Taxpayer Motor Vehicle Form

What is the taxpayer motor vehicle?

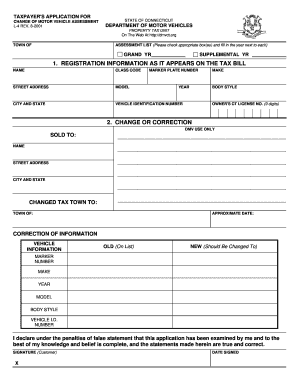

The taxpayer motor vehicle refers to a specific form used by individuals in the United States to report and manage their motor vehicle-related tax obligations. This form is essential for taxpayers who need to declare their vehicle ownership, changes in vehicle status, or any other relevant information pertaining to motor vehicles for tax purposes. It ensures compliance with state and federal regulations while facilitating proper record-keeping for tax assessments.

Steps to complete the taxpayer motor vehicle

Completing the taxpayer motor vehicle form involves several important steps:

- Gather necessary information, including your vehicle's make, model, year, and VIN (Vehicle Identification Number).

- Determine your eligibility based on your state’s requirements and ensure you have all supporting documentation.

- Fill out the form accurately, providing all requested details regarding your vehicle and any changes in ownership or status.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person, as per your state’s guidelines.

Legal use of the taxpayer motor vehicle

The taxpayer motor vehicle form must be used in accordance with legal requirements to ensure its validity. It is crucial that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal complications. Compliance with state and federal laws governing motor vehicle taxation is essential, and utilizing electronic signatures through a reliable platform can enhance the legitimacy of the submission.

Required documents

When completing the taxpayer motor vehicle form, several documents may be required to support your application. These can include:

- Proof of vehicle ownership, such as a title or bill of sale.

- Identification documents, like a driver’s license or state ID.

- Previous tax returns or forms related to motor vehicle taxes.

- Any relevant correspondence from tax authorities regarding your vehicle.

Form submission methods

The taxpayer motor vehicle form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax department website.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices or service centers.

IRS guidelines

IRS guidelines provide essential information regarding the taxpayer motor vehicle form, including filing requirements, deadlines, and compliance standards. It is important for taxpayers to familiarize themselves with these guidelines to avoid potential issues. The IRS may also offer resources to assist with the completion of the form and ensure adherence to federal tax laws.

Eligibility criteria

Eligibility for using the taxpayer motor vehicle form may vary by state but generally includes criteria such as:

- Being a registered owner of a motor vehicle.

- Meeting specific residency requirements within the state.

- Having no outstanding tax liabilities related to motor vehicles.

Quick guide on how to complete taxpayer motor vehicle

Effortlessly Prepare Taxpayer Motor Vehicle on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Taxpayer Motor Vehicle on any device through airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Taxpayer Motor Vehicle with Ease

- Obtain Taxpayer Motor Vehicle and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact private information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Taxpayer Motor Vehicle and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer motor vehicle

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the significance of the taxpayer motor vehicle in document signing?

The taxpayer motor vehicle refers to the required documentation needed for vehicle registration and tax purposes. Using airSlate SignNow, you can streamline the process of signing and sending these documents electronically, ensuring compliance and efficiency.

-

How does airSlate SignNow support taxpayer motor vehicle documentation?

airSlate SignNow allows users to create, send, and eSign taxpayer motor vehicle documents seamlessly. By digitizing paperwork, businesses can reduce processing time and eliminate the need for physical signatures, making it easier to manage vehicle-related compliance.

-

What pricing plans does airSlate SignNow offer for taxpayer motor vehicle services?

airSlate SignNow offers competitive pricing plans tailored to the needs of businesses handling taxpayer motor vehicle documents. Depending on the features you require, you can choose from various options that fit within your budget while enhancing your document management process.

-

Are there any specific features of airSlate SignNow beneficial for taxpayer motor vehicle documentation?

Yes, airSlate SignNow includes features like customizable templates, automatic reminders, and secure storage that are particularly beneficial for taxpayer motor vehicle documentation. These features enhance efficiency and ensure that all necessary signatures are obtained promptly.

-

How can airSlate SignNow improve the efficiency of managing taxpayer motor vehicle documents?

By using airSlate SignNow, businesses can reduce paper waste and processing delays associated with taxpayer motor vehicle documents. The platform's electronic signature functionality accelerates approvals, helping you focus on your core operations.

-

Does airSlate SignNow integrate with other tools for taxpayer motor vehicle workflows?

Absolutely! airSlate SignNow integrates with various applications such as CRM systems and cloud storage solutions, allowing for a streamlined workflow for taxpayer motor vehicle documentation. This enables businesses to manage all vehicle-related processes in one cohesive platform.

-

Can airSlate SignNow help with compliance related to taxpayer motor vehicle documents?

Yes, airSlate SignNow assists in maintaining compliance by ensuring that all taxpayer motor vehicle documents are signed and stored securely. The system tracks all changes and signatures, providing an audit trail to help businesses adhere to regulations.

Get more for Taxpayer Motor Vehicle

- West palm beach utilities form

- Health insurance application form

- Stadtkasse troisdorf form

- Umass boston transcript form

- Rule 50 01 idapa 12 01 10 50 01 form

- Backhome change of ownership form virbac rsa backhome co

- Humor style mediates the association between pathological narcissism form

- How to donkey fc and npi any corpora parles upf universitat form

Find out other Taxpayer Motor Vehicle

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors