Tennessee Short Form Inheritance Tax Form 2015

What is the Tennessee Short Form Inheritance Tax Form

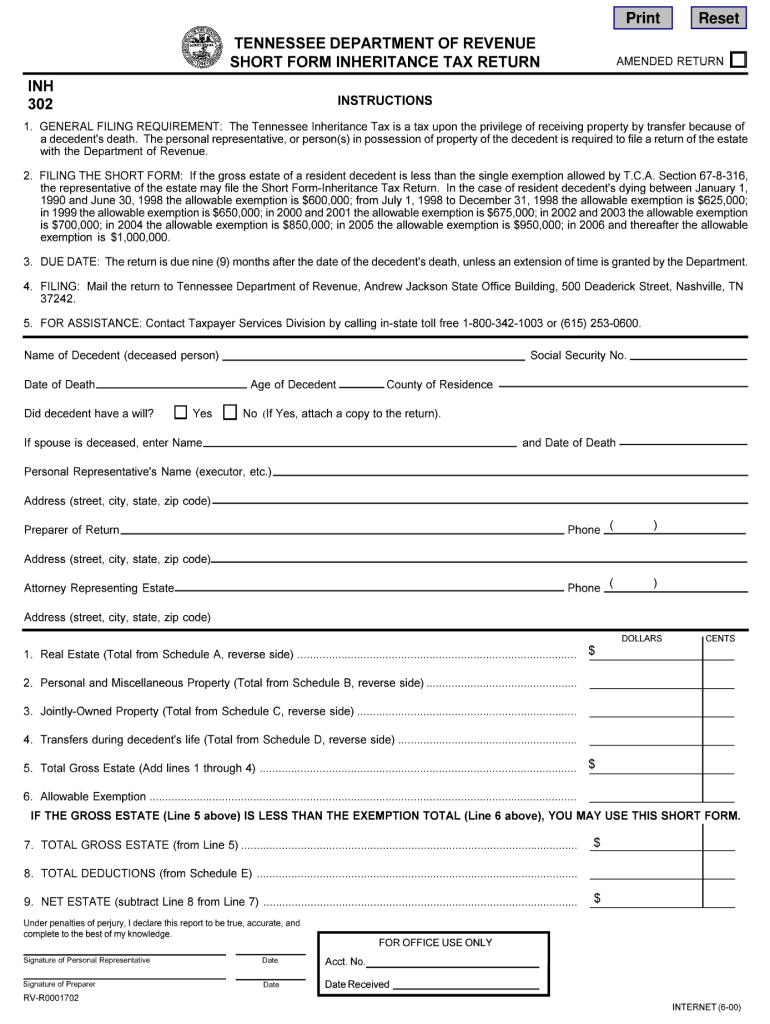

The Tennessee Short Form Inheritance Tax Form is a legal document used to report the inheritance tax due on the transfer of property following an individual's death. This form simplifies the process for smaller estates that fall under specific thresholds, allowing for a more streamlined filing experience. It is essential for heirs and executors to understand the requirements and implications of this form to ensure compliance with state tax laws.

How to use the Tennessee Short Form Inheritance Tax Form

To effectively use the Tennessee Short Form Inheritance Tax Form, individuals must first determine their eligibility based on the size of the estate and the relationship to the deceased. Once eligibility is established, the form should be filled out accurately, providing all necessary information regarding the decedent's assets and liabilities. After completing the form, it must be submitted to the appropriate state tax authority, along with any required documentation.

Steps to complete the Tennessee Short Form Inheritance Tax Form

Completing the Tennessee Short Form Inheritance Tax Form involves several key steps:

- Gather all relevant information about the decedent's assets, debts, and beneficiaries.

- Fill out the form with accurate details, ensuring that all sections are completed.

- Calculate the inheritance tax owed based on the provided information.

- Review the form for accuracy and completeness before submission.

- Submit the form to the appropriate tax authority, either online or by mail.

Key elements of the Tennessee Short Form Inheritance Tax Form

The key elements of the Tennessee Short Form Inheritance Tax Form include the decedent's personal information, a detailed list of assets and liabilities, and the calculation of the inheritance tax owed. Additionally, the form requires signatures from the executor or administrator of the estate, affirming the accuracy of the information provided. Understanding these elements is crucial for ensuring proper completion and compliance.

Legal use of the Tennessee Short Form Inheritance Tax Form

The legal use of the Tennessee Short Form Inheritance Tax Form is governed by state law, which outlines the requirements for filing and payment of inheritance tax. This form is legally binding once completed and submitted correctly. It is important for users to be aware of the legal implications of the information provided, as inaccuracies can lead to penalties or delays in the processing of the estate.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Short Form Inheritance Tax Form are critical to avoid penalties. Typically, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is advisable for executors and heirs to keep track of these important dates to ensure timely compliance with state regulations.

Quick guide on how to complete tennessee short form inheritance tax form 2000

Effortlessly Prepare Tennessee Short Form Inheritance Tax Form on Any Device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Tennessee Short Form Inheritance Tax Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Tennessee Short Form Inheritance Tax Form Seamlessly

- Obtain Tennessee Short Form Inheritance Tax Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds exactly the same legal authority as a conventional wet ink signature.

- Review all information carefully and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your preference. Edit and eSign Tennessee Short Form Inheritance Tax Form and maintain excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee short form inheritance tax form 2000

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Tennessee Short Form Inheritance Tax Form?

The Tennessee Short Form Inheritance Tax Form is a simplified document that allows executors or administrators of estates to report the inheritance tax owed on estate assets. This form is designed for smaller estates, streamlining the reporting process and making it easier for families during a difficult time.

-

How do I complete the Tennessee Short Form Inheritance Tax Form?

To complete the Tennessee Short Form Inheritance Tax Form, you will need to gather necessary information about the deceased's assets, liabilities, and beneficiaries. The form requires details on the estate's value and tax owed, which can be efficiently managed using airSlate SignNow, ensuring accuracy and compliance.

-

Is the Tennessee Short Form Inheritance Tax Form eligible for electronic signatures?

Yes, the Tennessee Short Form Inheritance Tax Form can be electronically signed using airSlate SignNow. This feature not only speeds up the process but also provides security and convenience for all parties involved, making it easier to finalize tax obligations.

-

What are the advantages of using airSlate SignNow for the Tennessee Short Form Inheritance Tax Form?

Using airSlate SignNow for the Tennessee Short Form Inheritance Tax Form simplifies the entire process by allowing users to upload, edit, and send documents securely. Additionally, it provides real-time tracking of who has signed and when, ensuring that you stay organized and compliant with state requirements.

-

How much does it cost to use airSlate SignNow for filling out the Tennessee Short Form Inheritance Tax Form?

airSlate SignNow offers affordable pricing plans that cater to individual users and businesses alike. Depending on your needs, you can choose a subscription that allows you to efficiently process the Tennessee Short Form Inheritance Tax Form without any hidden fees, providing great value for your investment.

-

Can I integrate airSlate SignNow with other applications for the Tennessee Short Form Inheritance Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to enhance your workflow when handling the Tennessee Short Form Inheritance Tax Form. You can connect it with CRM systems, cloud storage solutions, and more, creating a comprehensive environment for document management.

-

What if I need help with the Tennessee Short Form Inheritance Tax Form?

If you require assistance with the Tennessee Short Form Inheritance Tax Form, airSlate SignNow provides various resources including tutorials, FAQs, and customer support to guide you through the process. This ensures you have all the necessary support to complete your form accurately and efficiently.

Get more for Tennessee Short Form Inheritance Tax Form

- Employment application osso healthcare network form

- Employer and retirement coordinator verification form opers ok

- Biweekly time sheet for employees office of economic and durhamnc form

- For issuance of employment certificate work permit roe54 k12 il form

- Fill out by hand form

- Certificate of physical fitness illinois department of labor form

- Power of attorney for representing employer under the illinois unemployment insurance act form le 10 and special mailing form

- Ed543933 pdf eric department of education form

Find out other Tennessee Short Form Inheritance Tax Form

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe