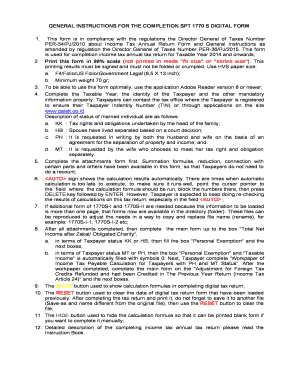

GENERAL INSTRUCTIONS for the COMPLETION SPT 1770 S DIGITAL FORM

General instructions for the completion of SPT 1770 S digital form

The SPT 1770 S form is essential for individuals in the United States to report specific financial information accurately. Completing this form digitally involves several key steps to ensure compliance and accuracy. First, gather all necessary documentation, including income statements, tax deductions, and any relevant financial records. Each section of the form must be filled out completely, ensuring that all figures are accurate and reflect your financial situation. Pay close attention to the instructions provided for each section, as they guide you on how to report your information correctly.

Steps to complete the SPT 1770 S digital form

To complete the SPT 1770 S form digitally, follow these steps:

- Access the digital form through a secure platform.

- Input your personal information, including your name, address, and Social Security number.

- Enter your income details, ensuring that you include all sources of income.

- Fill in any deductions or credits you are eligible for, as specified in the form instructions.

- Review all entries for accuracy before submission.

- Sign the form electronically, ensuring that your signature meets legal requirements.

- Submit the form through the designated method, whether online or via mail.

Legal use of the SPT 1770 S digital form

The SPT 1770 S form is legally recognized when completed and submitted according to established guidelines. Electronic signatures are valid, provided they comply with the ESIGN Act and UETA, which govern the legality of electronic documents and signatures in the United States. It is crucial to ensure that the digital platform used for signing adheres to these regulations to maintain the form's legal standing.

Filing deadlines / Important dates

Filing deadlines for the SPT 1770 S form are typically set by the IRS and may vary each tax year. It is important to stay informed about these dates to avoid penalties. Generally, the deadline for filing is April 15 of each year, but extensions may be available under certain circumstances. Always check for any updates or changes to filing dates to ensure timely submission.

Required documents for SPT 1770 S

To complete the SPT 1770 S form accurately, you will need several key documents, including:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Bank statements

- Any relevant tax documents from previous years

Having these documents ready will facilitate a smoother completion process and help ensure that all information reported is accurate.

Form submission methods

The SPT 1770 S form can be submitted through various methods, including online submission via a secure platform, mailing a printed copy to the designated IRS address, or delivering it in person at an IRS office. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs and timeline.

Quick guide on how to complete general instructions for the completion spt 1770 s digital form

Complete GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to find the correct form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM with ease

- Obtain GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the general instructions for the completion spt 1770 s digital form

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the spt 1770 s, and how does it work?

The spt 1770 s is a specialized template designed for digital signatures and document management. With airSlate SignNow, it allows users to efficiently send, receive, and eSign documents securely. The solution streamlines the signing process, making it faster and more efficient for businesses of all sizes.

-

What are the key features of the spt 1770 s?

The spt 1770 s offers features such as customizable templates, real-time tracking, and robust security measures. These features ensure that your documents are signed quickly while maintaining compliance with industry standards. Additionally, airSlate SignNow allows you to integrate the spt 1770 s with various applications to enhance workflow efficiency.

-

How much does the spt 1770 s cost?

The pricing for the spt 1770 s is competitive, offering different tiers depending on your business needs. airSlate SignNow provides a cost-effective solution that can scale as your company grows. You can explore various plans on the website to find a pricing structure that suits your budget and requirements.

-

Can the spt 1770 s be integrated with other software?

Yes, the spt 1770 s seamlessly integrates with various software applications, enhancing your document management process. airSlate SignNow supports integrations with popular CRMs, project management tools, and cloud storage services. This allows for a more cohesive workflow and better data management across platforms.

-

What benefits does the spt 1770 s provide to businesses?

The spt 1770 s simplifies the document signing process, which can save businesses time and resources. With airSlate SignNow, companies benefit from improved efficiency and reduced paper usage, contributing to a more sustainable operation. Additionally, the solution enhances document security and accessibility.

-

Is the spt 1770 s secure for sensitive documents?

Absolutely, the spt 1770 s is designed with top-notch security features including encryption and legal compliance. airSlate SignNow ensures that your sensitive documents are protected during transmission and storage. This gives users peace of mind when handling confidential information.

-

What type of customer support is available for the spt 1770 s?

airSlate SignNow offers comprehensive customer support for users of the spt 1770 s. You can access resources such as tutorials, FAQs, and dedicated support teams ready to assist you with any issues. This ensures that your experience with the spt 1770 s remains smooth and hassle-free.

Get more for GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM

Find out other GENERAL INSTRUCTIONS FOR THE COMPLETION SPT 1770 S DIGITAL FORM

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will