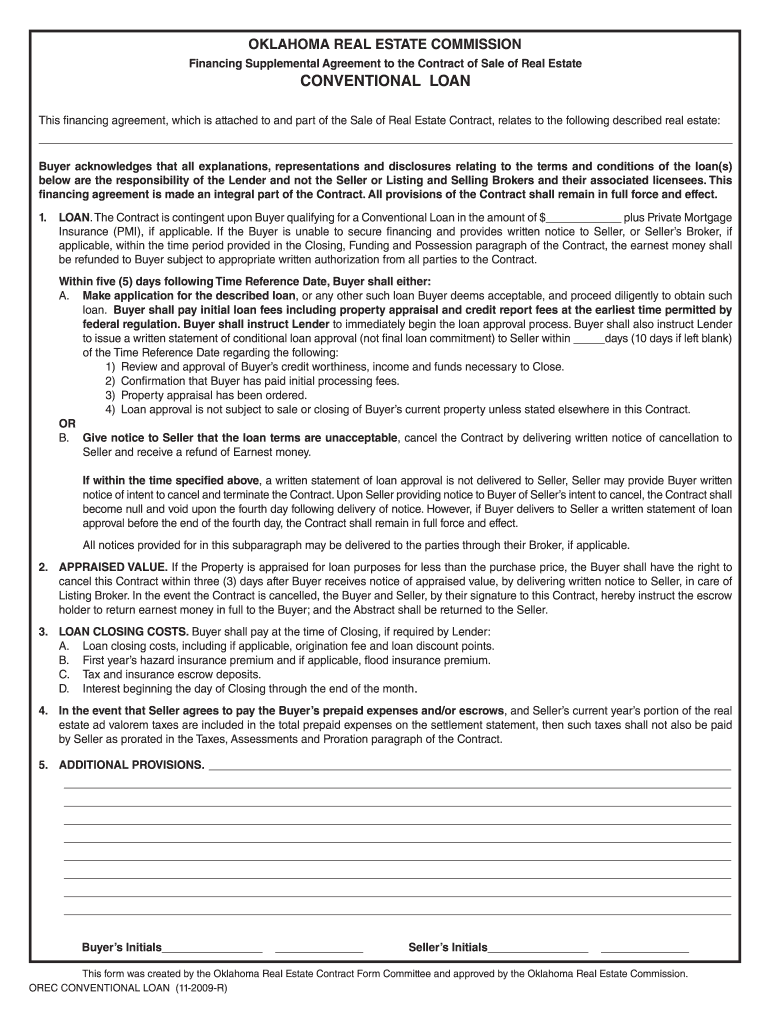

Orec Conventional Loan Form

What is the OREC Conventional Loan?

The OREC Conventional Loan is a financing option designed for individuals seeking to purchase residential properties in Oklahoma. This type of loan adheres to the guidelines established by the Oklahoma Real Estate Commission (OREC) and is typically used for properties that meet standard eligibility criteria. The loan is characterized by its fixed or adjustable interest rates and can be utilized for various property types, including single-family homes, townhouses, and condominiums.

How to Obtain the OREC Conventional Loan

To obtain an OREC Conventional Loan, potential borrowers must follow a series of steps. First, they should assess their financial situation, including credit score and income stability. Next, borrowers can approach lenders who offer OREC-approved loans. It is advisable to gather necessary documentation, such as proof of income, tax returns, and credit history, to streamline the application process. Once the application is submitted, lenders will evaluate the information and determine loan eligibility.

Steps to Complete the OREC Conventional Loan

Completing the OREC Conventional Loan involves several key steps:

- Gather necessary financial documents, including income verification and tax returns.

- Choose a lender that offers OREC Conventional Loans.

- Submit the loan application along with required documentation.

- Await the lender's assessment and approval process.

- Once approved, review the loan terms and conditions before signing.

- Complete any additional paperwork required by the lender.

- Close the loan by signing the final documents and receiving the funds.

Legal Use of the OREC Conventional Loan

The legal use of the OREC Conventional Loan is governed by state and federal regulations. Borrowers must ensure that the loan is used for legitimate purposes, such as purchasing a primary residence or investment property. Compliance with the terms outlined in the loan agreement is essential to avoid legal repercussions. Additionally, borrowers should be aware of their rights and responsibilities under the loan agreement to ensure a smooth borrowing experience.

Key Elements of the OREC Conventional Loan

Key elements of the OREC Conventional Loan include:

- Interest Rates: These loans may have fixed or adjustable rates, impacting monthly payments.

- Loan Terms: Typically range from fifteen to thirty years.

- Down Payment: A minimum down payment is often required, which can vary based on lender policies.

- Mortgage Insurance: May be required if the down payment is less than twenty percent.

- Prepayment Penalties: Borrowers should review if their loan includes penalties for early repayment.

Eligibility Criteria

Eligibility for the OREC Conventional Loan typically includes several factors:

- Minimum credit score requirements set by lenders.

- Stable income and employment history.

- Debt-to-income ratio within acceptable limits.

- Ability to provide necessary documentation and disclosures.

- Compliance with state and federal lending regulations.

Quick guide on how to complete orec conventional loan

Effortlessly Prepare Orec Conventional Loan on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to design, modify, and electronically sign your documents swiftly without any holdups. Manage Orec Conventional Loan on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Orec Conventional Loan with Ease

- Find Orec Conventional Loan and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Orec Conventional Loan to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the orec conventional loan

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is an Oklahoma conventional loan?

An Oklahoma conventional loan is a type of mortgage that is not insured or guaranteed by the federal government. It typically requires a higher credit score and a larger down payment compared to government-backed loans. These loans are ideal for buyers in Oklahoma looking for flexible financing options without the complexities of federal programs.

-

What are the benefits of an Oklahoma conventional loan?

The main benefits of an Oklahoma conventional loan include competitive interest rates, fewer fees, and flexible loan terms. Borrowers can leverage this type of loan for a primary residence, second home, or investment property. Additionally, there are no mortgage insurance requirements if the down payment is 20% or more, saving homeowners money over time.

-

What are the typical requirements for obtaining an Oklahoma conventional loan?

To qualify for an Oklahoma conventional loan, borrowers typically need a credit score of at least 620, a stable income, and a debt-to-income ratio of 43% or lower. Additionally, lenders may require a minimum down payment of 3% to 5%, depending on the loan program. It's important to check with local lenders for specific eligibility criteria.

-

How does the pricing of an Oklahoma conventional loan compare to other loan types?

The pricing of an Oklahoma conventional loan can be more competitive than government-backed loans due to its lower risk for lenders. However, traditional loans usually require higher credit scores and down payments. Borrowers often find that conventional loans offer better terms in terms of interest rates and longer amortization periods.

-

Can I use an Oklahoma conventional loan for refinancing?

Yes, you can use an Oklahoma conventional loan to refinance an existing mortgage. Refinancing can help you reduce your monthly payments or access equity in your home. Borrowers should evaluate the current interest rates and their credit score to determine the potential benefits of refinancing with an Oklahoma conventional loan.

-

What features should I look for in an Oklahoma conventional loan?

When considering an Oklahoma conventional loan, look for features such as fixed or adjustable rates, flexible repayment terms, and options for paying points to lower your interest rate. Additionally, pay attention to the lender's fees, customer service, and whether they offer personalized loan programs suited to your financial needs.

-

Are there any integrations available for managing my Oklahoma conventional loan?

Yes, many lenders offer digital platforms that integrate with financial management tools to help you track your Oklahoma conventional loan. These seamless integrations can provide insights into payment schedules, remaining balance, and even automate payments for a hassle-free experience. Check with your lender to see which integrations are available.

Get more for Orec Conventional Loan

- Nynm form 1070 fillable

- Post conviction motion form

- Combustion air calculation worksheet 60093629 form

- Transcript request form eastern international college eicollege

- Proposal routing form sdsu research foundation san diego foundation sdsu

- Form ca 2 notice of occupational disease and claim for

- Instructions file original and one 1 copy of ap form

- Jsa job safety analysis siteproject name of cont form

Find out other Orec Conventional Loan

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS