Florida Revocable Living Trust Form PdfTrust LawTrustee

What is the Florida Revocable Living Trust?

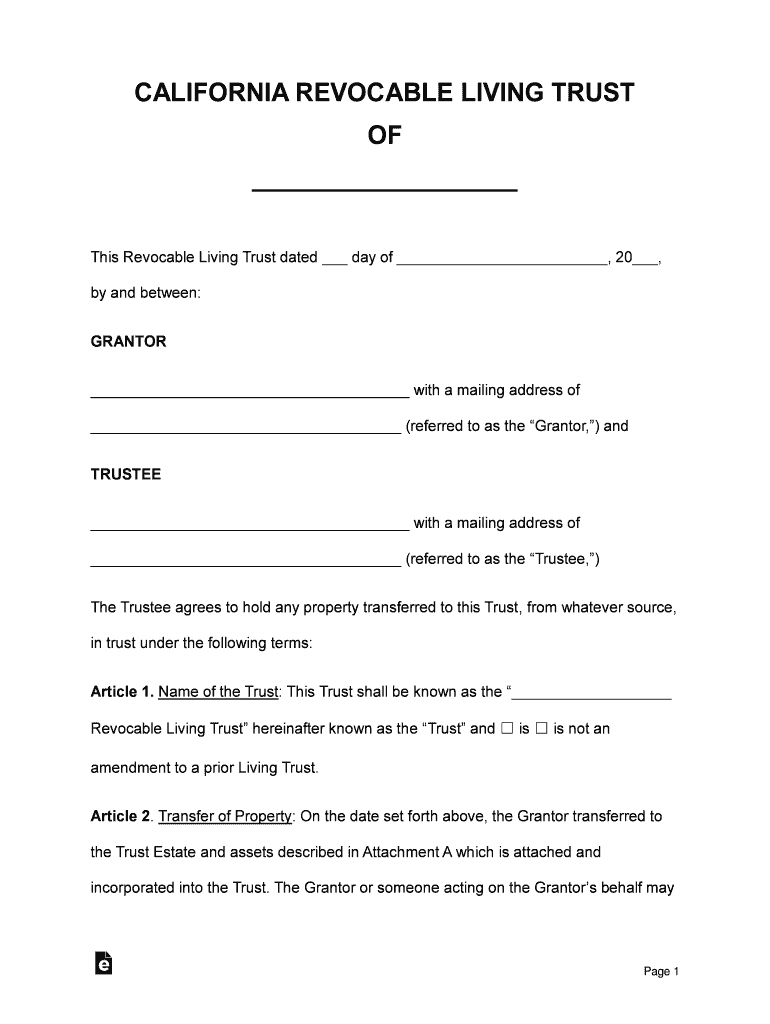

The Florida revocable living trust is a legal document that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust can be altered or revoked at any time while the grantor is alive, providing flexibility in estate planning. It helps avoid probate, ensuring a smoother transition of assets to beneficiaries. The trust can hold various types of property, including real estate, bank accounts, and investments, making it a comprehensive tool for asset management.

How to Use the Florida Revocable Living Trust

Using the Florida revocable living trust involves several steps. First, individuals must identify the assets they wish to include in the trust. Next, they need to draft the trust document, which outlines the terms and conditions of the trust, including the trustee's powers and the beneficiaries' rights. Once the document is prepared, it should be signed and notarized to ensure its legal validity. Finally, transferring assets into the trust is essential to ensure they are managed according to the trust's terms.

Steps to Complete the Florida Revocable Living Trust

Completing the Florida revocable living trust involves a structured approach:

- Identify and list all assets intended for the trust.

- Draft the trust document, specifying the grantor, trustee, and beneficiaries.

- Sign the document in the presence of a notary public.

- Transfer ownership of assets into the trust by changing titles and designations.

- Review and update the trust periodically to reflect any changes in circumstances or wishes.

Key Elements of the Florida Revocable Living Trust

Several key elements define the Florida revocable living trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust's assets.

- Beneficiaries: Individuals or entities designated to receive assets from the trust upon the grantor's death.

- Terms of the Trust: Specific instructions on how assets should be managed and distributed.

Legal Use of the Florida Revocable Living Trust

The Florida revocable living trust is legally recognized and provides several advantages. It allows for asset management during the grantor's lifetime and ensures that assets are distributed according to the grantor's wishes after death. This trust can help minimize estate taxes and avoid the lengthy probate process. However, it is essential to ensure compliance with Florida laws to maintain its legal standing and effectiveness.

State-Specific Rules for the Florida Revocable Living Trust

Florida has specific rules governing the creation and management of revocable living trusts. These include requirements for drafting the trust document, the necessity of notarization, and the process for transferring assets into the trust. Additionally, Florida law allows for the inclusion of specific provisions that can impact how the trust operates, such as rules regarding the appointment of successor trustees and the handling of debts and taxes. Understanding these state-specific rules is crucial for effective estate planning.

Quick guide on how to complete florida revocable living trust formpdftrust lawtrustee

Complete Florida Revocable Living Trust Form pdfTrust LawTrustee smoothly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Manage Florida Revocable Living Trust Form pdfTrust LawTrustee on any device using the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

The easiest way to edit and eSign Florida Revocable Living Trust Form pdfTrust LawTrustee effortlessly

- Locate Florida Revocable Living Trust Form pdfTrust LawTrustee and click Get Form to begin.

- Utilize the tools available to complete your document submission.

- Emphasize important sections of your documents or redact sensitive data using tools provided by airSlate SignNow specifically for that reason.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal authority as a customary wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Florida Revocable Living Trust Form pdfTrust LawTrustee and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida revocable living trust formpdftrust lawtrustee

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is a Florida revocable living trust?

A Florida revocable living trust is a legal entity that allows you to manage your assets during your lifetime and distribute them after your death without going through probate. It offers flexibility, as it can be altered or revoked by the individual during their lifetime. This trust is particularly beneficial for Florida residents looking to streamline the management of their estate.

-

What are the benefits of establishing a Florida revocable living trust?

The key benefits of a Florida revocable living trust include avoiding probate, maintaining privacy over your assets, and providing a smoother transition for your heirs. Unlike a will, a trust allows for direct asset distribution upon your death, which can save time and reduce legal fees. Additionally, it provides the flexibility to amend the terms as your situation changes.

-

How much does it cost to set up a Florida revocable living trust?

The costs for setting up a Florida revocable living trust vary widely depending on the complexity of your estate and whether you choose to use an attorney or complete it yourself. Typically, legal fees for professional preparation can range from a few hundred to several thousand dollars. However, the long-term savings from avoiding probate can outweigh the initial setup costs.

-

Can a Florida revocable living trust hold all types of assets?

Yes, a Florida revocable living trust can hold various types of assets, including real estate, bank accounts, investments, and personal property. However, certain assets, like life insurance policies and retirement accounts, may need to be treated differently. It's important to ensure all relevant assets are funded into the trust to fully utilize its benefits.

-

How does a Florida revocable living trust work with taxes?

A Florida revocable living trust is considered a 'pass-through' entity for tax purposes, meaning it does not pay income taxes separately. Instead, any income generated by the assets held in the trust is reported on your personal tax return. As a result, a revocable living trust does not provide tax benefits, but it can simplify estate management.

-

What happens to a Florida revocable living trust when the grantor dies?

Upon the death of the grantor, a Florida revocable living trust becomes irrevocable, and the assets are distributed according to the terms laid out in the trust document. This process avoids probate, allowing beneficiaries to access their inheritances more quickly. The designated trustee will manage the administration of the trust.

-

Can I make changes to my Florida revocable living trust?

Yes, one of the primary advantages of a Florida revocable living trust is that you can modify or revoke it at any time during your lifetime, as long as you are competent. This flexibility allows you to adjust the terms as your situation changes, which is essential for ensuring that your estate plan remains relevant. After your death, however, the trust becomes irrevocable.

Get more for Florida Revocable Living Trust Form pdfTrust LawTrustee

- Louisiana locet form

- Arizona withholding tax form

- The printed portions of this form have been approved by the colorado real estate commission lp 46 1 97 drop in center flyer

- The veldt vocabulary pdf form

- Resigned as a director sunbiz form

- Florissant police department form

- Field trip behavior contract form

- Montreal camera club gemboree competition entry form

Find out other Florida Revocable Living Trust Form pdfTrust LawTrustee

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract