Arizona Form 835 2017

What is the Arizona Form 835

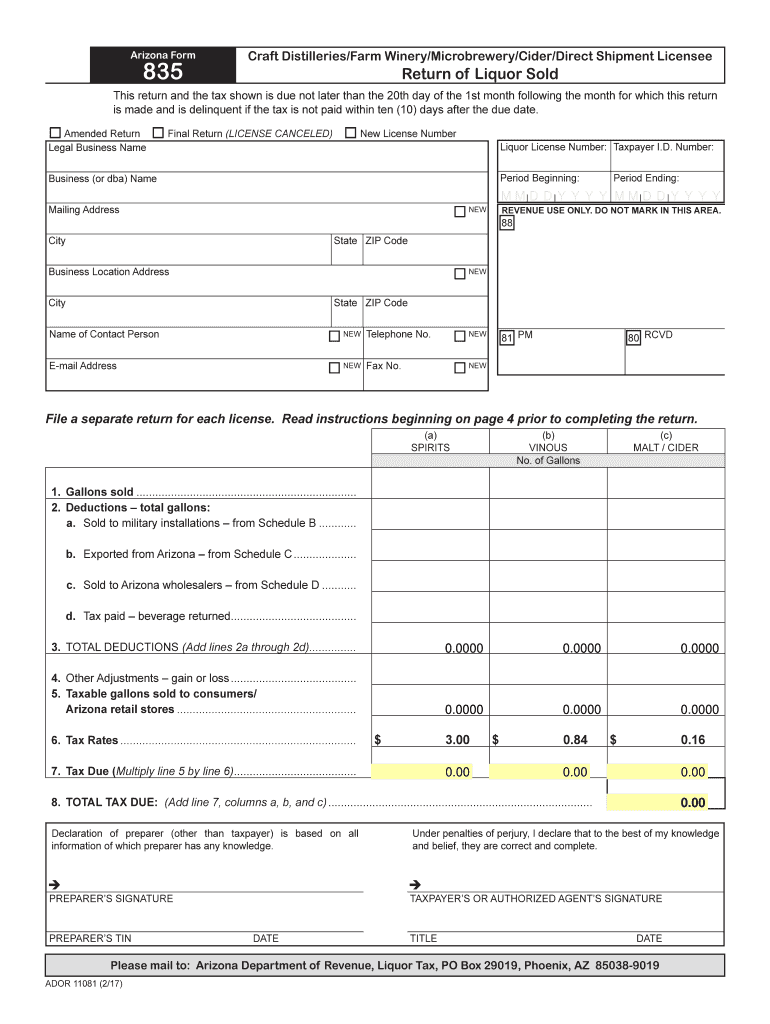

The Arizona Form 835 is a tax document used by businesses to report and remit taxes on liquor sales. This form is essential for ensuring compliance with state tax regulations regarding the sale of alcoholic beverages. It serves as a declaration of the total amount of liquor sold and the corresponding taxes owed to the state. Understanding the purpose of this form is crucial for businesses operating in the liquor industry in Arizona.

How to use the Arizona Form 835

Using the Arizona Form 835 involves several steps to ensure accurate reporting and compliance. First, businesses must gather all relevant sales data for the reporting period. This includes total sales figures, tax rates applicable to liquor sales, and any exemptions that may apply. Once the data is collected, it can be entered into the appropriate sections of the form. After completing the form, it should be reviewed for accuracy before submission to the state tax authority.

Steps to complete the Arizona Form 835

Completing the Arizona Form 835 requires careful attention to detail. Here are the steps to follow:

- Gather all sales data for the reporting period.

- Identify the applicable tax rates for liquor sales in Arizona.

- Fill in the total sales amount in the designated section of the form.

- Calculate the total tax owed based on the sales figures.

- Review the completed form for accuracy.

- Submit the form to the Arizona Department of Revenue by the specified deadline.

Legal use of the Arizona Form 835

The Arizona Form 835 is legally recognized as a valid document for reporting liquor sales and remitting taxes. For it to be considered legally binding, it must be completed accurately and submitted on time. Compliance with state regulations is essential to avoid penalties or legal issues. Businesses should ensure that they keep copies of submitted forms for their records, as these may be required for audits or future reference.

Key elements of the Arizona Form 835

Several key elements must be included when filling out the Arizona Form 835. These include:

- Business name and address

- Tax identification number

- Reporting period

- Total liquor sales

- Tax calculations

- Signature of the authorized representative

Each of these elements plays a critical role in ensuring the form is complete and compliant with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 835 are crucial for maintaining compliance. Typically, the form must be submitted quarterly, with specific due dates set by the Arizona Department of Revenue. Businesses should be aware of these deadlines to avoid late fees and penalties. It is advisable to check the official state resources for the most current filing dates and requirements.

Quick guide on how to complete arizona form 835

Effortlessly Prepare Arizona Form 835 on Any Device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without delays. Handle Arizona Form 835 on any platform with airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Arizona Form 835 effortlessly

- Obtain Arizona Form 835 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to send your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Arizona Form 835 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 835

Create this form in 5 minutes!

How to create an eSignature for the arizona form 835

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Arizona Form 835?

The Arizona Form 835 is a document used for the settlement of claims by healthcare providers. This form simplifies the payment processes and helps ensure that healthcare providers receive their payments efficiently. Using airSlate SignNow, you can easily eSign and send the Arizona Form 835 securely.

-

How can airSlate SignNow help me with the Arizona Form 835?

airSlate SignNow provides a seamless solution to create, send, and eSign the Arizona Form 835. With its user-friendly interface, you can complete your documents faster and ensure compliance with healthcare regulations. This streamlines your workflow and reduces errors in the documentation process.

-

Is there a cost to use airSlate SignNow for the Arizona Form 835?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs regarding the Arizona Form 835. These plans are designed to be cost-effective while providing robust eSigning capabilities. Check out airSlate's website for detailed pricing information tailored to your requirements.

-

Are there any features specific to the Arizona Form 835 in airSlate SignNow?

Yes, airSlate SignNow includes features specifically optimized for handling the Arizona Form 835. Features like customizable templates, audit trails, and automated reminders help ensure that your document handling processes are efficient. This allows you to manage your healthcare documents with ease.

-

Can I integrate airSlate SignNow with other software for managing the Arizona Form 835?

Absolutely! airSlate SignNow offers integrations with various software to enhance your experience with the Arizona Form 835. Whether you need to sync data with your EHR system or accounting software, these integrations help streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the Arizona Form 835?

Using airSlate SignNow for the Arizona Form 835 enhances efficiency by allowing quick access to eSigning capabilities. It minimizes the time spent on paperwork and helps ensure that transactions are secure. Moreover, with tracking features, you can monitor progress and receive updates in real-time.

-

Is airSlate SignNow compliant with Arizona healthcare regulations for the Form 835?

Yes, airSlate SignNow is compliant with Arizona healthcare regulations regarding the processing of the Form 835. The platform follows best practices in data security and privacy, ensuring that all signed documents meet the required standards. This gives you peace of mind when handling sensitive healthcare information.

Get more for Arizona Form 835

- Home language survey scschools org form

- Dual employment form chicago park district

- Gedlogin form

- Ou childrens referral form

- Reviewing manuscripts for peer review journals a primer form

- Impact of pre grading resubmission of projects on test grades in an proc isecon form

- Antique mall vendor contract template form

- Antenuptial without accrual contract template form

Find out other Arizona Form 835

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy