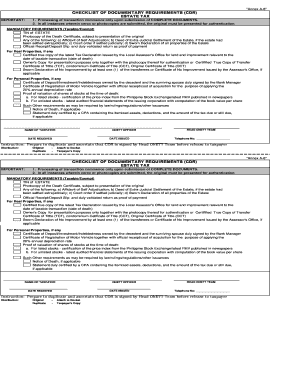

Estate Tax Return Checklist of Documentary Requirements Annex B3 Form

What is the estate tax return checklist of documentary requirements annex B3

The estate tax return checklist of documentary requirements annex B3 is a vital tool for individuals and businesses navigating the complexities of estate tax filings in the Philippines. This checklist outlines the specific documents and information necessary to ensure compliance with tax regulations. It serves as a comprehensive guide, detailing each requirement to facilitate the accurate completion of the estate tax return process. Understanding these requirements is essential for avoiding delays and ensuring that all necessary documentation is submitted correctly.

Key elements of the estate tax return checklist of documentary requirements annex B3

Key elements of the estate tax return checklist include various documents that must be gathered and submitted. These typically encompass:

- Death certificate of the deceased

- Will or testament, if applicable

- List of assets and liabilities

- Valuation of estate assets

- Proof of payment for any estate tax due

Each of these elements plays a crucial role in the assessment of the estate's value and the calculation of the corresponding tax obligations. Proper documentation ensures that the estate is handled in accordance with legal requirements.

Steps to complete the estate tax return checklist of documentary requirements annex B3

Completing the estate tax return checklist involves several systematic steps:

- Gather all required documents as outlined in the checklist.

- Verify the accuracy of the information provided, ensuring that all assets and liabilities are accounted for.

- Complete the estate tax return form, using the gathered information.

- Submit the completed form along with the necessary documentation to the appropriate tax authority.

- Retain copies of all submitted documents for your records.

Following these steps helps ensure a smooth filing process and compliance with estate tax regulations.

Legal use of the estate tax return checklist of documentary requirements annex B3

The legal use of the estate tax return checklist is grounded in its role as a compliance tool. It is essential for ensuring that all necessary documents are submitted in accordance with the law. The checklist serves as evidence that the estate has been properly managed and that all tax obligations have been met. Utilizing this checklist can help avoid legal complications and penalties associated with incomplete or inaccurate filings.

Required documents for the estate tax return checklist of documentary requirements annex B3

To successfully complete the estate tax return, specific documents are required. These include:

- Death certificate

- Will or testament

- Asset inventory

- Liability statements

- Tax clearance certificates, if applicable

Each document must be carefully prepared and submitted to ensure compliance with the estate tax requirements. Missing or inaccurate documents can lead to delays in processing and potential penalties.

Form submission methods for the estate tax return checklist of documentary requirements annex B3

Submitting the estate tax return can be done through various methods, including:

- Online submission via the official tax authority website

- Mailing the completed form and documents to the designated tax office

- In-person submission at local tax offices

Choosing the appropriate submission method can streamline the filing process and ensure timely compliance with estate tax obligations.

Quick guide on how to complete estate tax return checklist of documentary requirements annex b3

Complete Estate Tax Return Checklist Of Documentary Requirements Annex B3 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Estate Tax Return Checklist Of Documentary Requirements Annex B3 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Estate Tax Return Checklist Of Documentary Requirements Annex B3 with ease

- Locate Estate Tax Return Checklist Of Documentary Requirements Annex B3 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Estate Tax Return Checklist Of Documentary Requirements Annex B3 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estate tax return checklist of documentary requirements annex b3

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the philippines checklist tax?

The philippines checklist tax is a comprehensive guide that outlines the important tax requirements and deadlines businesses must adhere to in the Philippines. Using this checklist can ensure you meet all regulatory demands and avoid penalties. It's crucial for efficient tax planning and compliance.

-

How can airSlate SignNow help with the philippines checklist tax?

airSlate SignNow streamlines the document signing process, ensuring that all paperwork related to the philippines checklist tax is handled efficiently. With easy-to-use templates and automated workflows, businesses can simplify their document management during tax season. This minimizes the risk of errors and enhances compliance.

-

Is airSlate SignNow cost-effective for managing the philippines checklist tax?

Yes, airSlate SignNow offers a cost-effective solution for managing documents related to the philippines checklist tax. Our pricing plans are designed to suit businesses of all sizes, ensuring you can access essential features without breaking the bank. You'll save both time and resources, making it a wise investment for your tax management.

-

What features does airSlate SignNow provide for the philippines checklist tax?

airSlate SignNow includes features like document templates, eSignature capabilities, and real-time tracking which are ideal for handling the philippines checklist tax. These features enhance efficiency and accuracy, allowing teams to focus on other vital aspects of their business. Additionally, you can access your documents from anywhere at any time.

-

Can I integrate airSlate SignNow with other tools for the philippines checklist tax?

Absolutely! airSlate SignNow offers seamless integrations with popular tools such as CRM systems, project management platforms, and accounting software. This means you can keep your workflows organized while ensuring all documentation related to the philippines checklist tax is up-to-date and accessible. The integration capabilities extend your productivity even further.

-

What benefits does using airSlate SignNow provide for tax compliance in the Philippines?

Using airSlate SignNow enhances tax compliance in the Philippines by reducing the risk of errors in document preparation and submission associated with the philippines checklist tax. The electronic signing process speeds up approvals, ensuring that all necessary paperwork is filed on time. This leads to peace of mind, knowing your tax processes are handled accurately and efficiently.

-

Is there customer support for questions related to the philippines checklist tax?

Yes, airSlate SignNow provides robust customer support to assist users with any queries related to the philippines checklist tax. Our knowledgeable team is available to help you navigate any challenges you may encounter. This support is vital in ensuring that your tax compliance processes are smooth and effective.

Get more for Estate Tax Return Checklist Of Documentary Requirements Annex B3

- Notice of petition holdover proceeding nycourts form

- Gift letter mcap form

- Sewer capacity certification letter application miami dade portal miamidade form

- Change of address form sdcera

- Nc dental screening and varnish encounter form

- Renewal new multi tenant registration application city of dallas dallascityhall form

- 311t contracts city of dallas form

- To view the application for alarm registration windsor police service form

Find out other Estate Tax Return Checklist Of Documentary Requirements Annex B3

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile