Cfpb Advisory Application Form

What is the CFPB Advisory Application?

The CFPB advisory application is a formal request submitted to the Consumer Financial Protection Bureau (CFPB) for guidance on specific financial practices or regulations. This application allows individuals or organizations to seek clarification on compliance with federal consumer financial laws. The CFPB aims to assist consumers and businesses by providing clear and actionable advice, ensuring that all parties understand their rights and responsibilities under the law.

Steps to Complete the CFPB Advisory Application

Completing the CFPB advisory application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information related to your inquiry, including relevant financial details and documentation. Next, fill out the application form, providing clear and concise answers to each question. It is crucial to review your application for any errors before submission. Once completed, submit the application via the designated method, ensuring you keep a copy for your records.

Legal Use of the CFPB Advisory Application

The CFPB advisory application is legally recognized as a means for individuals and organizations to seek official guidance on consumer financial laws. To ensure its legal validity, the application must be filled out accurately and submitted according to CFPB guidelines. The advice provided through this application is based on existing laws and regulations, making it a reliable resource for compliance and legal assurance.

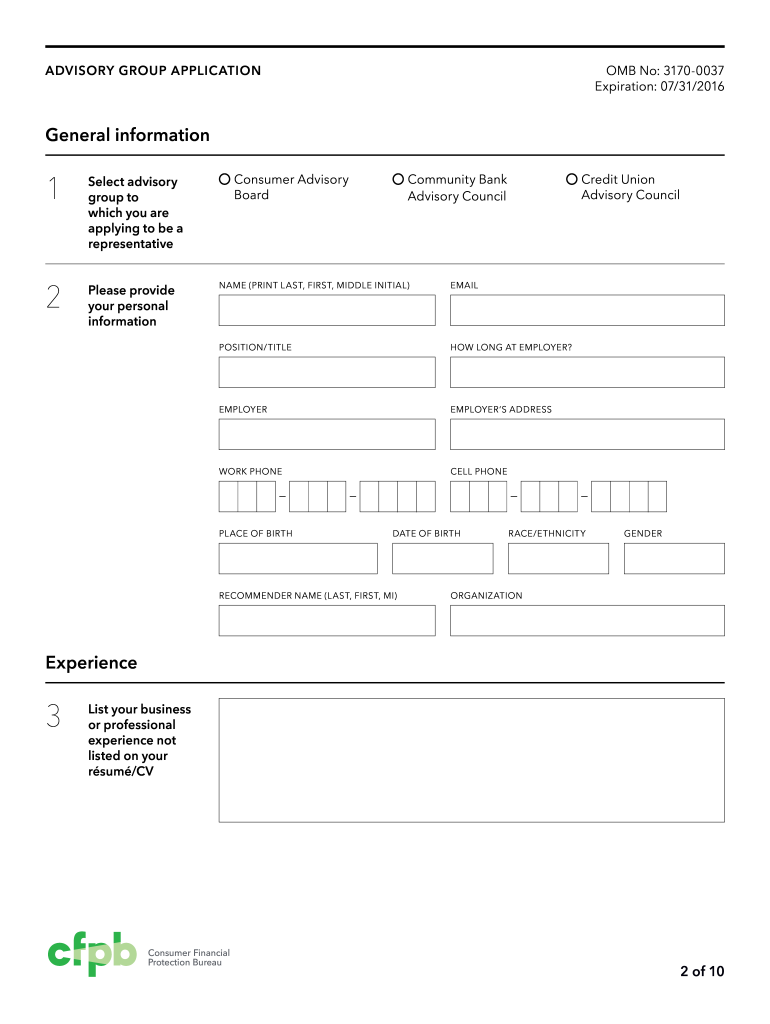

Key Elements of the CFPB Advisory Application

Several key elements are essential for a successful CFPB advisory application. These include:

- Applicant Information: Full name, contact details, and any relevant identification.

- Inquiry Details: A clear description of the issue or question regarding consumer financial law.

- Supporting Documentation: Any documents that may assist in clarifying the inquiry.

- Signature: A signed declaration affirming the accuracy of the information provided.

Who Issues the Form?

The CFPB advisory application is issued by the Consumer Financial Protection Bureau, a U.S. government agency responsible for enforcing federal consumer financial laws. The CFPB provides resources and guidance to consumers and financial institutions, ensuring transparency and fairness in the financial marketplace.

Eligibility Criteria

To submit a CFPB advisory application, applicants must meet specific eligibility criteria. Generally, individuals or organizations involved in consumer financial transactions or practices may apply. This includes businesses, financial institutions, and consumers seeking clarification on their rights and obligations under federal laws. It is essential to ensure that the inquiry pertains to a matter governed by the CFPB to qualify for assistance.

Quick guide on how to complete cfpb advisory application

Effortlessly prepare Cfpb Advisory Application on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Cfpb Advisory Application on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to edit and electronically sign Cfpb Advisory Application with ease

- Locate Cfpb Advisory Application and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Cfpb Advisory Application and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cfpb advisory application

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the cfpb advisory application, and how can it benefit my business?

The cfpb advisory application is designed to help businesses comply with regulations set forth by the Consumer Financial Protection Bureau (CFPB). By using this application, businesses can streamline their compliance processes, reduce the risk of regulatory penalties, and enhance their operational efficiency. It's an essential tool for companies in the financial sector looking to ensure adherence to CFPB guidelines.

-

How does the airSlate SignNow integrate with the cfpb advisory application?

airSlate SignNow seamlessly integrates with the cfpb advisory application, allowing users to manage, send, and eSign documents in a compliant manner. This integration helps streamline the document workflow while ensuring that all electronic signatures meet CFPB standards. With this capability, businesses can enhance their compliance strategies without sacrificing speed or efficiency.

-

What features does the cfpb advisory application offer?

The cfpb advisory application comes equipped with several essential features, including document templates, eSignature capabilities, and compliance tracking. These features simplify the preparation and signing of documents while ensuring that businesses adhere to CFPB regulations. Additionally, users can customize workflows to fit their specific needs, making it a versatile solution for compliance management.

-

Is the cfpb advisory application cost-effective for small businesses?

Yes, the cfpb advisory application is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. By utilizing airSlate SignNow's platform, small businesses can access essential compliance tools without incurring high costs. This affordability enables them to focus on growth while maintaining the necessary compliance with CFPB regulations.

-

How can the cfpb advisory application improve compliance efficiency?

The cfpb advisory application improves compliance efficiency by automating various steps in the document management process. It reduces the time spent on manual paperwork, decreases the possibility of errors, and ensures that all documents are compliant with CFPB standards. Consequently, businesses can dedicate more resources to core operations rather than administrative tasks.

-

What support options are available for users of the cfpb advisory application?

Users of the cfpb advisory application have access to a range of support options, including online resources, live chat, and dedicated customer service representatives. These support channels ensure that businesses can navigate any challenges they face while using the application. Comprehensive training materials are also available to help users maximize the application's features effectively.

-

Can I customize the cfpb advisory application to fit my business needs?

Yes, the cfpb advisory application allows for substantial customization, enabling businesses to tailor the platform to meet their specific compliance requirements. Users can modify document templates, workflows, and even user permissions to ensure that all teams can work effectively. This flexibility promotes a more efficient compliance process tailored to each business's unique environment.

Get more for Cfpb Advisory Application

Find out other Cfpb Advisory Application

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast