Official Voluntary Online Form

What is the Official Voluntary Online

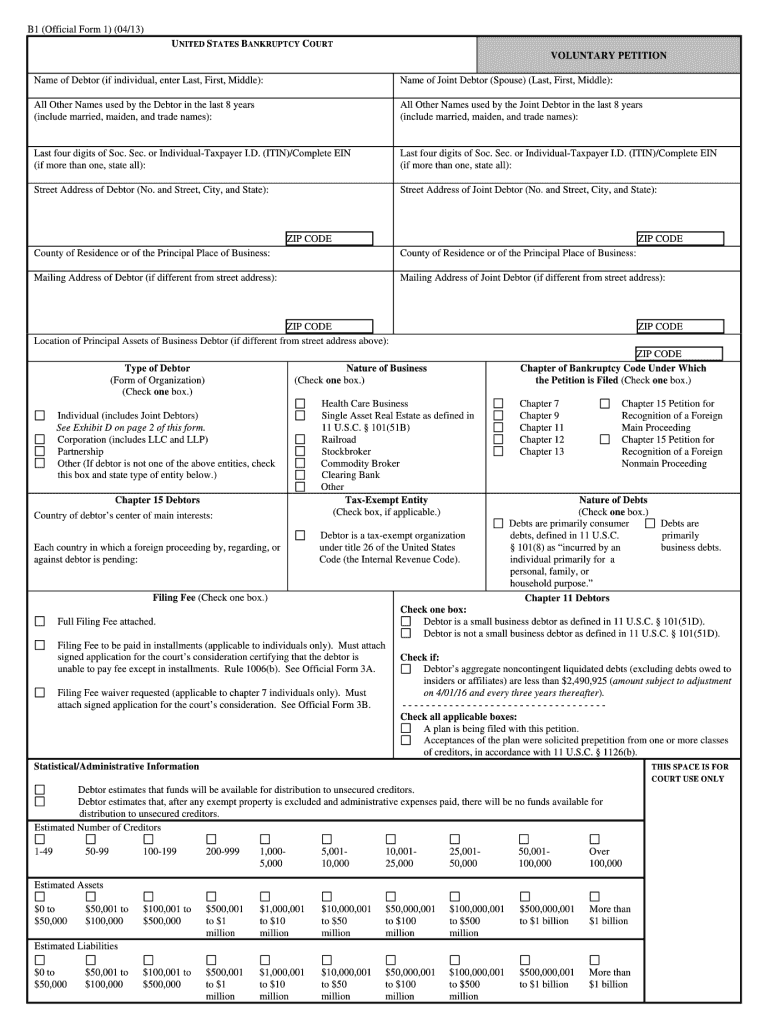

The Official Voluntary Online is a digital form used for filing taxes in the United States. This form allows individuals or businesses to declare their intention to file for bankruptcy voluntarily, providing a structured approach to managing their financial obligations. The form is recognized by the IRS and is essential for those seeking to navigate the complexities of bankruptcy law. By utilizing this online version, users can ensure that their submissions are processed efficiently and securely.

How to use the Official Voluntary Online

Using the Official Voluntary Online involves several straightforward steps. First, ensure you have all necessary information at hand, including personal identification details and financial records. Next, access the form through a secure platform that supports electronic signatures. Fill out the required fields, ensuring accuracy to avoid delays. After completing the form, review it carefully before submitting. The online submission process typically allows for immediate confirmation of receipt, which is crucial for tracking your filing status.

Steps to complete the Official Voluntary Online

Completing the Official Voluntary Online requires careful attention to detail. Follow these steps:

- Gather all required documents, including income statements and debt records.

- Access the form on a secure platform.

- Fill in your personal information, ensuring all details are accurate.

- Provide a comprehensive list of assets and liabilities.

- Review your entries for any errors or omissions.

- Submit the form electronically and save a copy for your records.

Legal use of the Official Voluntary Online

The legal use of the Official Voluntary Online is governed by federal laws and regulations pertaining to bankruptcy. It is crucial to ensure that the form is filled out in compliance with the guidelines set forth by the IRS and the United States Bankruptcy Court. An electronically signed document is considered legally binding when it meets specific criteria, such as proper authentication and adherence to eSignature laws. Utilizing a reliable platform for submission can help ensure compliance and protect your rights during the bankruptcy process.

Required Documents

When preparing to file the Official Voluntary Online, several documents are required to substantiate your claims. These typically include:

- Proof of income, such as pay stubs or tax returns.

- A list of all debts, including credit cards, loans, and mortgages.

- Documentation of assets, including bank statements and property deeds.

- Any prior bankruptcy filings or court documents.

Having these documents ready can streamline the filing process and ensure that all necessary information is provided.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for anyone using the Official Voluntary Online. Typically, bankruptcy filings must be submitted within specific timeframes to avoid penalties. Important dates may include:

- The date by which the form must be submitted to initiate bankruptcy proceedings.

- Deadlines for submitting additional documentation if requested by the court.

- Dates for required hearings or meetings with creditors.

Staying informed about these deadlines can help ensure compliance and protect your interests throughout the bankruptcy process.

Quick guide on how to complete official voluntary online

Complete Official Voluntary Online effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Official Voluntary Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Official Voluntary Online with ease

- Locate Official Voluntary Online and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Official Voluntary Online while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the official voluntary online

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a US bankruptcy petition?

A US bankruptcy petition is a legal document filed with the bankruptcy court to initiate the bankruptcy process. It allows individuals or businesses to seek relief from debts and obtain a fresh financial start. Understanding how to properly complete and file a US bankruptcy petition is crucial for successfully navigating bankruptcy proceedings.

-

How can airSlate SignNow help with my US bankruptcy petition?

airSlate SignNow provides an easy-to-use platform for preparing and electronically signing your US bankruptcy petition. With features like customizable templates and document sharing, airSlate SignNow streamlines the process, making it efficient and organized. This ensures that your paperwork is completed correctly and submitted on time, reducing potential delays.

-

What are the costs associated with filing a US bankruptcy petition using airSlate SignNow?

The costs for filing a US bankruptcy petition through airSlate SignNow vary depending on the package you choose. Our platform offers flexible pricing plans to accommodate different business needs, making it a cost-effective solution. Additionally, using airSlate SignNow can save you money on printing and mailing expenses.

-

What features does airSlate SignNow offer for US bankruptcy petitions?

airSlate SignNow includes several features specifically designed for handling US bankruptcy petitions, such as eSignature functionality, document templates, and secure storage. These tools enhance accuracy and improve collaboration with legal counsel. Additionally, our platform allows for easy tracking of document status, ensuring you stay informed throughout the process.

-

Is airSlate SignNow compliant with legal requirements for US bankruptcy petitions?

Yes, airSlate SignNow is fully compliant with legal requirements for submitting US bankruptcy petitions electronically. Our platform adheres to industry standards and regulations to ensure your documents are legally binding and secure. You can trust that your filings meet the necessary legal criteria for acceptance by bankruptcy courts.

-

Can I integrate airSlate SignNow with other tools for my US bankruptcy petition process?

Absolutely! airSlate SignNow offers integrations with various tools and software that are commonly used in the bankruptcy filing process. This allows you to connect your existing systems, streamline workflows, and improve overall efficiency when preparing your US bankruptcy petition and associated documents.

-

What are the benefits of using airSlate SignNow for a US bankruptcy petition?

Using airSlate SignNow for your US bankruptcy petition provides multiple benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the document preparation and eSigning process, allowing you to focus on other important aspects of your case. Additionally, our user-friendly interface makes it accessible for anyone, regardless of technical skills.

Get more for Official Voluntary Online

- Scca703 amended 082009 sc judicial department sccourts form

- Scca 446 42010 sccourts form

- Certificate of service form fulton county superior court

- Petsmart medication form

- Who is the head ombudsman in texas child support form

- Intern evaluation form pdf lsa umich

- Idaho sheep experiment station externship form

- Death certificate pdf hilliard funeral home form

Find out other Official Voluntary Online

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online