Form T39

What is the Form T39

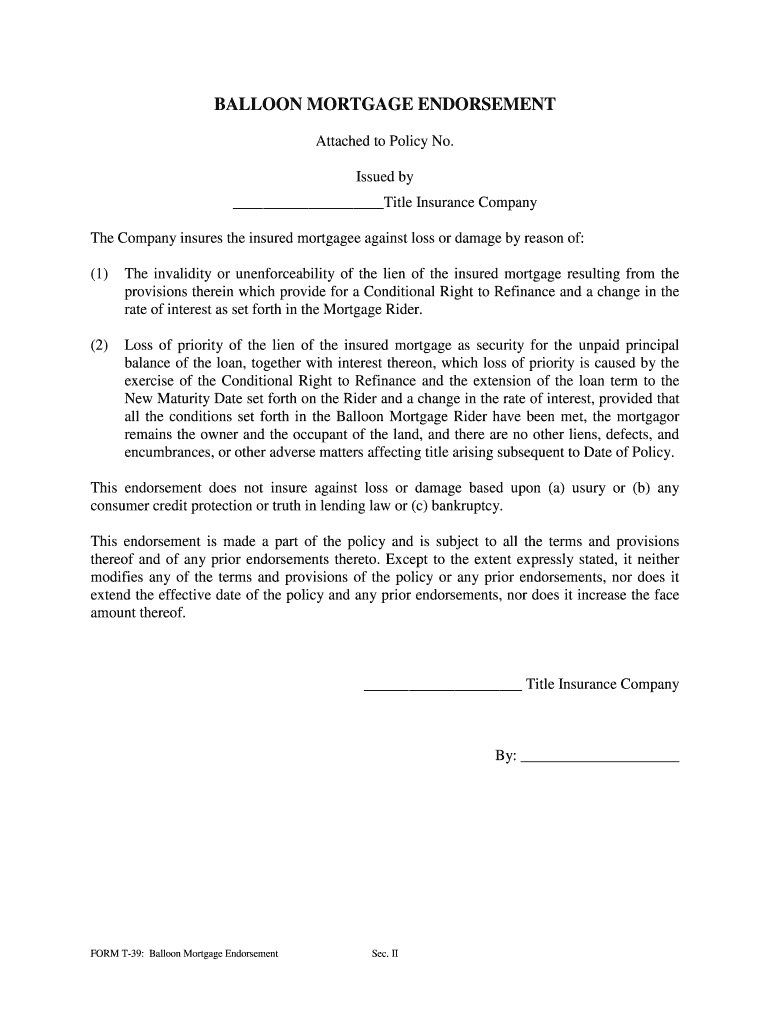

The Form T39, also known as the balloon mortgage endorsement, is a legal document used in the context of mortgage agreements. This form is essential for borrowers who have a balloon mortgage, which typically involves lower monthly payments followed by a large final payment at the end of the loan term. The T39 endorsement outlines the specific terms and conditions of the balloon payment, ensuring that all parties involved understand their obligations. It is crucial for both lenders and borrowers to be aware of the implications of this form, as it can significantly affect the financial responsibilities of the borrower.

How to use the Form T39

Using the Form T39 involves several steps to ensure that it is completed accurately and legally. First, the borrower should review the terms of their balloon mortgage agreement to understand the specific details that need to be included in the endorsement. Next, the borrower must fill out the form with accurate information, including the loan amount, interest rate, and the due date of the final balloon payment. After completing the form, both the borrower and lender must sign it to validate the endorsement. It is advisable to keep a copy of the signed form for personal records and future reference.

Steps to complete the Form T39

Completing the Form T39 requires attention to detail. Follow these steps:

- Gather necessary information about the mortgage, including loan amount, interest rate, and payment schedule.

- Access the Form T39, which can typically be obtained from the lender or financial institution.

- Fill in the borrower’s and lender’s information accurately.

- Clearly state the terms of the balloon payment, including the amount and due date.

- Review the completed form for accuracy and completeness.

- Both parties should sign the form to finalize the endorsement.

- Store the signed document in a safe place for future reference.

Legal use of the Form T39

The legal use of the Form T39 is governed by state and federal laws that regulate mortgage agreements. For the endorsement to be legally binding, it must be executed in accordance with these laws. This includes ensuring that the form is signed by both the borrower and the lender and that all necessary information is accurately provided. Additionally, the use of electronic signatures is permitted under the ESIGN and UETA acts, making it easier for parties to complete the form digitally while maintaining its legal validity.

Key elements of the Form T39

The Form T39 contains several key elements that are critical for its validity and effectiveness. These include:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Loan Details: Amount borrowed, interest rate, and payment schedule.

- Balloon Payment Terms: The amount due at the end of the loan term and the due date.

- Signatures: Signatures of both the borrower and lender to validate the endorsement.

Examples of using the Form T39

Examples of using the Form T39 can vary based on the specific terms of the mortgage agreement. For instance, a borrower with a balloon mortgage may use the T39 endorsement to clarify the obligations related to their final payment. This can be particularly important in cases where the borrower plans to refinance or sell the property before the balloon payment is due. Additionally, lenders may use the form to ensure that all parties are aware of the payment structure, reducing the risk of misunderstandings or disputes in the future.

Quick guide on how to complete form t39

Complete Form T39 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents rapidly without interruptions. Manage Form T39 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign Form T39 with minimal effort

- Find Form T39 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools available through airSlate SignNow designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing extra document copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Form T39 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t39

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What are endorsements forth terms in the context of airSlate SignNow?

Endorsements forth terms refer to the specific clauses or approvals included in electronic signatures on documents. With airSlate SignNow, these endorsements ensure that all parties agree to the terms outlined in the document, making it legally binding and secure.

-

How does airSlate SignNow handle endorsements forth terms in documents?

airSlate SignNow provides users with the ability to clearly outline endorsements forth terms within the document. This feature allows businesses to customize their agreements and ensure that every party involved is aware of and agrees to the specific terms and conditions.

-

Are there any additional costs associated with endorsements forth terms in airSlate SignNow?

No, there are no additional costs for implementing endorsements forth terms using airSlate SignNow. The pricing plans are designed to be straightforward and include all essential features, ensuring that businesses can manage endorsements without unexpected fees.

-

What benefits does airSlate SignNow offer for managing endorsements forth terms?

By utilizing airSlate SignNow for endorsements forth terms, businesses benefit from streamlined document signing processes, enhanced compliance, and quicker turnaround times. This efficiency not only saves time but also helps in maintaining a clear record of all agreements made.

-

Can airSlate SignNow integrate with other software for managing endorsements forth terms?

Yes, airSlate SignNow easily integrates with various software applications, allowing businesses to manage endorsements forth terms alongside other essential operations. These integrations enhance workflow automation and improve overall efficiency in document management.

-

Is airSlate SignNow secure for handling endorsements forth terms?

Absolutely. airSlate SignNow employs advanced security measures to protect all documents, including those with endorsements forth terms. Features such as encryption, secure access controls, and audit trails ensure that your documents remain safe and compliant.

-

How user-friendly is the process of adding endorsements forth terms in airSlate SignNow?

Adding endorsements forth terms in airSlate SignNow is incredibly user-friendly. The platform is designed with an intuitive interface that allows users to easily customize their documents and incorporate necessary endorsements without requiring extensive training or technical skills.

Get more for Form T39

- Sub order from form

- El camino college transcripts form

- Financial status report short form

- Sample ice breaker questions for use in small group form

- Fl 130 appearance stipulations and waivers family lawuniform parentagecustody and support

- Lake orion central enrollment fill and sign printable form

- Hvac installation contract template form

- Hvac maintenance contract template form

Find out other Form T39

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe