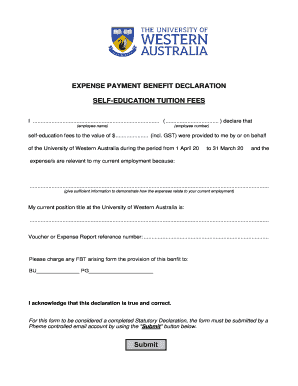

SELF EDUCATION TUITION FEES Form

What is the declaration self education form?

The declaration self education form is a document that allows individuals to claim deductions for educational expenses related to self-education. This form is particularly relevant for those pursuing courses or training that enhance their skills or knowledge in their current job or profession. By completing this form, individuals can provide evidence of their educational investments, which may result in tax benefits. It is essential to understand the criteria for eligibility and the types of expenses that can be claimed to maximize potential deductions.

Steps to complete the declaration self education form

Completing the declaration self education form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all relevant documentation, including receipts for tuition, books, and other educational materials. Next, fill out the form by providing personal information, the details of the educational program, and a breakdown of expenses incurred. It is crucial to review the completed form for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the requirements set by the IRS.

Legal use of the declaration self education form

The legal use of the declaration self education form hinges on compliance with IRS regulations. To be considered valid, the form must accurately reflect educational expenses that meet the criteria outlined by the IRS. This includes ensuring that the education is necessary for maintaining or improving skills in a current job. Additionally, the form must be signed and dated to validate the claim. Understanding the legal implications of the form helps individuals avoid potential penalties or audits related to improper claims.

Eligibility Criteria

To qualify for deductions using the declaration self education form, individuals must meet specific eligibility criteria. First, the education must be related to their current job or profession. Second, the expenses claimed must be necessary and directly related to the educational program. Additionally, individuals must not be claiming the same expenses for any other tax benefits. It is important to review these criteria carefully to ensure that all claimed expenses are legitimate and compliant with IRS regulations.

Required Documents

When preparing to submit the declaration self education form, individuals must gather several required documents. This includes receipts for tuition, books, and other educational materials. Additionally, proof of enrollment in the educational program, such as an acceptance letter or course registration, may be necessary. Keeping detailed records of all expenses and correspondence related to the educational endeavor is crucial for substantiating claims and ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the declaration self education form align with the general tax filing deadlines set by the IRS. Typically, individuals must submit their forms by April fifteenth of the following tax year. However, if additional time is needed, individuals can file for an extension, which generally allows for an extra six months. It is essential to stay informed about these deadlines to avoid late penalties and ensure that all claims are submitted on time.

Quick guide on how to complete self education tuition fees

Prepare SELF EDUCATION TUITION FEES effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle SELF EDUCATION TUITION FEES on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to adjust and eSign SELF EDUCATION TUITION FEES with ease

- Find SELF EDUCATION TUITION FEES and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign SELF EDUCATION TUITION FEES and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self education tuition fees

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is a declaration self education form?

A declaration self education form is a document used to affirm an individual's commitment to self-directed education. This form is commonly utilized by learners who pursue independent study options and need to declare their educational path. By filling out this form, you can easily communicate your learning objectives and plans.

-

How can airSlate SignNow help with the declaration self education form?

airSlate SignNow provides a seamless platform for you to create, send, and eSign your declaration self education form. Our user-friendly features ensure that you can easily manage your documents without any hassle. This makes it straightforward to handle all necessary signatures and approvals quickly.

-

Is there a cost associated with using airSlate SignNow for the declaration self education form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs when handling the declaration self education form. We provide flexible subscription options, enabling you to choose a plan that fits your budget. Additionally, you'll enjoy cost-effective solutions without compromising features or usability.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you benefit from features such as customizable templates, electronic signatures, and document tracking when dealing with your declaration self education form. Our platform also allows you to collaborate with others easily and securely manage your documents. These features streamline the entire process from creation to completion.

-

Can I integrate airSlate SignNow with other apps for managing the declaration self education form?

Absolutely! airSlate SignNow integrates with various applications to enhance your workflow for the declaration self education form. You can connect with tools like Google Drive, Dropbox, and more, allowing for seamless file sharing and management. This ensures your documents are always accessible and organized.

-

What are the benefits of using airSlate SignNow for the declaration self education form?

Utilizing airSlate SignNow for your declaration self education form provides numerous benefits. You'll experience increased efficiency, as the platform simplifies the signing process, reducing turnaround times. Additionally, our solution is cost-effective, making it ideal for individuals and businesses alike.

-

Is airSlate SignNow secure for handling the declaration self education form?

Yes, security is a top priority at airSlate SignNow. Our platform employs robust encryption and compliance measures to ensure your declaration self education form and other documents are protected. You can confidently manage sensitive information knowing it is safe from unauthorized access.

Get more for SELF EDUCATION TUITION FEES

- Low income rental application knik tribal council form

- Dataformfillcom

- Cpt recertification application nasm form

- Cigna eap claims form

- Pre qualification questionnaire intake form builders of hope cdc

- Ex parte application and declaration san francisco superior court sfsuperiorcourt form

- Commercial loan application self help credit union self help form

- Ride along application waiver and disclaimer i have cdcr ca form

Find out other SELF EDUCATION TUITION FEES

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template