Online Fillable Ifta Reports for Arkansas Form

What is the Online Fillable IFTA Reports for Arkansas Form

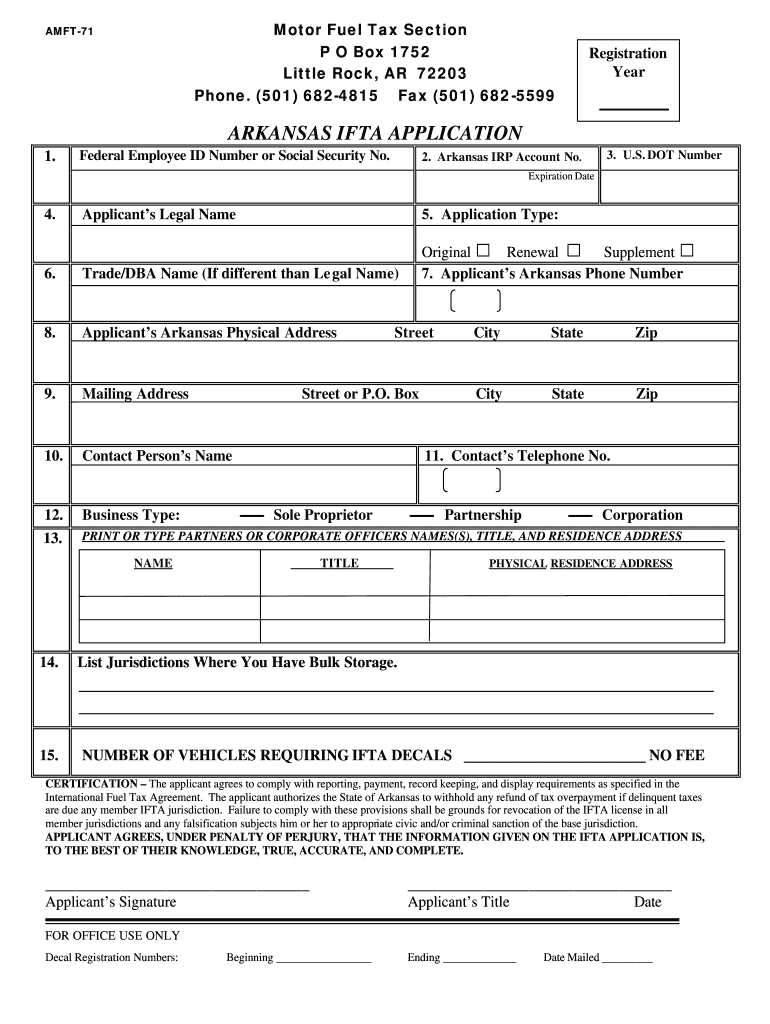

The Online Fillable IFTA Reports for Arkansas form is a digital document that allows businesses operating commercial vehicles to report their fuel usage and miles traveled across multiple jurisdictions. This form is essential for compliance with the Arkansas motor fuel tax regulations and the International Fuel Tax Agreement (IFTA). The IFTA reporting form simplifies the process of calculating fuel taxes owed to each jurisdiction based on the miles driven and fuel purchased. By utilizing an online fillable format, users can easily complete the form, ensuring accuracy and efficiency in their reporting.

How to Use the Online Fillable IFTA Reports for Arkansas Form

To effectively use the Online Fillable IFTA Reports for Arkansas form, begin by gathering all necessary information regarding your fuel purchases and mileage. This includes records of fuel receipts and travel logs. Once you have the required data, access the online fillable form through the appropriate state website. Enter the information into the designated fields, ensuring that all data is accurate and complete. After filling out the form, review it thoroughly for any errors before submitting it electronically. This process not only streamlines your reporting but also helps maintain compliance with state regulations.

Steps to Complete the Online Fillable IFTA Reports for Arkansas Form

Completing the Online Fillable IFTA Reports for Arkansas form involves several key steps:

- Gather all relevant documentation, including fuel purchase receipts and mileage logs.

- Access the online fillable form on the Arkansas state website.

- Input your business information, including your IFTA license number.

- Enter the total miles traveled in each jurisdiction and the total gallons of fuel purchased.

- Calculate the tax due based on the provided rates for each jurisdiction.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the designated submission method.

Legal Use of the Online Fillable IFTA Reports for Arkansas Form

The Online Fillable IFTA Reports for Arkansas form is legally binding when completed and submitted in compliance with state and federal regulations. To ensure its legal validity, the form must be filled out accurately, reflecting true and correct information regarding fuel consumption and mileage. Utilizing a reliable eSignature solution, like airSlate SignNow, can enhance the legal standing of your submission by providing a digital certificate that verifies the identity of the signer and maintains compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Timely filing of the Online Fillable IFTA Reports for Arkansas form is crucial to avoid penalties. The quarterly filing deadlines are typically set for the last day of the month following the end of each quarter. This means that reports for the first quarter are due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. Staying aware of these deadlines helps ensure compliance and avoids potential fines.

Penalties for Non-Compliance

Failure to file the Online Fillable IFTA Reports for Arkansas form on time or inaccuracies in the reported information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential revocation of your IFTA license. It is essential to maintain accurate records and submit the form by the deadlines to mitigate these risks. Understanding the consequences of non-compliance reinforces the importance of proper reporting practices.

Quick guide on how to complete online fillable ifta reports for arkansas form

Complete Online Fillable Ifta Reports For Arkansas Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without any holdups. Handle Online Fillable Ifta Reports For Arkansas Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to amend and eSign Online Fillable Ifta Reports For Arkansas Form with ease

- Locate Online Fillable Ifta Reports For Arkansas Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or an invite link, or download it onto your computer.

Eliminate worries about lost or misfiled documents, tiresome form searches, or mistakes that require new copies to be printed. airSlate SignNow caters to all your document management needs with just a few clicks from your preferred device. Modify and eSign Online Fillable Ifta Reports For Arkansas Form while ensuring smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I fill out a KYC form online for SBI?

Fill out ? If you want to update your kyc, you can just write up a formal letter with your cif/ac details and attach photo copies of the proofs, self attested by you and send them by post to your home branch or you can do it yourself, if you have online banking facility.

Create this form in 5 minutes!

How to create an eSignature for the online fillable ifta reports for arkansas form

How to generate an electronic signature for your Online Fillable Ifta Reports For Arkansas Form online

How to create an electronic signature for the Online Fillable Ifta Reports For Arkansas Form in Google Chrome

How to generate an eSignature for signing the Online Fillable Ifta Reports For Arkansas Form in Gmail

How to create an eSignature for the Online Fillable Ifta Reports For Arkansas Form straight from your smartphone

How to make an electronic signature for the Online Fillable Ifta Reports For Arkansas Form on iOS devices

How to generate an eSignature for the Online Fillable Ifta Reports For Arkansas Form on Android devices

People also ask

-

What is Arkansas IFTA and how does it apply to my business?

Arkansas IFTA, or International Fuel Tax Agreement, is a tax collection agreement between states that simplifies fuel tax payment for businesses operating in multiple jurisdictions. It allows trucking companies to report and pay fuel taxes in one state. By understanding Arkansas IFTA, your business can ensure compliance and streamline tax reporting.

-

How can airSlate SignNow help me with Arkansas IFTA compliance?

airSlate SignNow offers an efficient way to manage and sign documents related to Arkansas IFTA compliance. With its user-friendly interface, you can easily eSign necessary forms and track all transactions digitally. This ensures that your IFTA paperwork is accurate and submitted on time, minimizing the risk of penalties.

-

What features of airSlate SignNow are beneficial for Arkansas IFTA documentation?

airSlate SignNow provides several features that enhance the management of Arkansas IFTA documentation. Key features include customizable templates for tax forms, secure document storage, and real-time collaboration with your team. These tools help streamline the process, making it easier to prepare and submit your IFTA forms.

-

Is airSlate SignNow cost-effective for Arkansas IFTA filings?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling Arkansas IFTA filings. With flexible pricing plans, it delivers signNow savings by reducing the time and staffing needed for document management. You can utilize your resources more effectively while ensuring compliance with state tax regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for Arkansas IFTA?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions that can help manage your Arkansas IFTA process. By connecting your existing tools, you can automate workflows and ensure that all your documents and financials are in sync, simplifying tax preparation and reporting.

-

What benefits does eSigning documents provide for Arkansas IFTA?

eSigning documents for Arkansas IFTA brings several benefits, including a faster turnaround time for approvals and improved security for sensitive data. With airSlate SignNow, you can sign documents anywhere, anytime, eliminating the need for physical signatures. This convenience enhances your operational efficiency while maintaining regulatory compliance.

-

How does airSlate SignNow ensure the security of my Arkansas IFTA documents?

airSlate SignNow prioritizes the security of all your Arkansas IFTA documents by implementing advanced encryption protocols and secure data storage. Your documents are protected against unauthorized access, ensuring that sensitive tax information remains confidential. This level of security helps build trust and confidence in your document management process.

Get more for Online Fillable Ifta Reports For Arkansas Form

- Notice to remedy breach form 11 residential tenancies

- Application for extension of idaho drivers license or id card form

- Identification card application for minors under virginia dmv form

- Standard form residential tenancy agreement gerber

- Claim for refund of bond money form primus property

- An association is a tier 2 association if form

- Please provide at time of submission form

- Illinois drivers license reinstatement payment form

Find out other Online Fillable Ifta Reports For Arkansas Form

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document