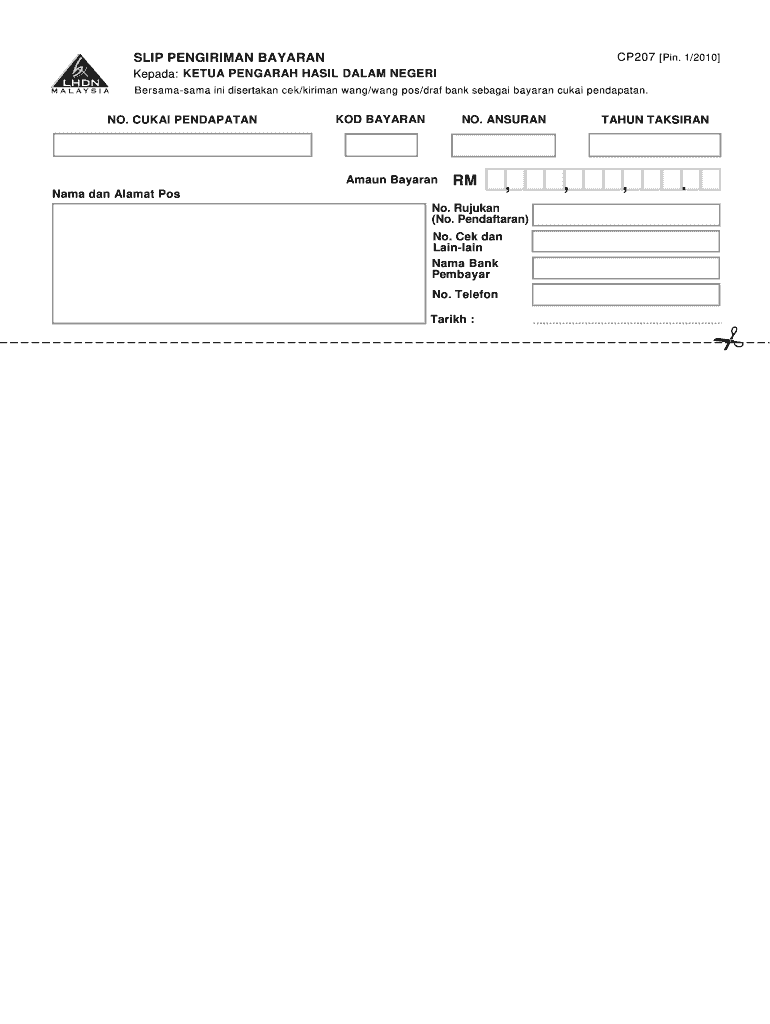

Cp207 Form

What is the Cp207

The Cp207 is a specific form used in the context of financial transactions and reporting in Malaysia. Although it is not commonly used in the United States, understanding its purpose can be beneficial for businesses and individuals involved in international dealings. The form is primarily associated with the reporting of payments and is often required for tax purposes. It serves as a record of transactions and helps ensure compliance with financial regulations.

How to use the Cp207

Using the Cp207 involves several steps. First, gather all necessary information related to the payment being reported. This includes details about the payer, payee, and the amount involved. Next, fill out the form accurately, ensuring all fields are completed according to the guidelines. Once the form is filled, it should be submitted to the relevant tax authority or financial institution. It is important to keep a copy of the completed form for your records.

Steps to complete the Cp207

Completing the Cp207 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including invoices and payment receipts.

- Access the Cp207 form, which can often be found on official tax authority websites.

- Fill in the required fields, including payer and payee information, transaction details, and amounts.

- Review the form for accuracy and completeness before submission.

- Submit the form to the appropriate authority, either electronically or by mail.

Legal use of the Cp207

The legal use of the Cp207 is crucial for maintaining compliance with financial regulations. This form is designed to ensure that all reported payments are documented and that the necessary taxes are paid. Failure to use the form correctly can lead to penalties or legal issues. It is essential to understand the legal implications of the information reported on the Cp207 and to ensure that all submissions are accurate and timely.

Required Documents

When completing the Cp207, certain documents are required to support the information provided on the form. These may include:

- Invoices related to the payments being reported.

- Receipts or proof of payment.

- Identification documents for both the payer and payee.

- Any additional documentation that may be required by the tax authority.

Form Submission Methods

The Cp207 can typically be submitted through various methods, depending on the requirements of the relevant tax authority. Common submission methods include:

- Online submission via the tax authority's official website.

- Mailing a physical copy of the completed form.

- In-person submission at designated tax offices.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Cp207 can result in significant penalties. These may include fines, interest on unpaid taxes, or other legal repercussions. It is important to adhere to all deadlines and ensure that the form is filled out accurately to avoid these potential issues. Understanding the consequences of non-compliance can help individuals and businesses take the necessary steps to remain compliant.

Quick guide on how to complete cp207

Effortlessly Prepare Cp207 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage Cp207 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign Cp207 with Ease

- Obtain Cp207 and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Cp207 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp207

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is slip bayaran and how does it work with airSlate SignNow?

Slip bayaran refers to a payment slip or receipt that confirms a transaction. With airSlate SignNow, you can easily create, send, and eSign slip bayaran documents, ensuring that all essential payment details are securely captured and shared. This process streamlines transactions and enhances the overall payment experience.

-

How can I create a slip bayaran using airSlate SignNow?

Creating a slip bayaran with airSlate SignNow is simple. You can use our customizable templates to design your slip bayaran, adding required fields for signatures and payment details. Once your document is ready, you can send it out for eSignature with just a few clicks.

-

What are the benefits of using airSlate SignNow for slip bayaran?

Using airSlate SignNow for slip bayaran offers several benefits, including enhanced security, faster processing times, and legal compliance. Our platform ensures that your payment slips are securely signed and stored, reducing the risk of fraud and increasing efficiency in transaction management.

-

Is airSlate SignNow suitable for small businesses needing slip bayaran?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses needing slip bayaran. Our flexible pricing plans allow you to choose a solution that fits your budget while still providing access to all necessary features for efficient payment management.

-

Can I integrate airSlate SignNow with other tools for managing slip bayaran?

Yes, airSlate SignNow offers robust integrations with various platforms to help manage slip bayaran efficiently. You can connect with tools like CRM systems, payment processors, and document management applications to streamline your workflow and enhance productivity.

-

What types of documents can I create alongside slip bayaran with airSlate SignNow?

Alongside slip bayaran, you can create various types of documents with airSlate SignNow, such as contracts, agreements, and invoices. Our platform provides a wide range of templates and customization options, making it easy to design documents that meet your business needs.

-

How does airSlate SignNow ensure the security of my slip bayaran?

airSlate SignNow ensures the security of your slip bayaran through advanced encryption and secure cloud storage. We comply with industry standards and regulations, so you can trust that your payment documents are protected from unauthorized access and data bsignNowes.

Get more for Cp207

Find out other Cp207

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation