T2209 Form

What is the T2209

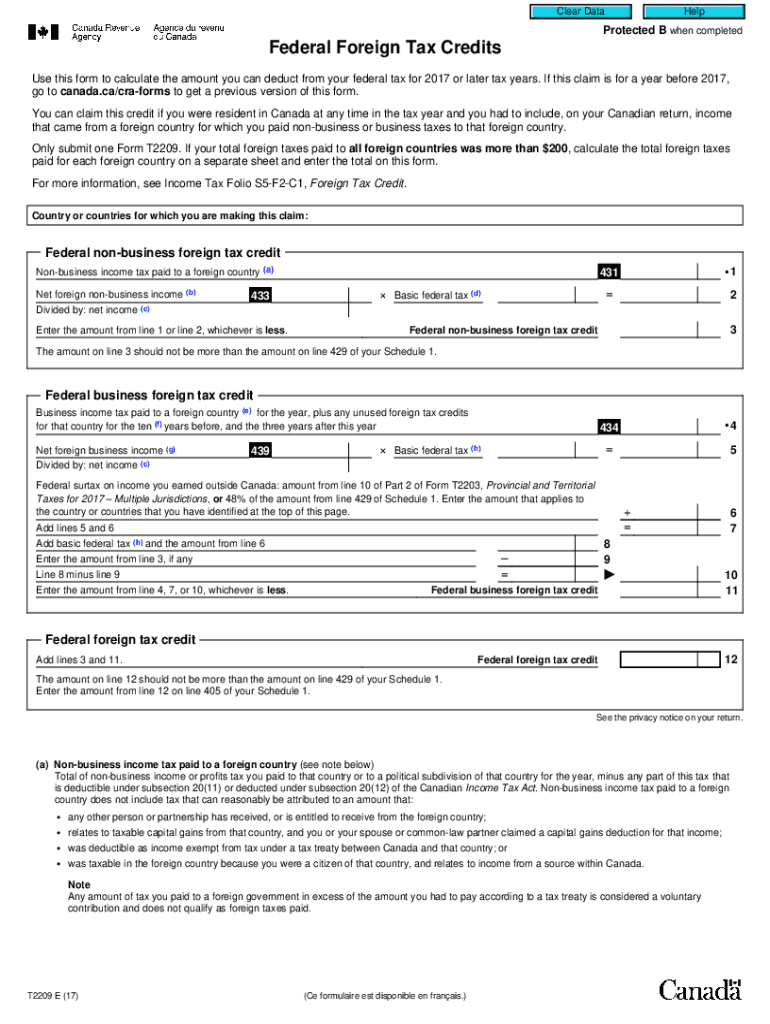

The T2209 is a Canadian income tax form used to claim foreign tax credits. Specifically, it allows taxpayers to report foreign taxes paid on income earned outside Canada, which can help reduce their overall tax liability. This form is crucial for individuals who have investments or income sources in other countries, ensuring they receive credit for taxes already paid abroad. The T2209 is particularly relevant for Canadian residents who have foreign income, as it helps prevent double taxation on the same income.

How to use the T2209

To effectively use the T2209, taxpayers must first gather all relevant documentation regarding foreign income and taxes paid. This includes tax statements from foreign governments and any other supporting documents. Once all necessary information is compiled, the taxpayer can fill out the T2209 form, detailing the foreign income and corresponding taxes paid. It is essential to accurately report this information to ensure compliance and maximize potential tax credits. After completing the form, it should be submitted along with the annual tax return to the Canada Revenue Agency (CRA).

Steps to complete the T2209

Completing the T2209 involves several key steps:

- Gather all necessary documents related to foreign income and taxes paid.

- Obtain the T2209 form from the CRA website or through tax preparation software.

- Fill out the form by entering details about foreign income and taxes paid.

- Ensure all information is accurate and complete to avoid delays or issues.

- Submit the completed T2209 along with your annual tax return to the CRA.

Legal use of the T2209

The T2209 must be used in accordance with Canadian tax laws and regulations. It is legally binding when filled out correctly and submitted as part of the taxpayer's annual return. The form must accurately reflect the foreign taxes paid to qualify for credits. Failure to comply with the legal requirements can result in penalties or audits by the CRA. Therefore, it is crucial to ensure that all information reported on the T2209 is truthful and substantiated by appropriate documentation.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the T2209. Typically, the deadline for filing personal income tax returns in Canada is April 30 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to submit the T2209 along with the tax return by this deadline to ensure that any foreign tax credits are applied in a timely manner. Late submissions can lead to penalties and interest on unpaid taxes.

Required Documents

When completing the T2209, certain documents are required to substantiate claims for foreign tax credits. These documents may include:

- Foreign tax statements indicating the amount of taxes paid.

- Proof of income earned from foreign sources.

- Any additional documentation that supports the claim for foreign tax credits.

Having these documents readily available will facilitate the accurate completion of the T2209 and help ensure compliance with tax regulations.

Quick guide on how to complete 2017 t2209

Effortlessly Prepare T2209 on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without any delays. Manage T2209 across any platform with airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to Modify and eSign T2209 with Ease

- Find T2209 and select Get Form to begin.

- Use the available tools to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign T2209 and maintain excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 t2209

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is the 2017 t2209 and how is it used?

The 2017 t2209 is a tax form used by Canadian taxpayers to calculate their foreign tax credits. Understanding how this form works is crucial for filing your taxes accurately and maximizing your credits. By utilizing tools like airSlate SignNow, you can efficiently manage your tax documents, including the 2017 t2209, ensuring you have everything you need for submission.

-

How can airSlate SignNow assist with the 2017 t2209 form?

airSlate SignNow simplifies the eSigning process for documents like the 2017 t2209. You can easily upload, edit, and send the form for signatures, reducing the time spent on paperwork. This ensures that you have a streamlined method to handle all your tax-related documents securely.

-

Is airSlate SignNow affordable for businesses needing the 2017 t2209?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes. By opting for our pricing plans, you can access features that support your document needs, including those for the 2017 t2209. This way, you ensure your business stays compliant without breaking the bank.

-

What features does airSlate SignNow provide for managing the 2017 t2209?

airSlate SignNow provides a variety of features designed to assist with document management, including customizable templates and automated reminders. These features are especially helpful when dealing with tax forms like the 2017 t2209, as they keep you organized and prompt you to complete necessary steps timely.

-

Can I track the status of my 2017 t2209 submissions via airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their document submissions, including the 2017 t2209. This tracking feature ensures that you are always aware of where your documents stand in the signing process. It brings peace of mind knowing that you won't miss any important deadlines.

-

Does airSlate SignNow integrate with other tools for managing the 2017 t2209?

AirSlate SignNow offers seamless integrations with various tools that businesses commonly use. This includes accounting software where you can manage your finances, ensuring your 2017 t2209 is accounted for correctly amidst other financial documents. The integration capabilities make it easy to enhance overall business efficiency.

-

What benefits does eSigning provide for the 2017 t2209?

ESigning through airSlate SignNow for the 2017 t2209 offers numerous benefits, including increased speed and convenience. You can send, sign, and store important tax documents from any device without needing to print or scan. This not only saves time but also reduces the environmental impact of paper usage.

Get more for T2209

- Shoreline exemption application requirements whatcomcounty form

- Apv250 form

- Form nastf

- Girl scout parent permission form

- Gsnorcal troop driver form

- Washington federal residential loan application form

- Community service log sheet for court form

- Ohio residential lease agreement form american standard online

Find out other T2209

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed