What is Loan Estimate Form

What is the loan estimate form?

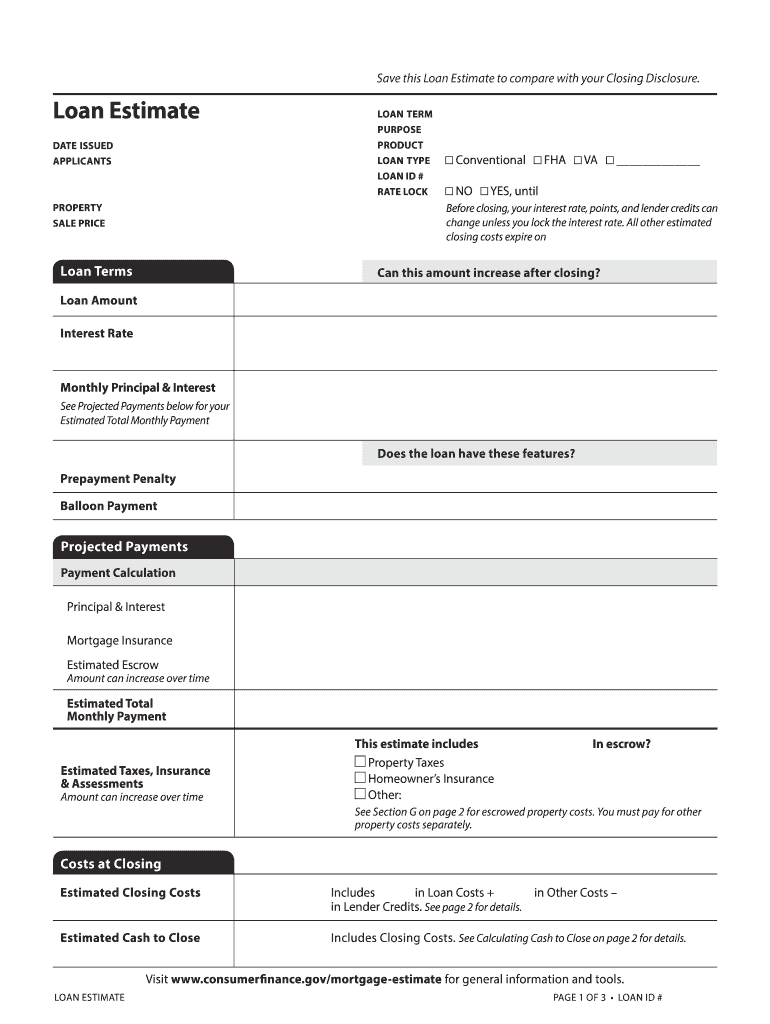

The loan estimate form is a standardized document that provides borrowers with crucial information about the terms and costs of a mortgage loan. This form is designed to help consumers understand the financial implications of their loan options, making it easier to compare different mortgage offers. It includes details such as the loan amount, interest rate, monthly payment, and estimated closing costs. The loan estimate must be provided to borrowers within three business days of applying for a mortgage, ensuring transparency and informed decision-making.

Key elements of the loan estimate form

Understanding the key elements of the loan estimate form is essential for making informed financial decisions. The form typically includes:

- Loan Terms: This section outlines the loan amount, interest rate, and monthly payment.

- Estimated Closing Costs: This provides a breakdown of the fees associated with closing the loan, including origination fees, title insurance, and appraisal costs.

- Projected Payments: This details the estimated monthly payment over the life of the loan, including principal, interest, taxes, and insurance.

- Comparisons: This section allows borrowers to compare the loan estimate with other offers, highlighting differences in costs and terms.

Steps to complete the loan estimate form

Completing the loan estimate form involves several straightforward steps. First, gather necessary financial information, including your income, debts, and credit history. Next, provide details about the property you wish to finance, such as its address and purchase price. Once you have this information, you can fill out the form accurately. Be sure to review the completed form for any errors or omissions before submitting it to your lender. This careful approach ensures that you receive the most accurate estimates and terms for your mortgage.

Legal use of the loan estimate form

The loan estimate form is governed by federal regulations, specifically the Truth in Lending Act and the Real Estate Settlement Procedures Act. These laws require lenders to provide this form to borrowers to promote transparency in the lending process. By ensuring that the loan estimate is accurate and complete, lenders help protect consumers from potential misunderstandings regarding loan terms and costs. Additionally, the legal framework surrounding the loan estimate form mandates that borrowers receive this document within three business days of their application, reinforcing the importance of timely information in the mortgage process.

Who issues the loan estimate form?

The loan estimate form is issued by lenders and mortgage brokers when a borrower applies for a mortgage. This includes banks, credit unions, and other financial institutions that offer mortgage products. The form must be provided to the borrower within three business days of receiving the loan application. It is important for borrowers to understand that while the lender prepares the loan estimate, they are responsible for ensuring that the information is accurate and compliant with federal regulations.

Examples of using the loan estimate form

Using the loan estimate form can significantly enhance a borrower's ability to make informed decisions. For example, if a borrower receives loan estimates from multiple lenders, they can compare the terms side by side to identify the most favorable option. Additionally, the form can help borrowers understand the long-term financial implications of their mortgage, such as how different interest rates affect monthly payments and overall loan costs. By leveraging the information provided in the loan estimate, consumers can negotiate better terms and select a loan that aligns with their financial goals.

Quick guide on how to complete what is loan estimate form

Effortlessly Prepare What Is Loan Estimate Form on Any Device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage What Is Loan Estimate Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign What Is Loan Estimate Form with Ease

- Locate What Is Loan Estimate Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure confidential information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign What Is Loan Estimate Form and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is loan estimate form

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is a consumer financial loan estimate?

A consumer financial loan estimate is a detailed document provided by lenders that outlines the key terms, costs, and conditions of a loan. It helps borrowers understand their potential loan obligations and enables informed decision-making about their finances. By reviewing a consumer financial loan estimate, you can compare offers from different lenders.

-

How does airSlate SignNow help with consumer financial loan estimates?

airSlate SignNow streamlines the process of managing consumer financial loan estimates by enabling easy document signing and sharing. With our platform, you can securely send and eSign estimates, ensuring timely transactions and eliminating the hassle of printed paperwork. This improves efficiency and reduces the time needed to finalize loan agreements.

-

What are the benefits of using airSlate SignNow for consumer financial loan estimates?

Using airSlate SignNow for your consumer financial loan estimates offers numerous benefits, including flexibility, security, and ease of use. Our electronic signing solutions are compliant with legal standards, ensuring that your documents are valid. Additionally, the platform saves you time and resources, allowing you to focus on securing your loan.

-

Are there any costs associated with using airSlate SignNow for consumer financial loan estimates?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for all sizes of businesses. Depending on the features you choose, your plan will cater to your specific needs regarding consumer financial loan estimates and electronic signatures. You can save money by opting for our subscription plans, which provide signNow savings over pay-per-use options.

-

Can I integrate airSlate SignNow with other financial tools for consumer financial loan estimates?

Absolutely! airSlate SignNow offers seamless integrations with various financial tools and CRMs, enhancing your workflow for managing consumer financial loan estimates. By connecting with platforms like accounting software or loan processing systems, you can streamline your operations and ensure that all relevant information is easily accessible.

-

What security measures does airSlate SignNow provide for consumer financial loan estimates?

airSlate SignNow prioritizes security with industry-leading measures for handling consumer financial loan estimates. We use encryption technology to protect your documents during transmission and storage. Additionally, our platform is compliant with various security regulations to ensure that your data remains safe and confidential.

-

Is there customer support available for questions about consumer financial loan estimates?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions about consumer financial loan estimates. Our knowledgeable team is available through various channels, including chat, email, and phone, to ensure that your concerns are addressed promptly. We strive to make your experience as smooth as possible.

Get more for What Is Loan Estimate Form

- Does blue cross blue shield cover car seats form

- Sample trial by written declaration california form

- Holt physics problem 4b answers form

- Trainwithjaclyn form

- Adl and iadl form

- Medical source statement of ability to do work form

- Full litter plus registration application american kennel club images akc form

- Debt repayment agreement template form

Find out other What Is Loan Estimate Form

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation