PTC001 Property Tax Consultant Registration Application Form

What is the PTC001 Property Tax Consultant Registration Application

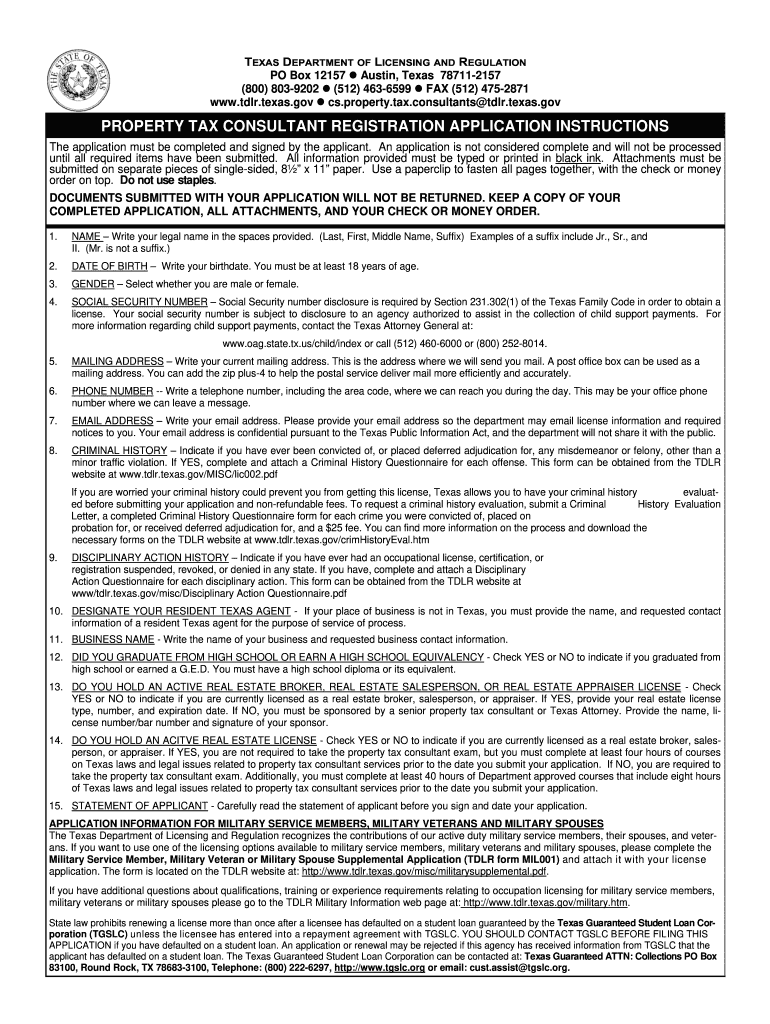

The PTC001 Property Tax Consultant Registration Application is a formal document required for individuals or businesses seeking to operate as property tax consultants in the United States. This application serves as a means to register with the appropriate state authorities, ensuring compliance with local regulations governing property tax consulting services. By completing this application, consultants can demonstrate their qualifications and intent to provide professional services in property tax assessment and appeals.

Steps to complete the PTC001 Property Tax Consultant Registration Application

Completing the PTC001 Property Tax Consultant Registration Application involves several key steps:

- Gather Required Information: Collect all necessary personal and business information, including identification details, business address, and any relevant certifications.

- Fill Out the Application: Carefully complete the application form, ensuring all sections are filled out accurately to avoid delays.

- Review for Accuracy: Double-check all information for correctness and completeness before submission.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person, and ensure you meet any deadlines.

Legal use of the PTC001 Property Tax Consultant Registration Application

The legal use of the PTC001 Property Tax Consultant Registration Application is crucial for establishing legitimacy in the property tax consulting field. This form must be filled out in accordance with state laws and regulations. By submitting this application, consultants affirm their commitment to ethical practices and compliance with applicable laws. Failure to properly register can lead to penalties or restrictions on providing consulting services.

Eligibility Criteria

To qualify for the PTC001 Property Tax Consultant Registration Application, applicants must meet specific eligibility criteria set by state authorities. Generally, these criteria may include:

- Minimum age requirement, typically eighteen years.

- Relevant educational background or experience in property tax consulting.

- No prior felony convictions related to fraud or dishonesty.

- Completion of any required training or certification programs.

Required Documents

When applying for the PTC001 Property Tax Consultant Registration Application, several documents are typically required to support the application. These may include:

- A valid government-issued identification, such as a driver's license or passport.

- Proof of residency or business location.

- Certificates of completion for any relevant training programs.

- Background check documentation, if applicable.

Form Submission Methods

The PTC001 Property Tax Consultant Registration Application can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states offer an online portal for electronic submission, which can expedite the process.

- Mail: Applicants can print the completed form and send it via postal service to the appropriate state office.

- In-Person: For those who prefer direct interaction, submitting the application in person at the local regulatory office is often an option.

Quick guide on how to complete ptc001 property tax consultant registration application

Conveniently Prepare PTC001 Property Tax Consultant Registration Application on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any hold-ups. Handle PTC001 Property Tax Consultant Registration Application on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and eSign PTC001 Property Tax Consultant Registration Application Effortlessly

- Find PTC001 Property Tax Consultant Registration Application and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign PTC001 Property Tax Consultant Registration Application and ensure exceptional communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptc001 property tax consultant registration application

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the PTC001 Property Tax Consultant Registration Application?

The PTC001 Property Tax Consultant Registration Application is a streamlined process designed to help property tax consultants register efficiently. It offers a user-friendly interface and ensures compliance with local regulations to facilitate a smooth registration experience.

-

How much does the PTC001 Property Tax Consultant Registration Application cost?

The cost of the PTC001 Property Tax Consultant Registration Application is tailored to meet varying business needs. Pricing plans are designed to be cost-effective, ensuring that businesses can benefit from its features without breaking the bank.

-

What features does the PTC001 Property Tax Consultant Registration Application offer?

The PTC001 Property Tax Consultant Registration Application includes features such as document tracking, easy eSigning, and compliance management. These features are designed to simplify the registration process while ensuring that all important documents are managed securely.

-

How does the PTC001 Property Tax Consultant Registration Application benefit my business?

By utilizing the PTC001 Property Tax Consultant Registration Application, businesses can save time and reduce paperwork. This application streamlines the registration process, allowing consultants to focus more on their clients and less on administrative tasks.

-

Can I integrate the PTC001 Property Tax Consultant Registration Application with other tools?

Yes, the PTC001 Property Tax Consultant Registration Application is designed for seamless integration with various business tools. This allows you to connect your workflow with existing software solutions, enhancing productivity and efficiency.

-

Is the PTC001 Property Tax Consultant Registration Application suitable for large organizations?

Absolutely! The PTC001 Property Tax Consultant Registration Application is scalable and can accommodate the needs of both small businesses and large organizations. Its robust features support a wide range of users and registration processes.

-

How do I get support for the PTC001 Property Tax Consultant Registration Application?

Support for the PTC001 Property Tax Consultant Registration Application is readily available through various channels. Users can access online resources, customer service representatives, and FAQs to find assistance whenever needed.

Get more for PTC001 Property Tax Consultant Registration Application

Find out other PTC001 Property Tax Consultant Registration Application

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself