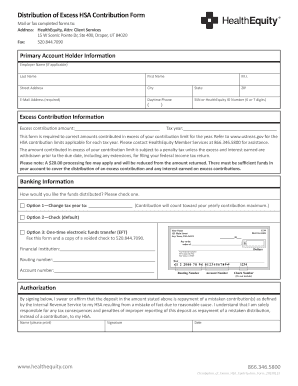

Distribution of Excess HSA Contribution Form HealthEquity

Understanding the HSA Contribution Form Template

The HSA contribution form template is essential for individuals looking to report their contributions to a Health Savings Account (HSA). This form serves as a record of contributions made during the tax year, which can be crucial for tax reporting and compliance. It is important to ensure that all contributions are accurately documented to avoid any potential issues with the IRS. The form typically includes sections for personal information, contribution amounts, and the year of contribution.

Steps to Complete the HSA Contribution Form Template

Completing the HSA contribution form template involves several straightforward steps:

- Gather Required Information: Collect personal identification details, including name, address, and Social Security number.

- Document Contribution Amounts: Clearly state the total contributions made to the HSA for the tax year.

- Specify the Tax Year: Indicate the tax year for which the contributions are being reported.

- Review and Sign: Carefully review all entered information for accuracy before signing the form.

IRS Guidelines for HSA Contributions

According to IRS guidelines, contributions to an HSA must adhere to specific limits based on the taxpayer's coverage type. For 2023, the contribution limits are:

- $3,850 for individuals with self-only coverage.

- $7,750 for individuals with family coverage.

- An additional $1,000 catch-up contribution is allowed for individuals aged fifty-five and older.

It is crucial to stay informed about these limits, as exceeding them may result in tax penalties.

Form Submission Methods

The HSA contribution form can be submitted through various methods, depending on the requirements of the financial institution managing the HSA. Common submission methods include:

- Online Submission: Many institutions allow for digital submission through their secure portals.

- Mail: Printed forms can be sent through standard mail to the designated address of the HSA provider.

- In-Person: Some individuals may prefer to deliver the form directly to their HSA provider's office.

Key Elements of the HSA Contribution Form Template

When filling out the HSA contribution form template, it is important to include key elements to ensure it is complete and compliant:

- Personal Information: Full name, address, and Social Security number.

- Contribution Details: Amount contributed and the type of coverage.

- Tax Year: Clearly indicate the year for which the contributions are being reported.

- Signature: A signature is often required to validate the information provided.

Penalties for Non-Compliance

Failing to accurately report HSA contributions can lead to penalties imposed by the IRS. Some potential consequences include:

- Excess Contribution Penalties: If contributions exceed the allowable limit, a six percent excise tax applies to the excess amount.

- Tax Liabilities: Unreported contributions may result in additional tax liabilities during tax filing.

- Loss of Tax Benefits: Inaccurate reporting can jeopardize the tax advantages associated with HSAs.

Quick guide on how to complete distribution of excess hsa contribution form healthequity

Complete Distribution Of Excess HSA Contribution Form HealthEquity effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Handle Distribution Of Excess HSA Contribution Form HealthEquity on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Distribution Of Excess HSA Contribution Form HealthEquity with ease

- Locate Distribution Of Excess HSA Contribution Form HealthEquity and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Distribution Of Excess HSA Contribution Form HealthEquity and maintain outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the distribution of excess hsa contribution form healthequity

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is an HSA contribution form template?

An HSA contribution form template is a pre-designed document used to document contributions to a Health Savings Account (HSA). It simplifies the process of tracking and reporting contributions for tax purposes. Using a well-structured template ensures compliance and accuracy in financial records.

-

How does airSlate SignNow enhance the use of HSA contribution form templates?

airSlate SignNow provides an efficient platform for businesses to create, customize, and eSign HSA contribution form templates. This streamlines the contribution documentation process, allowing for quick distribution and collection of signatures. Our solution empowers users with secure and easy-to-use tools that facilitate seamless document management.

-

Is there a cost associated with using the HSA contribution form template on airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model with various pricing plans tailored to business needs. Each plan includes access to customizable HSA contribution form templates along with a range of features for document management. Explore our pricing options to find the best fit for your organization.

-

Can I customize the HSA contribution form template?

Absolutely! airSlate SignNow allows you to easily customize the HSA contribution form template to meet your specific needs. You can add your branding, modify fields, and adjust text to fit your requirements. This customization ensures the template aligns perfectly with your business practices.

-

What are the benefits of using an HSA contribution form template?

Using an HSA contribution form template streamlines the data collection process and minimizes errors associated with manual entry. It ensures consistent documentation and helps maintain compliance with IRS requirements. Additionally, airSlate SignNow enhances these benefits with secure eSignature capabilities, making the process faster and more efficient.

-

Does airSlate SignNow integrate with other software for HSA management?

Yes, airSlate SignNow offers integrations with a variety of accounting and HR software, enhancing the management of HSA contributions. These integrations facilitate effective data transfers and ensure all information is up-to-date. Check our integrations page to see how easily you can connect your existing tools with our HSA contribution form template.

-

How can I ensure the security of my HSA contribution form template?

airSlate SignNow prioritizes security, utilizing advanced encryption and secure cloud storage to protect your HSA contribution form template. Additionally, all documents are stored in compliance with industry standards, ensuring your sensitive information remains confidential. You can eSign and manage your documents with peace of mind.

Get more for Distribution Of Excess HSA Contribution Form HealthEquity

Find out other Distribution Of Excess HSA Contribution Form HealthEquity

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile