Nj Tax Authorization Form

What is the NJ Tax Authorization Form

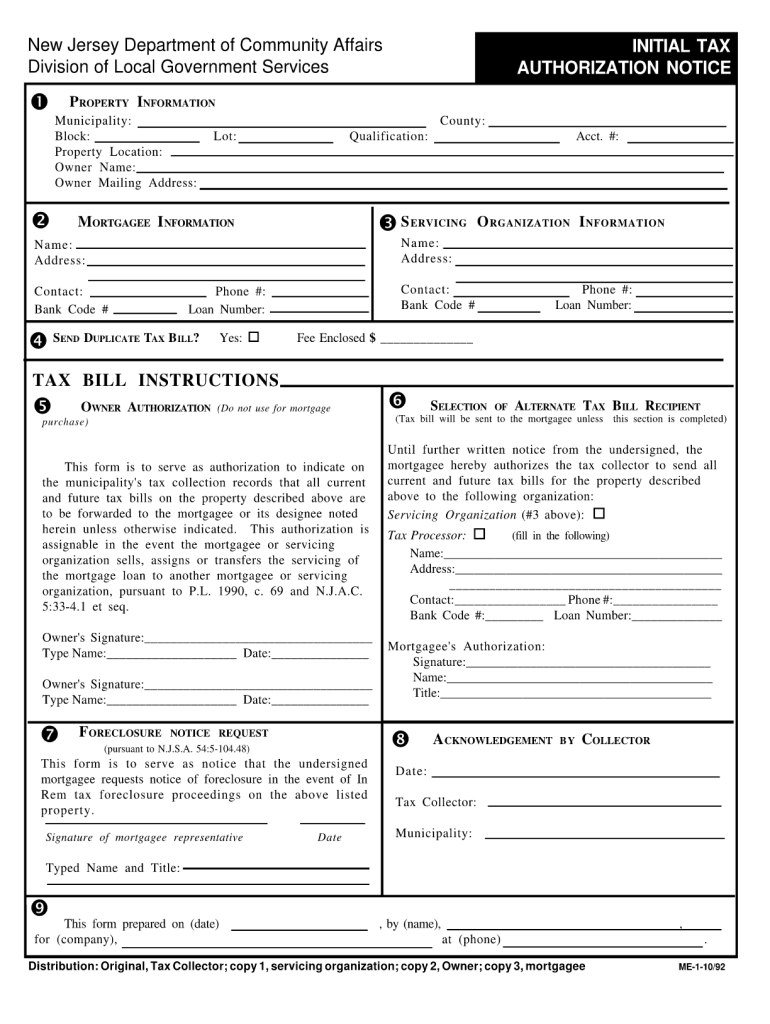

The NJ Tax Authorization Form, also known as the NJ Initial Authorization Notice, is a critical document used by taxpayers in New Jersey to authorize the New Jersey Division of Taxation to communicate with a designated representative regarding their tax matters. This form is essential for individuals who wish to have a tax professional handle their tax filings or inquiries on their behalf. By submitting this form, taxpayers grant permission for their chosen representative to access information related to their tax accounts, ensuring that they receive appropriate guidance and support.

How to Use the NJ Tax Authorization Form

Using the NJ Tax Authorization Form involves several straightforward steps. First, taxpayers need to download the form from the official New Jersey Division of Taxation website or obtain a physical copy. Next, fill out the required fields, including personal information and the details of the authorized representative. Once completed, the form should be signed and dated by the taxpayer. Finally, submit the form to the New Jersey Division of Taxation through the appropriate channels, such as online submission, mail, or in-person delivery. It is crucial to keep a copy of the submitted form for personal records.

Steps to Complete the NJ Tax Authorization Form

Completing the NJ Tax Authorization Form requires careful attention to detail. Follow these steps for accurate submission:

- Download the form from the New Jersey Division of Taxation website.

- Provide your full name, address, and Social Security number or Tax Identification Number.

- Enter the name and contact information of the representative you are authorizing.

- Specify the types of tax matters the representative is authorized to handle.

- Sign and date the form to validate your authorization.

- Submit the completed form to the New Jersey Division of Taxation.

Legal Use of the NJ Tax Authorization Form

The NJ Tax Authorization Form is legally binding once it is properly completed and submitted. This form complies with state regulations governing tax representation and ensures that the designated representative can act on behalf of the taxpayer in matters related to their tax obligations. It is important for taxpayers to understand that this authorization does not transfer responsibility for tax liabilities; the taxpayer remains accountable for all tax obligations, even when represented by a professional.

Key Elements of the NJ Tax Authorization Form

Several key elements are essential for the NJ Tax Authorization Form to be valid:

- Taxpayer Information: Accurate personal details of the taxpayer, including name and identification numbers.

- Representative Information: Complete contact information for the authorized representative.

- Scope of Authorization: Clear specification of the tax matters the representative is permitted to handle.

- Signature: The taxpayer's signature is required to confirm authorization.

- Date: The date of signature is necessary to establish the validity of the authorization.

Form Submission Methods

Taxpayers can submit the NJ Tax Authorization Form through various methods, depending on their preference and convenience. The submission options include:

- Online: Submit the form electronically through the New Jersey Division of Taxation's online portal.

- Mail: Send the completed form to the designated address provided by the Division of Taxation.

- In-Person: Deliver the form directly to a local Division of Taxation office for immediate processing.

Quick guide on how to complete nj tax authorization form

Effortlessly Prepare Nj Tax Authorization Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delay. Handle Nj Tax Authorization Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Nj Tax Authorization Form with Ease

- Find Nj Tax Authorization Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Nj Tax Authorization Form and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj tax authorization form

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is nj initial tax and how does airSlate SignNow help with it?

NJ initial tax refers to the tax obligations incurred by businesses in New Jersey when establishing operations in the state. airSlate SignNow simplifies the document processes related to NJ initial tax by providing an efficient platform for eSigning and managing essential forms, ensuring compliance without hassle.

-

How much does it cost to use airSlate SignNow for managing nj initial tax forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs, starting at a low monthly rate. By utilizing this cost-effective solution, businesses can efficiently manage their NJ initial tax documentation without incurring high administrative costs.

-

What features does airSlate SignNow offer to assist with nj initial tax documentation?

airSlate SignNow includes key features such as document templates, real-time tracking, and customizable workflows specifically designed for managing NJ initial tax forms. These tools streamline the eSigning process, making it easier for businesses to comply with tax regulations.

-

Can airSlate SignNow integrate with other software for nj initial tax management?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, including CRM systems and accounting software, to enhance your NJ initial tax management process. This connectivity facilitates data sharing, making it simple to keep track of tax-related documents.

-

Is airSlate SignNow secure for handling nj initial tax information?

Absolutely! airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures to protect sensitive NJ initial tax information. Users can confidently manage and eSign their tax documents knowing that their data is secure.

-

How can airSlate SignNow help speed up the nj initial tax filing process?

By using airSlate SignNow, businesses can quickly prepare, eSign, and submit their NJ initial tax forms online, signNowly reducing the time spent on paperwork. The streamlined workflow ensures that companies can focus more on their operations rather than getting bogged down with tax submissions.

-

What support does airSlate SignNow provide for nj initial tax queries?

airSlate SignNow offers customer support to assist users with any questions regarding NJ initial tax processes. Whether you need guidance on document preparation or eSigning, their support team is available to ensure a smooth experience.

Get more for Nj Tax Authorization Form

Find out other Nj Tax Authorization Form

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile