Printable Car Finance Application Form

What is the Printable Car Finance Application

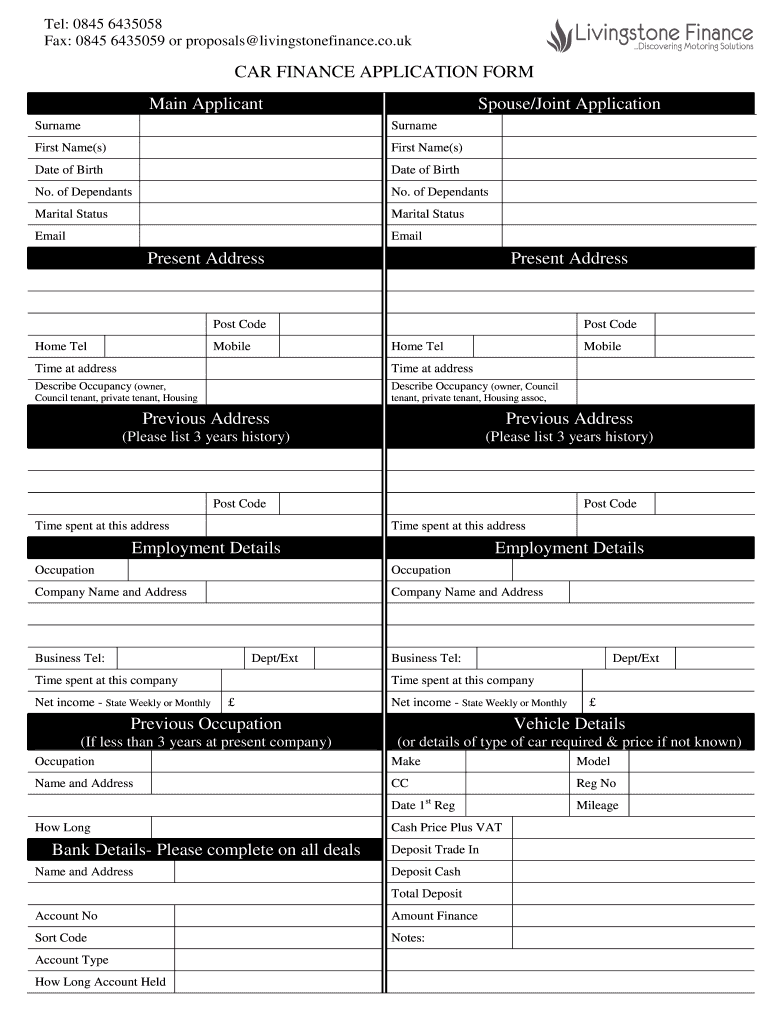

The printable car finance application is a document used by individuals seeking to finance a vehicle purchase. This form collects essential information about the applicant's financial status, employment history, and personal details. It serves as a formal request to lenders, enabling them to assess the applicant's creditworthiness and determine the terms of financing. The application typically includes sections for income verification, existing debts, and desired loan amounts, ensuring a comprehensive overview of the applicant's financial situation.

Steps to Complete the Printable Car Finance Application

Completing the printable car finance application involves several key steps to ensure accuracy and completeness:

- Gather Personal Information: Collect your full name, address, phone number, and Social Security number.

- Provide Employment Details: Include your current employer's name, address, and your job title, along with your length of employment.

- Disclose Financial Information: Report your monthly income, any other sources of income, and your total monthly expenses.

- List Existing Debts: Detail any outstanding loans or credit obligations to give lenders a clear picture of your financial commitments.

- Specify Loan Details: Indicate the amount you wish to borrow and the type of vehicle you intend to purchase.

- Review and Sign: Carefully check all provided information for accuracy before signing the application.

Legal Use of the Printable Car Finance Application

The printable car finance application is legally binding once completed and signed. To ensure its validity, it must comply with relevant laws governing electronic signatures and documentation. In the United States, adherence to the ESIGN Act and UETA is essential for the application to be recognized as legally enforceable. These laws establish that electronic signatures carry the same weight as traditional handwritten signatures, provided they meet specific criteria, such as intent and consent from all parties involved.

Key Elements of the Printable Car Finance Application

Understanding the key elements of the printable car finance application can enhance the likelihood of approval. Important components include:

- Personal Identification: Accurate personal information is crucial for identity verification.

- Income Verification: Lenders require proof of income to assess repayment ability.

- Credit History: Some applications may request permission to access your credit report, which influences loan terms.

- Loan Amount and Terms: Clearly stating the desired loan amount and repayment period helps lenders provide tailored options.

How to Obtain the Printable Car Finance Application

The printable car finance application can be obtained through various channels. Many financial institutions, including banks and credit unions, offer downloadable versions on their websites. Additionally, dealerships often provide their own finance application forms. It is important to ensure that the version you use is up-to-date and compliant with current lending practices. Some platforms may also allow users to fill out the application electronically, streamlining the process.

Form Submission Methods

Submitting the printable car finance application can be done through several methods, depending on the lender's preferences:

- Online Submission: Many lenders accept electronic submissions through their websites or secure portals, allowing for quicker processing.

- Mail: You can print the completed application and send it via postal service to the lender's designated address.

- In-Person Submission: Some applicants prefer to deliver their application directly to a bank or dealership, where they can ask questions and receive immediate feedback.

Quick guide on how to complete printable car finance application

Effortlessly prepare Printable Car Finance Application on any device

The management of online documents has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Printable Car Finance Application on any device with the airSlate SignNow applications for Android or iOS and simplify any paperwork-related process today.

How to modify and electronically sign Printable Car Finance Application seamlessly

- Find Printable Car Finance Application and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Printable Car Finance Application and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable car finance application

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the airSlate SignNow finance application form?

The airSlate SignNow finance application form is a digital document designed to streamline the process of applying for financial services. It allows users to fill out and eSign necessary information quickly and securely, eliminating the need for paper-based forms and enhancing efficiency.

-

How much does the finance application form feature cost?

The cost for using the airSlate SignNow finance application form feature can vary based on the chosen subscription plan. Each plan offers different functionalities, but overall, airSlate SignNow provides a cost-effective solution for businesses looking to streamline their financial documentation processes.

-

What are the key features of the finance application form?

Key features of the airSlate SignNow finance application form include customizable templates, electronic signatures, secure document storage, and audit trails. These features ensure that your financial documents are managed efficiently and securely, meeting both your business needs and compliance requirements.

-

Can I integrate the finance application form with other software?

Yes, the airSlate SignNow finance application form can be integrated with various software applications such as CRM systems, payment processors, and accounting software. This integration capability enables seamless workflows and enhances overall productivity by connecting your financial processes.

-

How does the finance application form benefit my business?

Using the airSlate SignNow finance application form benefits your business by simplifying the documentation process, reducing turnaround times, and minimizing errors. Additionally, it enhances customer experience by providing a quick and convenient method for clients to complete their applications electronically.

-

Is the finance application form secure?

Absolutely! The airSlate SignNow finance application form offers robust security features such as data encryption, secure cloud storage, and compliance with major industry standards. This ensures that your sensitive financial information is protected at all times.

-

How can I track submissions of the finance application form?

You can easily track submissions of the airSlate SignNow finance application form through the dashboard. This feature allows you to monitor the status of applications in real-time, ensuring you stay up-to-date on important documents without any hassle.

Get more for Printable Car Finance Application

- Certification sheet form

- Replevin action delaware form

- Delaware form 200 c 2002

- Delaware claim for revision 1049l 9605 form

- Dc child protection register form

- Online filling dcps form

- Form mo crp certification of rent paid

- K 40 kansas individual income tax return8 5 25 k 40 kansas individual income tax returnrevised 8 5 25 form

Find out other Printable Car Finance Application

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer