Kentucky Non Profit Corporation Form

What is the Kentucky Non Profit Corporation

A Kentucky non profit corporation is an organization formed under Kentucky state law to operate for a charitable, educational, religious, or other public purpose. Unlike for-profit entities, these corporations do not distribute profits to members or shareholders. Instead, any surplus revenue is reinvested into the organization’s mission. To establish a Kentucky non profit corporation, specific legal requirements must be met, including filing articles of incorporation with the Kentucky Secretary of State.

Steps to complete the Kentucky Non Profit Corporation

Completing the formation of a Kentucky non profit corporation involves several key steps:

- Choose a name: The name must be unique and not similar to existing entities in Kentucky.

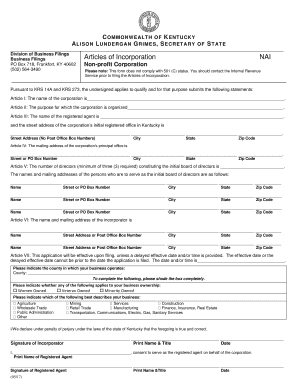

- Draft the articles of incorporation: This document outlines the corporation's purpose, structure, and governance.

- File the articles: Submit the completed articles of incorporation to the Kentucky Secretary of State, along with the required filing fee.

- Create bylaws: Bylaws govern the internal operations of the corporation and should be adopted by the board of directors.

- Obtain an Employer Identification Number (EIN): This is necessary for tax purposes and can be acquired from the IRS.

- Apply for tax-exempt status: If applicable, file for 501(c)(3) status with the IRS to gain federal tax exemption.

Required Documents

To establish a Kentucky non profit corporation, several documents are essential:

- Articles of Incorporation: This primary document must include the corporation's name, purpose, registered agent, and duration.

- Bylaws: These internal rules govern the management of the corporation.

- Employer Identification Number (EIN): This number is necessary for tax filings and opening bank accounts.

- Tax-exempt application (if applicable): Form 1023 or Form 1023-EZ must be filed with the IRS for 501(c)(3) status.

Legal use of the Kentucky Non Profit Corporation

The legal use of a Kentucky non profit corporation is primarily to serve a public or community benefit. This may include activities related to education, health, arts, or social services. Non profit corporations must adhere to both state and federal regulations, including maintaining transparency in financial reporting and governance. Compliance with these regulations is essential to retain tax-exempt status and ensure the organization operates within the law.

Eligibility Criteria

To form a Kentucky non profit corporation, certain eligibility criteria must be met:

- Purpose: The organization must operate for a lawful purpose that benefits the public.

- Members: There must be at least three directors who are not related by blood or marriage.

- Registered agent: The corporation must designate a registered agent with a physical address in Kentucky.

Form Submission Methods (Online / Mail / In-Person)

Filing for a Kentucky non profit corporation can be accomplished through various methods:

- Online: Applications can be submitted electronically via the Kentucky Secretary of State’s website.

- Mail: Completed forms can be printed and sent to the Secretary of State’s office by postal mail.

- In-Person: Documents may also be filed in person at the Secretary of State’s office in Frankfort, Kentucky.

Quick guide on how to complete kentucky non profit corporation

Effortlessly Prepare Kentucky Non Profit Corporation on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Manage Kentucky Non Profit Corporation across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Kentucky Non Profit Corporation with Ease

- Locate Kentucky Non Profit Corporation and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with features specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to apply your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky Non Profit Corporation to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky non profit corporation

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is a Kentucky non profit corporation?

A Kentucky non profit corporation is an organization established under Kentucky law to serve a public or mutual benefit rather than for profit. These corporations can engage in a variety of activities, including charitable, educational, or religious missions, and they can qualify for federal tax exemption under IRS regulations.

-

How can airSlate SignNow help with establishing a Kentucky non profit corporation?

airSlate SignNow provides an efficient platform for eSigning documents necessary for establishing a Kentucky non profit corporation. With its easy-to-use interface, users can quickly prepare, send, and receive signed documents, streamlining the filing process with the state.

-

What are the benefits of forming a Kentucky non profit corporation?

Creating a Kentucky non profit corporation provides limited liability protection for its directors and officers, along with potential tax exemptions. Additionally, it enhances credibility with donors and grants access to funding opportunities specifically available to non profit status.

-

What is the cost of incorporating a Kentucky non profit corporation?

The cost to incorporate a Kentucky non profit corporation can vary based on filing fees and administrative expenses. Using airSlate SignNow can help save money by minimizing paper-related costs and providing a budget-friendly eSignature solution.

-

What documents are required to form a Kentucky non profit corporation?

To form a Kentucky non profit corporation, you typically need to prepare articles of incorporation and bylaws, and possibly additional documentation based on your activities. airSlate SignNow's digital tools ease the process of drafting and sending these documents for eSignature.

-

Are there any specific features in airSlate SignNow that are beneficial for Kentucky non profit corporations?

Yes, airSlate SignNow offers features such as customizable templates, bulk sending, and team collaboration tools that are particularly beneficial for Kentucky non profit corporations. These features aid in efficient document management and streamline the process of obtaining signatures.

-

Can airSlate SignNow integrate with other tools for managing a Kentucky non profit corporation?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Workspace and Microsoft Office, helping to manage documents more effectively for a Kentucky non profit corporation. This integration allows for easier collaboration and document access among teams.

Get more for Kentucky Non Profit Corporation

Find out other Kentucky Non Profit Corporation

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure