B Schedule B Sales Form

What is the B Schedule B Sales

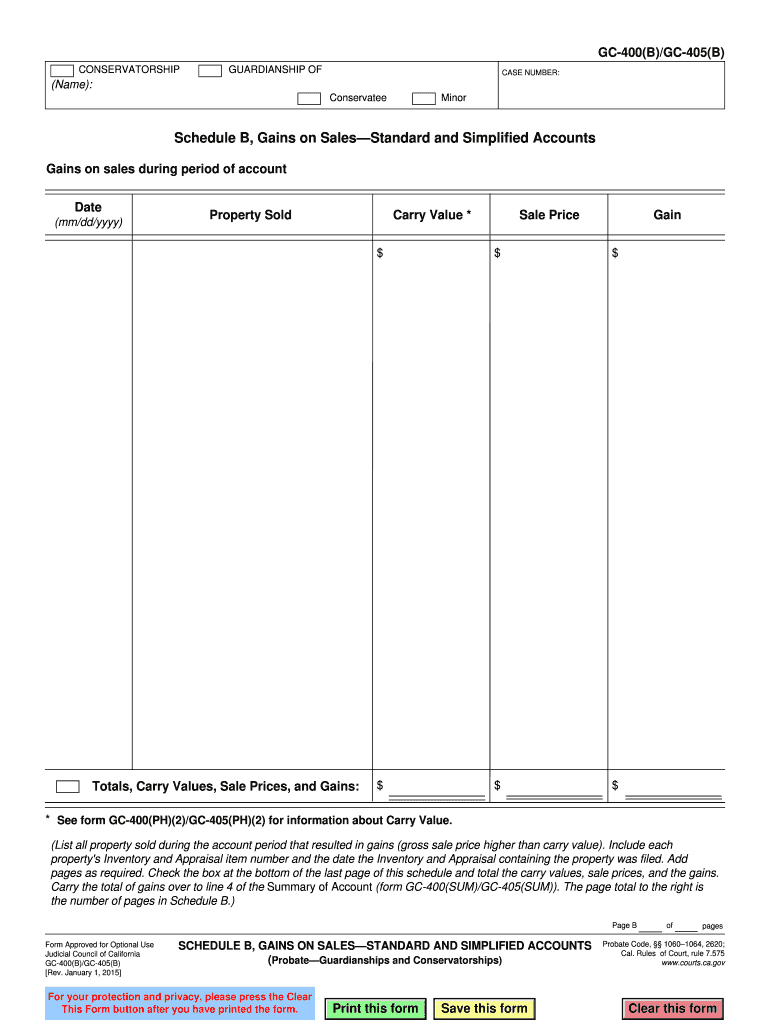

The B Schedule B Sales is a tax form used by businesses to report sales and other income. It plays a crucial role in the overall tax reporting process, ensuring that all sales activities are accurately documented for tax purposes. This form is essential for maintaining compliance with IRS regulations and helps in calculating the total income that is subject to taxation.

Steps to complete the B Schedule B Sales

Completing the B Schedule B Sales involves several key steps:

- Gather necessary financial records, including sales receipts and invoices.

- Determine the total sales amount for the reporting period.

- Fill out the form accurately, ensuring all income sources are included.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the B Schedule B Sales

The B Schedule B Sales must be used in accordance with IRS guidelines to ensure that the reported information is legally valid. This includes accurately reporting all sales income and adhering to the specific instructions provided by the IRS. Failure to comply with these regulations can result in penalties and legal issues.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines for the B Schedule B Sales to avoid late penalties. Typically, the form must be filed by the due date of the business tax return. For most businesses, this is usually April fifteenth of the following year, but specific dates may vary based on the business structure and fiscal year.

Who Issues the Form

The B Schedule B Sales is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides the necessary forms and instructions for businesses to report their income accurately. It is essential to use the most current version of the form to ensure compliance with any recent changes in tax law.

Examples of using the B Schedule B Sales

Businesses of various types utilize the B Schedule B Sales to report their sales income. For example:

- A retail store reports total sales from merchandise sold during the tax year.

- A service-based business documents income earned from client services provided.

- Online businesses report sales generated through e-commerce platforms.

These examples illustrate the diverse applications of the B Schedule B Sales across different industries.

Quick guide on how to complete b schedule b sales

Complete B Schedule B Sales effortlessly on any gadget

Online document management has gained traction with companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage B Schedule B Sales on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to edit and eSign B Schedule B Sales without breaking a sweat

- Locate B Schedule B Sales and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign B Schedule B Sales and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the b schedule b sales

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the b 405 b feature in airSlate SignNow?

The b 405 b feature in airSlate SignNow allows users to easily send and eSign documents through a streamlined process. This feature is designed to simplify transactions, making it ideal for businesses of all sizes. Whether you need to send contracts or forms, the b 405 b makes it efficient and straightforward.

-

How does pricing work for the b 405 b service?

Pricing for the b 405 b service in airSlate SignNow is competitive and flexible, catering to different business needs. You can choose from various plans that fit your usage requirements, ensuring you only pay for what you need. This cost-effective structure makes implementing b 405 b an excellent choice for budget-conscious organizations.

-

What are the key benefits of using the b 405 b feature?

The b 405 b feature offers numerous benefits, including increased efficiency and reduced turnaround times for document transactions. Users also enjoy enhanced security protocols, ensuring that all eSigned documents are safe and legally compliant. Overall, the b 405 b feature empowers businesses to operate more effectively.

-

Can I integrate b 405 b with my existing software?

Yes, airSlate SignNow's b 405 b feature supports integrations with a variety of third-party applications. This capability allows you to seamlessly connect with tools you already use, enhancing workflow and productivity. Integration options make the b 405 b feature versatile and user-friendly.

-

Is the b 405 b feature suitable for small businesses?

Absolutely! The b 405 b feature in airSlate SignNow is tailored to meet the needs of small businesses by providing an affordable and user-friendly eSigning solution. It simplifies document management, enabling smaller teams to operate efficiently without a signNow investment. Small businesses can leverage the b 405 b to grow and enhance productivity.

-

What types of documents can be signed using b 405 b?

You can use the b 405 b feature to sign a wide range of documents, including contracts, agreements, non-disclosure documents, and more. This flexibility makes it an ideal solution for various industries and purposes. The b 405 b simplifies the eSigning process for any document type you need.

-

How secure is the b 405 b feature?

The b 405 b feature in airSlate SignNow employs advanced encryption and security measures to protect your documents. This includes authentication protocols and secure storage, ensuring that your eSigned documents remain confidential and compliant with regulations. You can rely on the b 405 b to keep your information safe.

Get more for B Schedule B Sales

- Vessel report stolen or embezzled vessel dbwcagov dbw ca form

- Hw027 form

- Epic air trampoline park it s a jump party form

- Pamtproperty form

- Dd form 2807 1 aug

- Informal procedure federal court canada cas ncr nter03 cas satj gc

- Structured abc antecedent behavior consequence analysis form

- Community risk reduction division california form

Find out other B Schedule B Sales

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract