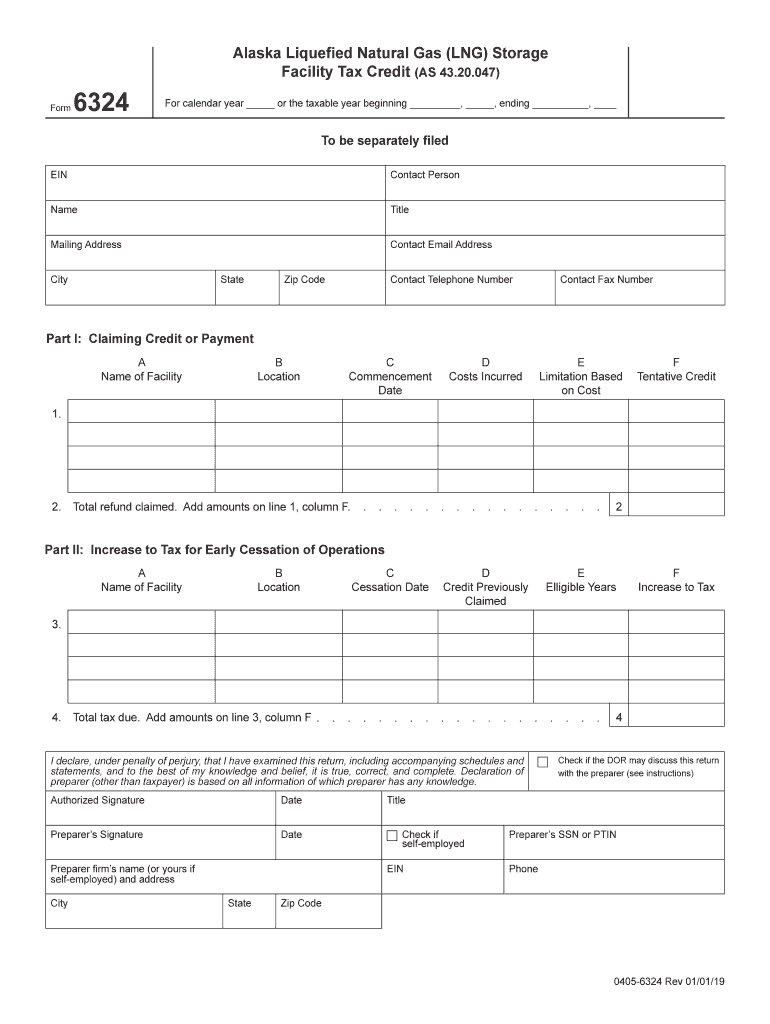

Part I Claiming Credit or Payment 2019

What is the Part I Claiming Credit or Payment?

The Part I Claiming Credit or Payment is a specific form used in the context of the Alaska LNG facility tax credit. This form allows eligible taxpayers to claim credits related to investments in liquefied natural gas facilities. Understanding this form is essential for businesses and individuals involved in the energy sector in Alaska, as it outlines the necessary information required to validate the claim for credits. The form is structured to ensure compliance with state regulations and provides a clear pathway for claiming financial benefits associated with liquefied natural gas operations.

Steps to Complete the Part I Claiming Credit or Payment

Completing the Part I Claiming Credit or Payment involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial statements and investment records related to the liquefied natural gas facility. Next, fill out the form accurately, ensuring all fields are completed to avoid delays. It is crucial to review the form for errors before submission. Finally, submit the completed form through the designated channels, whether online or via mail, ensuring that you keep copies for your records. Following these steps will help streamline the process and enhance the likelihood of a successful claim.

Eligibility Criteria

Eligibility for the Part I Claiming Credit or Payment is primarily determined by the nature of the investments made in liquefied natural gas facilities. To qualify, applicants must demonstrate that their investments meet specific state criteria, including the type of facility and the amount invested. Additionally, businesses must be operating within the state of Alaska and comply with all relevant regulations governing the LNG sector. Understanding these criteria is vital for ensuring that your claim is valid and that you meet all necessary requirements for the tax credit.

IRS Guidelines

Adhering to IRS guidelines is crucial when completing the Part I Claiming Credit or Payment. The IRS provides specific instructions on how to report tax credits, including necessary documentation and compliance with federal tax laws. It is important to familiarize yourself with these guidelines to ensure that your claim aligns with both state and federal requirements. This will not only facilitate a smoother application process but also help avoid potential issues with tax compliance in the future.

Form Submission Methods

There are multiple methods for submitting the Part I Claiming Credit or Payment. Taxpayers can choose to submit the form online through designated state portals, which often provide a quicker processing time. Alternatively, the form can be mailed to the appropriate state department or submitted in person at designated locations. Each method has its advantages, and selecting the right one can depend on personal preferences and the urgency of the claim. Ensuring that you follow the correct submission method is essential for timely processing.

Key Elements of the Part I Claiming Credit or Payment

The Part I Claiming Credit or Payment includes several key elements that must be accurately completed to ensure a valid claim. These elements typically include taxpayer identification information, details about the investment in the liquefied natural gas facility, and a breakdown of the credits being claimed. Additionally, the form may require supporting documentation to substantiate the claims made. Understanding these key elements is essential for preparing a comprehensive and compliant submission.

Quick guide on how to complete part i claiming credit or payment

Complete Part I Claiming Credit Or Payment effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Part I Claiming Credit Or Payment on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Part I Claiming Credit Or Payment effortlessly

- Find Part I Claiming Credit Or Payment and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Part I Claiming Credit Or Payment and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct part i claiming credit or payment

Create this form in 5 minutes!

How to create an eSignature for the part i claiming credit or payment

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2019 Alaska form liquefied PDF and why is it important?

The 2019 Alaska form liquefied PDF is a crucial document for businesses dealing with liquefied natural gas or similar products in Alaska. It ensures compliance with state regulations and facilitates proper record-keeping. Understanding this form can signNowly streamline your business processes.

-

How can airSlate SignNow help me manage the 2019 Alaska form liquefied PDF?

AirSlate SignNow provides an intuitive platform for uploading, signing, and sending your 2019 Alaska form liquefied PDF securely. It simplifies the entire documentation process and ensures all signatures are captured easily. With our solution, you can manage your forms more efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2019 Alaska form liquefied PDF?

Yes, airSlate SignNow offers several pricing plans designed to fit different business needs. You can evaluate the features available for each plan to find the best solution for managing your 2019 Alaska form liquefied PDF without breaking the bank. Our pricing is competitive and transparent.

-

Can I integrate airSlate SignNow with other tools to handle the 2019 Alaska form liquefied PDF?

Absolutely! AirSlate SignNow integrates with various third-party applications, enhancing your workflow. This allows for better management of the 2019 Alaska form liquefied PDF alongside other documents and business processes, ensuring a seamless experience.

-

What features does airSlate SignNow offer for the 2019 Alaska form liquefied PDF?

AirSlate SignNow offers several features that simplify the management of the 2019 Alaska form liquefied PDF, including bulk sending, template creation, and audit trails. These features ensure that you can send, sign, and track your documents effortlessly. You'll appreciate the time-saving benefits that come with our tools.

-

Is it easy to eSign the 2019 Alaska form liquefied PDF using airSlate SignNow?

Yes, eSigning the 2019 Alaska form liquefied PDF with airSlate SignNow is incredibly user-friendly. Our platform allows users to sign documents electronically from any device, making it quick and convenient. This process is legally binding and complies with regulations.

-

How secure is my 2019 Alaska form liquefied PDF when using airSlate SignNow?

AirSlate SignNow takes security very seriously. Your 2019 Alaska form liquefied PDF is protected with advanced encryption and secure cloud storage. We implement various security measures to ensure that your sensitive information remains safe and confidential.

Get more for Part I Claiming Credit Or Payment

- Diabetes registry template 33044361 form

- Form st16 application for nonprofit exempt status sales tax revenue state mn

- Health risk assessment form 54048185

- Dvsdpsmngov form

- Invoice template for private school tuition and fees step up for form

- Exit clearance form

- Po box 30924 salt lake city form

- Annual maintenance sop contract template form

Find out other Part I Claiming Credit Or Payment

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation