulations.

Steps to Complete the DR 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations

Completing the DR 1151 form involves several key steps to ensure accuracy and compliance. First, both parents should gather necessary information, including Social Security numbers and tax filing statuses. Next, they must discuss and agree on which parent will claim the exemption. Once an agreement is reached, the form should be filled out with the relevant details, including the children's names and ages. After completing the form, both parents must sign and date it to validate the agreement. Finally, it is advisable to keep copies for personal records and provide a copy to the relevant tax authorities if required.

Legal Use of the DR 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations

The DR 1151 form serves a crucial legal function in domestic relations cases. It is recognized by courts and tax authorities as a binding agreement between parents regarding tax exemptions. For the agreement to be enforceable, it must be filled out correctly and signed by both parties. This legal recognition helps prevent disputes during tax season and ensures that both parents understand their rights and responsibilities concerning tax exemptions for their children.

Key Elements of the DR 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations

Several key elements must be included in the DR 1151 form to ensure its validity. These elements include:

- Identification of Parents: Full names and contact information of both parents.

- Children's Information: Names, ages, and Social Security numbers of the children involved.

- Tax Exemption Agreement: Clear statement indicating which parent will claim the tax exemption.

- Signatures: Signatures of both parents, along with the date of signing.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the claiming of tax exemptions for children. According to IRS regulations, only one parent can claim the exemption for a child in any given tax year. The DR 1151 form helps facilitate this process by documenting the agreement between parents. It is essential for parents to follow IRS guidelines to avoid complications or penalties during tax filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the DR 1151 form is crucial for compliance. Generally, the form should be completed and signed before the tax filing deadline, which is typically April 15 for individual tax returns. Parents should ensure that they have the form finalized and any necessary discussions completed well in advance of this date to avoid last-minute issues.

Quick guide on how to complete dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations

Complete DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations seamlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without difficulties. Manage DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations effortlessly

- Locate DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes moments and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is DR 1151 claiming tax and why is it important?

DR 1151 claiming tax refers to the process businesses use to claim specific tax deductions related to their expenses. Understanding DR 1151 claiming tax can help you maximize your tax savings and ensure compliance with governmental regulations. Utilizing effective document management systems, like airSlate SignNow, can streamline the process and make it easier to keep track of necessary documentation.

-

How can airSlate SignNow assist with DR 1151 claiming tax?

airSlate SignNow offers a user-friendly platform that simplifies document signing and management, which is essential for DR 1151 claiming tax. You can easily send, sign, and store your tax-related documents, ensuring that all necessary paperwork is readily accessible during the tax claiming process. This streamlined approach helps reduce errors and saves time.

-

Is there a cost associated with using airSlate SignNow for DR 1151 claiming tax?

Yes, there is a pricing structure for airSlate SignNow that varies based on the features and services you select. The cost is designed to be cost-effective while providing robust solutions for DR 1151 claiming tax. Investing in airSlate SignNow can lead to greater efficiency and potentially higher tax refunds due to proper documentation.

-

What features does airSlate SignNow offer for DR 1151 claiming tax?

airSlate SignNow provides various features such as eSigning, document templates, and collaborative editing, which can enhance the DR 1151 claiming tax process. These features help streamline your workflows, ensuring that all documents are signed and stored securely. This can signNowly reduce the hassle of managing tax claims.

-

Can airSlate SignNow integrate with other tools for managing DR 1151 claiming tax?

Yes, airSlate SignNow integrates with various business applications that can help manage your DR 1151 claiming tax processes more effectively. Whether it’s accounting software or cloud storage solutions, these integrations allow for seamless workflow and accessibility to all important tax documents. By connecting your tools, you can create a comprehensive tax management system.

-

What are the benefits of using airSlate SignNow for my business regarding DR 1151 claiming tax?

Using airSlate SignNow for DR 1151 claiming tax not only simplifies document handling but also enhances overall productivity. With a secure and accessible platform, businesses can reduce paperwork and focus on more strategic aspects of tax claiming. Additionally, you can improve accuracy and compliance, minimizing the risk of audit issues.

-

How does security feature in airSlate SignNow support DR 1151 claiming tax?

Security is paramount when dealing with sensitive documents related to DR 1151 claiming tax. airSlate SignNow employs advanced encryption and secure access controls to protect your tax documents. This means you can confidently send and manage your documents without the worry of unauthorized access or data bsignNowes.

Get more for DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

- Tennessee bus 424 form

- Skilsmisse blanket til print form

- Os ss 89 form

- Dd form 2628 24427438

- Patient information form patient information form what is your main dental complaint or concern

- Steak n shake employee benefits form

- Business development agreement template form

- Business development consultant agreement template form

Find out other DR 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement