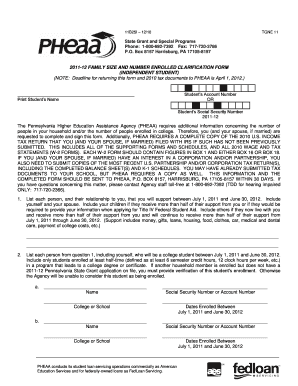

Pheaa Clarification Independent Online Form

IRS Guidelines

When preparing an appeal to the IRS, it is crucial to understand the specific guidelines outlined by the Internal Revenue Service. These guidelines provide a framework for submitting an appeal letter effectively. The IRS expects the letter to include pertinent details such as your name, address, Social Security number, and the tax year in question. Clearly state the reason for your appeal, referencing any relevant IRS notices or determinations. It is also important to include any supporting documentation that substantiates your claim. Following these guidelines will help ensure that your appeal is processed efficiently.

Required Documents

To successfully file an appeal to the IRS, you must gather and submit several key documents. These typically include:

- Your completed appeal letter

- Any IRS notices or letters related to your case

- Supporting evidence, such as tax returns, receipts, or other relevant records

- A copy of your previous correspondence with the IRS regarding the issue

Having all required documents ready will facilitate a smoother review process and strengthen your case.

Steps to Complete the Appeal Process

Completing the appeal process with the IRS involves several steps to ensure that your submission is thorough and accurate. Begin by drafting your appeal letter, ensuring it adheres to IRS guidelines. Next, gather all necessary documents that support your claim. Once your letter and documents are prepared, submit them to the appropriate IRS office. You can send your appeal via certified mail for tracking purposes, or you may choose to submit it electronically if applicable. After submission, monitor the status of your appeal and be prepared to respond to any further inquiries from the IRS.

Form Submission Methods

There are various methods available for submitting your appeal to the IRS. You can choose to send your appeal letter by mail, which is the most traditional method. Ensure that you use certified mail to confirm delivery. Alternatively, some appeals can be submitted electronically through the IRS online portal, depending on the nature of your case. Always check the IRS website for the latest information on submission methods, as they may vary based on the type of appeal and your specific circumstances.

Filing Deadlines / Important Dates

Being aware of filing deadlines is essential when appealing to the IRS. Generally, you must submit your appeal within thirty days of receiving an IRS notice of determination. Missing this deadline may result in the forfeiture of your right to appeal. It is advisable to keep a calendar of important dates related to your appeal, including any deadlines for submitting additional documentation or responding to IRS inquiries.

Taxpayer Scenarios

Different taxpayer scenarios can influence how you approach your appeal to the IRS. For instance, self-employed individuals may need to provide additional documentation related to business expenses, while retired individuals might focus on issues related to pension income. Understanding your specific situation will help tailor your appeal letter to address the unique aspects of your case, ensuring that you present a compelling argument to the IRS.

Quick guide on how to complete pheaa clarification independent online

Effortlessly Prepare Pheaa Clarification Independent Online on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely manage it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage Pheaa Clarification Independent Online on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Modify and Electronically Sign Pheaa Clarification Independent Online with Ease

- Find Pheaa Clarification Independent Online and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with the tools exclusively available from airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which only takes moments and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your alterations.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Pheaa Clarification Independent Online to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pheaa clarification independent online

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is an 'appeal to the IRS sample letter' and why would I need one?

An 'appeal to the IRS sample letter' is a template that helps you draft a formal request to the IRS regarding a tax decision you wish to contest. It’s crucial for taxpayers who believe an IRS ruling is incorrect, allowing them to present their case effectively. Using a well-structured sample letter can increase the chances of a successful appeal.

-

How can I create an 'appeal to the IRS sample letter' using airSlate SignNow?

With airSlate SignNow, you can easily create an 'appeal to the IRS sample letter' by utilizing our customizable document templates. Simply select a template, fill in your specific details, and personalize your letter according to your intended appeal. This streamlines the process, making it quick and efficient.

-

What features does airSlate SignNow offer for document signing and management?

airSlate SignNow offers features like drag-and-drop document creation, eSignature capabilities, and secure cloud storage for all your important files, including an 'appeal to the IRS sample letter.' Our user-friendly interface makes it easy to manage your documents and ensures a seamless experience for both you and the recipients.

-

Is there a cost associated with using airSlate SignNow for creating IRS appeal letters?

Yes, airSlate SignNow offers various pricing plans to fit different needs, which include creating documents like an 'appeal to the IRS sample letter.' The subscription plans are cost-effective and provide access to all essential features, ensuring you can manage documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integration with numerous applications like Google Drive, Dropbox, and more. This allows you to easily access your 'appeal to the IRS sample letter' and other documents across multiple platforms, enhancing your overall productivity.

-

What benefits does using an eSignature solution provide when sending an appeal to the IRS?

Using an eSignature solution like airSlate SignNow when sending an 'appeal to the IRS sample letter' adds a layer of security and validity to your correspondence. It ensures that your documents are signed, dated, and can’t be altered, giving you peace of mind. Additionally, it speeds up the signing process, which can be crucial when timing is essential.

-

How can I ensure my 'appeal to the IRS sample letter' meets all legal requirements?

To ensure your 'appeal to the IRS sample letter' meets legal requirements, utilize airSlate SignNow's compliant templates. These templates are designed with legal standards in mind, helping you include all necessary information and formatting. Additionally, consulting with a tax professional can further ensure accuracy and compliance.

Get more for Pheaa Clarification Independent Online

Find out other Pheaa Clarification Independent Online

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later