Jamaica Charity Form

What is the Jamaica Charity Form

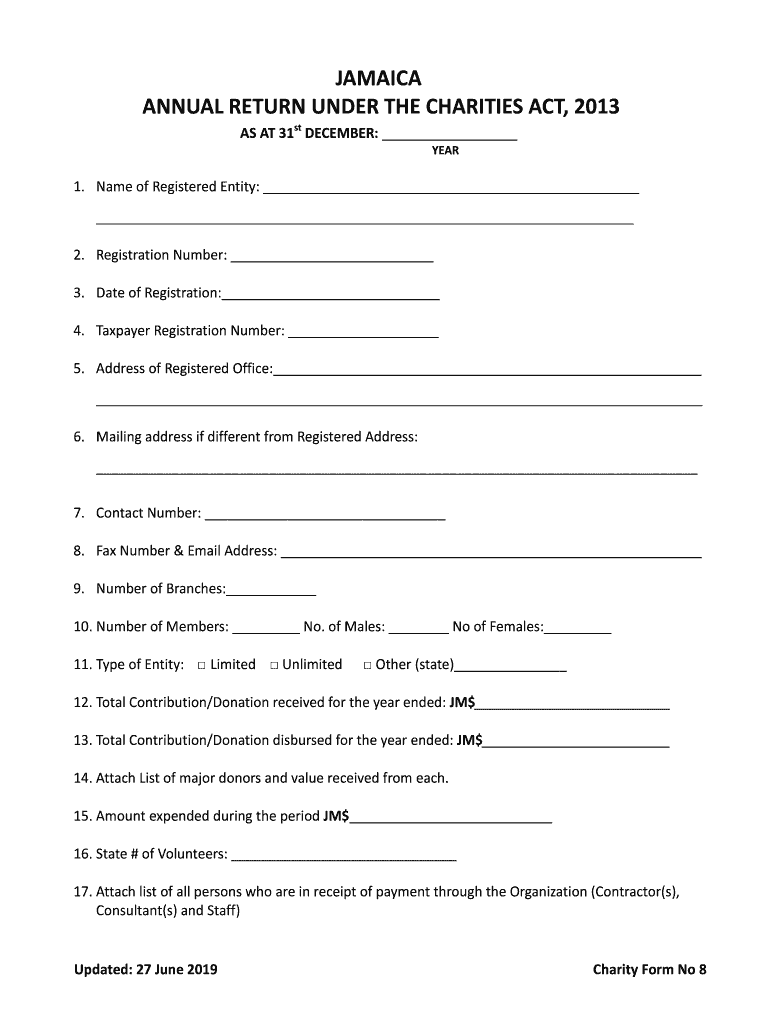

The Jamaica Charity Form is a crucial document used by nonprofit organizations in Jamaica to report their financial activities and ensure compliance with local regulations. This form, often referred to as the Jamaica Charity Return, provides essential information about the charity's income, expenditures, and overall financial health. It is designed to maintain transparency and accountability, allowing stakeholders to understand how funds are utilized within the organization.

Steps to complete the Jamaica Charity Form

Completing the Jamaica Charity Form requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation: Collect financial statements, bank records, and any other relevant documents that reflect the charity's activities over the reporting period.

- Fill out the form: Accurately enter information regarding income, expenses, and any other required details. Ensure that all figures are correct and reflect the charity's financial status.

- Review for accuracy: Double-check all entries for errors or omissions. This step is crucial to avoid penalties for non-compliance.

- Submit the form: Choose the preferred method of submission, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal use of the Jamaica Charity Form

The Jamaica Charity Form must be filled out in compliance with local laws and regulations governing nonprofit organizations. Legal use of this form ensures that charities maintain their tax-exempt status and adhere to reporting requirements. Accurate completion of the form helps prevent legal issues, including penalties or loss of charitable status.

Filing Deadlines / Important Dates

Timely filing of the Jamaica Charity Form is essential to avoid penalties. Organizations should be aware of the following important dates:

- Annual filing deadline: Typically, charities must submit their returns by a specific date each year, often aligned with the end of their financial year.

- Extensions: Some organizations may apply for extensions, but they must adhere to the rules set by the regulatory body.

Required Documents

To successfully complete the Jamaica Charity Form, several documents are typically required. These include:

- Financial statements: Comprehensive reports that detail the charity's income and expenses.

- Bank statements: Documentation of all transactions conducted during the reporting period.

- Board meeting minutes: Records of discussions related to financial decisions and organizational activities.

Form Submission Methods

Organizations have multiple options for submitting the Jamaica Charity Form. These methods include:

- Online submission: Many charities opt for digital submission, which can streamline the process and provide immediate confirmation of receipt.

- Mail: Paper submissions can be sent directly to the relevant regulatory body, but organizations should allow sufficient time for delivery.

- In-person submission: Some charities may choose to deliver their forms in person, ensuring direct interaction with regulatory officials.

Quick guide on how to complete jamaica charity form

Finalize Jamaica Charity Form seamlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Handle Jamaica Charity Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Jamaica Charity Form with ease

- Find Jamaica Charity Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Jamaica Charity Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jamaica charity form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the jamaica charity return process?

The jamaica charity return process involves filing a tax return each year to report your income and claim deductions for charitable donations. This ensures that charities in Jamaica can operate smoothly and that donors can benefit from tax incentives when contributing to these organizations.

-

How can airSlate SignNow help with jamaica charity return documentation?

AirSlate SignNow provides a streamlined solution for managing and signing necessary documents related to your jamaica charity return. Our platform allows you to create, store, and share your documentation effortlessly, ensuring that you meet all filing deadlines while staying organized.

-

What are the costs associated with filing a jamaica charity return?

The costs for filing a jamaica charity return can vary based on the complexity of your paperwork and the services you choose. While airSlate SignNow offers affordable pricing plans to facilitate document management and eSigning, other financial considerations may include potential fees for accountants or tax advisors.

-

Are there any benefits to filing a jamaica charity return online?

Filing your jamaica charity return online through airSlate SignNow offers several advantages, including enhanced security, speed, and convenience. You can complete your documentation from anywhere at any time, ensuring you never miss critical deadlines.

-

Can airSlate SignNow integrate with other tools for jamaica charity return submissions?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax software tools, making the jamaica charity return submission process even more efficient. This ensures that your data is organized, accurate, and easily accessible when you need to file your returns.

-

Is airSlate SignNow user-friendly for those unfamiliar with jamaica charity returns?

Absolutely! AirSlate SignNow is designed to be intuitive and user-friendly for anyone, regardless of their experience with jamaica charity returns. Our platform includes helpful resources and customer support to guide you through the process of managing your documents effectively.

-

What features does airSlate SignNow offer that can assist with jamaica charity returns?

AirSlate SignNow provides several features that are beneficial for filing jamaica charity returns, including electronic signatures, customizable document templates, and cloud storage. These tools make the process efficient, secure, and convenient for both organizations and donors alike.

Get more for Jamaica Charity Form

- Chandleraz form

- Homeschool attendance calendar form

- Da form 2696 2013 2019

- Cf 6r env 01 form

- Prescription records online form

- Drec property disclosure final effective 12 1 13 delaware form

- Rubric for food science lab experiments hospitality and tourism cte sfasu form

- Health care proxy appointing your health care agen form

Find out other Jamaica Charity Form

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online