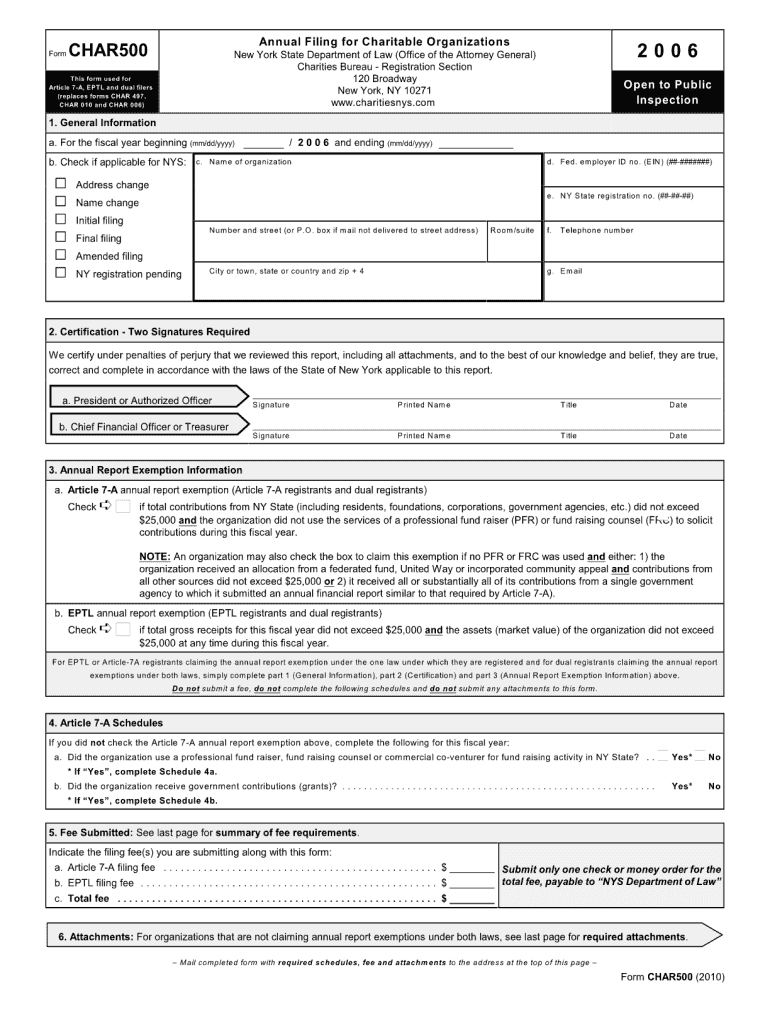

Char 500 Form 2019

What is the Char 500 Form

The Char 500 Form is a specific document used primarily for tax purposes in the United States. It is typically associated with the reporting of charitable contributions and is crucial for both individuals and organizations claiming deductions for donations made to qualifying charities. Understanding the purpose of this form is essential for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to use the Char 500 Form

Using the Char 500 Form involves several key steps. First, gather all necessary information about the charitable contributions made during the tax year. This includes details such as the name of the charity, the amount donated, and the date of the contribution. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted as part of your tax return to the IRS, either electronically or via mail, depending on your filing method.

Steps to complete the Char 500 Form

Completing the Char 500 Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather documentation of all charitable contributions, including receipts and bank statements.

- Fill in your personal information, including your name, address, and Social Security number.

- List each charitable contribution, providing the name of the organization, the donation amount, and the date.

- Review the form for accuracy, ensuring all entries are correct and complete.

- Submit the form with your tax return by the designated filing deadline.

Legal use of the Char 500 Form

The Char 500 Form is legally recognized for reporting charitable contributions to the IRS. To ensure its legal validity, it is important to adhere to IRS guidelines regarding eligibility for tax deductions. This includes ensuring that the charitable organization is a qualified 501(c)(3) entity. Proper use of the form can protect taxpayers from potential audits and penalties related to incorrect claims.

Filing Deadlines / Important Dates

Filing deadlines for the Char 500 Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these dates to avoid late penalties and ensure timely processing of their tax returns.

Who Issues the Form

The Char 500 Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax administration, the IRS provides this form as part of its efforts to facilitate accurate reporting of charitable contributions. Taxpayers can obtain the form directly from the IRS website or through tax preparation software that includes IRS forms.

Quick guide on how to complete char 500 2006 form

Effortlessly Prepare Char 500 Form on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can easily find the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Char 500 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Char 500 Form with Ease

- Locate Char 500 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which only takes seconds and is legally equivalent to a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Char 500 Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct char 500 2006 form

Create this form in 5 minutes!

How to create an eSignature for the char 500 2006 form

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Char 500 Form, and why is it important?

The Char 500 Form is a critical document used by nonprofits to report financial activities and maintain transparency. Completing the Char 500 Form is essential for organizations to comply with state regulations and to ensure continued tax-exempt status. Proper submission helps build trust with stakeholders and the public.

-

How can airSlate SignNow assist with the Char 500 Form?

airSlate SignNow provides an efficient platform for organizations to create, send, and eSign the Char 500 Form. With its user-friendly interface, you can streamline the document signing process, ensuring that all necessary signatures are captured promptly. This efficiency allows your organization to focus more on mission-driven activities.

-

What features does airSlate SignNow offer for completing the Char 500 Form?

airSlate SignNow offers a variety of features to simplify the process of filling out the Char 500 Form, including customizable templates, collaborative editing, and secure cloud storage. The platform ensures easy access to your documents and reliable audit trails for compliance tracking. These features elevate the overall efficiency of managing essential paperwork.

-

Is there a cost associated with using airSlate SignNow for the Char 500 Form?

Yes, airSlate SignNow operates on a subscription model with various pricing plans to accommodate different organizational needs. By offering cost-effective solutions, it is ideal for nonprofits looking to manage their documentation costs efficiently while ensuring smooth processing of the Char 500 Form. You can choose a plan that aligns with your budget and requirements.

-

Can I integrate other tools with airSlate SignNow when working on the Char 500 Form?

Absolutely! airSlate SignNow offers integrations with various business tools, such as CRMs and cloud storage services, allowing seamless management of the Char 500 Form. This interoperability ensures that data is consolidated, enhancing collaboration within your organization while simplifying the documentation process.

-

What are the benefits of using airSlate SignNow for the Char 500 Form?

Using airSlate SignNow for the Char 500 Form provides numerous benefits including enhanced security, reduced turnaround times for document signing, and improved compliance tracking. The platform is designed to minimize errors and ensure that all your forms are completed correctly. This reliability can signNowly reduce stress and administrative workload for your team.

-

How can I get started with airSlate SignNow for the Char 500 Form?

Getting started with airSlate SignNow for the Char 500 Form is simple. You can sign up for a free trial on their website to explore the features before committing to a plan. Once registered, you can easily create your Char 500 Form using the provided templates and start sending it for eSignature.

Get more for Char 500 Form

- D bill registration form requested background check

- Guided reading activity the constitution lesson 3 answer key form

- Request for cancellation bprcousacomb form

- Application for a state paid professional acta form

- Loan facility agreement template form

- Loan extension agreement template form

- Loan family agreement template form

- Loan forgiveness agreement template form

Find out other Char 500 Form

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement