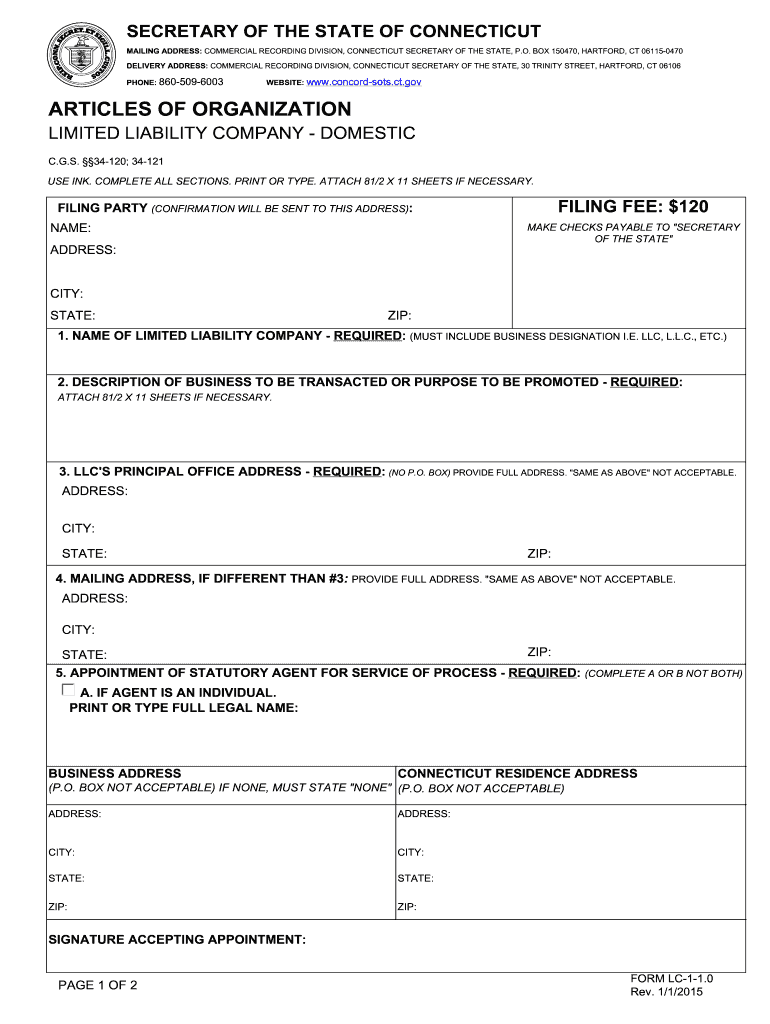

Connecticut Limited Liability Form

What is the Connecticut Limited Liability

The Connecticut Limited Liability Company (LLC) is a popular business structure that combines the flexibility of a partnership with the limited liability protection of a corporation. This means that the owners, known as members, are generally not personally liable for the debts and obligations of the company. In Connecticut, forming an LLC requires compliance with specific state laws and regulations, ensuring that the entity is recognized as a separate legal entity.

Steps to complete the Connecticut Limited Liability

Completing the formation of a Connecticut Limited Liability Company involves several key steps:

- Choose a name: The name must be unique and include "Limited Liability Company" or an abbreviation like "LLC."

- Designate a registered agent: This person or business must have a physical address in Connecticut and be available during business hours.

- File the Certificate of Organization: Submit this document to the Connecticut Secretary of State, either online or by mail, along with the required filing fee.

- Create an Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on the business type, additional local, state, or federal licenses may be required.

Required Documents

To form a Connecticut Limited Liability Company, several documents are necessary:

- Certificate of Organization: This official document is filed with the Secretary of State.

- Operating Agreement: While not required, it is highly recommended to clarify the roles and responsibilities of members.

- Employer Identification Number (EIN): This number is needed for tax purposes and can be obtained from the IRS.

Legal use of the Connecticut Limited Liability

The Connecticut Limited Liability Company is legally recognized as a separate entity, which provides several advantages. Members are protected from personal liability for business debts, meaning personal assets are generally safe from creditors. Additionally, LLCs can choose how they want to be taxed, either as a sole proprietorship, partnership, or corporation, allowing for greater financial flexibility.

State-specific rules for the Connecticut Limited Liability

Connecticut has specific regulations governing the formation and operation of Limited Liability Companies. These include:

- All LLCs must have at least one member.

- The name must be distinguishable from existing entities registered in the state.

- Annual reports must be filed with the Secretary of State, along with a fee.

Penalties for Non-Compliance

Failure to comply with Connecticut's regulations regarding Limited Liability Companies can result in various penalties. These may include:

- Fines for late filing of annual reports.

- Loss of good standing status, which can affect the ability to conduct business.

- Potential personal liability for members if the LLC is not properly maintained.

Quick guide on how to complete connecticut limited liability

Effortlessly Prepare Connecticut Limited Liability on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Connecticut Limited Liability on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Connecticut Limited Liability with ease

- Obtain Connecticut Limited Liability and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign function, which takes mere moments and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Connecticut Limited Liability while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut limited liability

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it benefit a ct organization company?

airSlate SignNow is an electronic signature and document management solution that helps ct organization companies streamline their workflows. By allowing users to send and eSign documents easily, it enhances productivity and reduces turnaround times. This cost-effective solution is designed to support various business processes, making document management seamless for organizations.

-

How does pricing work for a ct organization company using airSlate SignNow?

Pricing for airSlate SignNow is structured to accommodate the needs of ct organization companies at various levels. We offer flexible plans that scale according to the size and demands of your organization. Each plan provides access to essential features while ensuring that you only pay for what you need.

-

What key features are available for ct organization companies using airSlate SignNow?

airSlate SignNow offers a wide range of features tailored to ct organization companies, including eSignature capabilities, document templates, and robust reporting tools. Additionally, it supports real-time collaboration, which is crucial for teams working on critical documents. These features empower your organization to manage documents efficiently.

-

Is airSlate SignNow compliant with legal standards for a ct organization company?

Yes, airSlate SignNow is compliant with major laws and regulations, including ESIGN and UETA, making it a reliable choice for ct organization companies. The platform ensures that all electronic signatures are legally binding and secure, providing peace of mind for your organization. This compliance supports your business in meeting industry standards.

-

Can a ct organization company integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications commonly used by ct organization companies. These include platforms like Salesforce, Google Workspace, and Microsoft Office 365, among others. This integration helps unify your workflows, enhancing overall efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for document management in a ct organization company?

Using airSlate SignNow for document management provides ct organization companies with signNow benefits such as increased efficiency, reduced paper usage, and improved document security. The platform enables faster contract approvals and minimizes administrative overhead. As a result, your organization can focus more on core activities rather than manual document handling.

-

How can airSlate SignNow improve the client experience for a ct organization company?

airSlate SignNow enhances the client experience for ct organization companies by simplifying the document signing process. Clients can review and sign documents from anywhere, using any device, which signNowly speeds up transaction times. This convenience leads to higher customer satisfaction and fosters positive business relationships.

Get more for Connecticut Limited Liability

Find out other Connecticut Limited Liability

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document