Disability Premiums Are Paid 100% by the Employee on a Post Tax Basis 2020-2026

What is the Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

The phrase "Disability premiums are paid 100% by the employee on a post tax basis" refers to a specific arrangement where employees contribute fully to their disability insurance premiums using their after-tax income. This means that the premiums are deducted from the employee's paycheck after taxes have been applied, which can have implications for the taxation of benefits received in the event of a disability. Understanding this arrangement is crucial for employees who want to ensure they are adequately covered while being aware of how their contributions affect their tax situation.

Steps to complete the Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

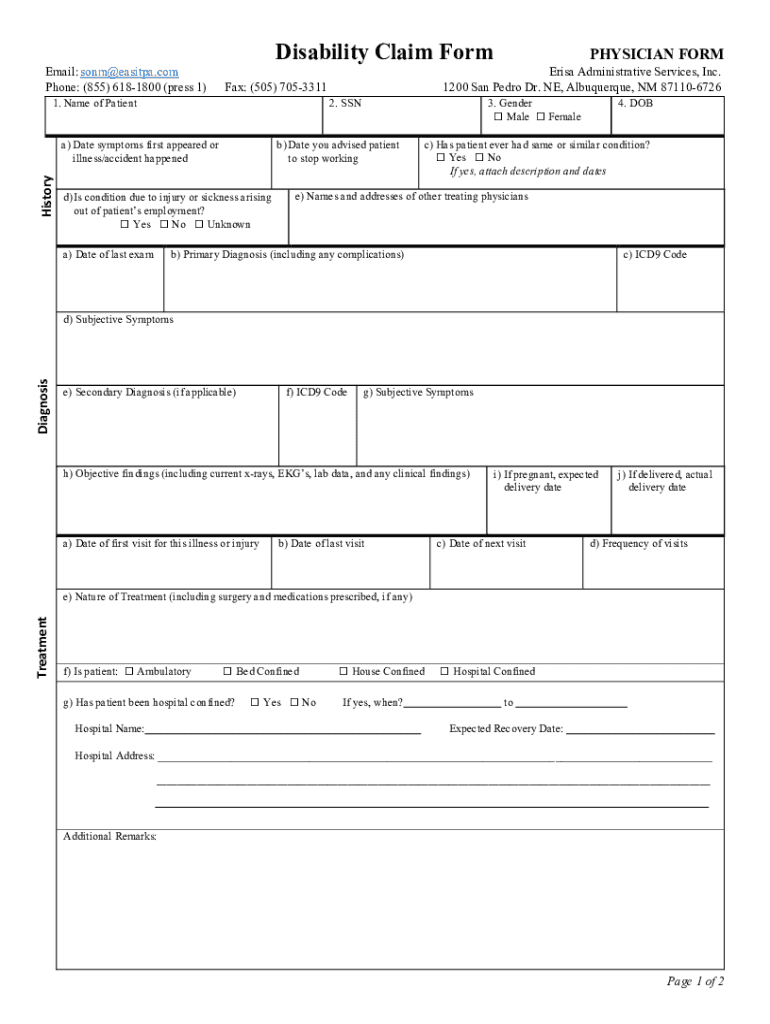

Completing the necessary documentation for disability premiums involves several steps. First, employees should review their employer's disability insurance policy to understand the coverage details. Next, they need to fill out the required forms, ensuring they indicate that the premiums will be paid on a post-tax basis. This may involve providing personal information, employment details, and selecting coverage options. Once completed, the forms should be submitted to the HR department or the designated benefits administrator for processing.

Legal use of the Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

The legal framework surrounding disability premiums paid on a post-tax basis is important for employees to understand. The Internal Revenue Service (IRS) has specific guidelines that govern how these premiums are treated for tax purposes. Since the premiums are paid with after-tax dollars, any benefits received from the disability insurance are generally tax-free. This legal distinction can significantly impact an employee's financial planning, especially in the event of a disability.

Eligibility Criteria

Eligibility for disability insurance premiums paid on a post-tax basis typically depends on the employer's specific policy and the employee's employment status. Generally, full-time employees are eligible to enroll in such plans, while part-time employees may have different criteria. Additionally, some employers may require a waiting period before employees can enroll in the disability insurance program. It is essential for employees to check with their HR department to confirm their eligibility status.

Examples of using the Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

There are various scenarios in which employees might utilize disability premiums paid on a post-tax basis. For instance, an employee who pays their premiums in this manner may find that if they become disabled, the benefits received will not be subject to federal income tax. This can be particularly advantageous for individuals who are concerned about their financial stability during a period of disability. Another example includes employees who may choose to increase their coverage as their income grows, ensuring that their benefits remain tax-free while providing adequate support in case of a disability.

Form Submission Methods (Online / Mail / In-Person)

Submitting the forms related to disability premiums can typically be done through various methods. Many employers now offer online submission options, allowing employees to fill out and submit their forms digitally. This method is often more efficient and secure. Alternatively, employees may choose to submit their forms via mail or in person at their HR department. Each method has its own advantages, and employees should select the one that best fits their needs and preferences.

Quick guide on how to complete disability premiums are paid 100 by the employee on a post tax basis

Prepare Disability Premiums Are Paid 100% By The Employee On A Post tax Basis effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without any hold-ups. Manage Disability Premiums Are Paid 100% By The Employee On A Post tax Basis on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to change and eSign Disability Premiums Are Paid 100% By The Employee On A Post tax Basis with ease

- Obtain Disability Premiums Are Paid 100% By The Employee On A Post tax Basis and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Alter and eSign Disability Premiums Are Paid 100% By The Employee On A Post tax Basis and assure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct disability premiums are paid 100 by the employee on a post tax basis

Create this form in 5 minutes!

How to create an eSignature for the disability premiums are paid 100 by the employee on a post tax basis

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What are disability premiums and how are they paid?

Disability premiums are payments made for disability insurance coverage. It’s important to note that disability premiums are paid 100% by the employee on a post tax basis, meaning the premiums are deducted from your paycheck after taxes have been applied.

-

How do disability premiums affect my net income?

Since disability premiums are paid 100% by the employee on a post tax basis, they can reduce your take-home pay. However, this also means that any benefits received from the disability insurance are generally tax-free, offering financial security during times of need.

-

Can I choose to opt out of paying disability premiums?

The ability to opt out of disability premiums depends on your employer’s policy. If disability premiums are required as part of your employee benefits package, remember that these premiums are paid 100% by the employee on a post tax basis, which may influence your decision regarding coverage.

-

What features does airSlate SignNow offer for managing disability forms?

AirSlate SignNow provides tools for digital document management, making it easier to handle disability forms. With features like eSignature options and secure document storage, you can efficiently process forms related to disability premiums that are paid 100% by the employee on a post tax basis.

-

How does the pricing of disability premiums work?

The pricing of disability premiums can vary based on your coverage level and the provider. Importantly, remember that disability premiums are paid 100% by the employee on a post tax basis, which affects your budgeting and planning for monthly expenses.

-

What are the benefits of choosing airSlate SignNow for disability documentation?

Choosing airSlate SignNow for disability documentation offers efficiency and security. You can streamline the signing process, keep your records organized, and meet deadlines effortlessly, especially concerning documents related to disability premiums that are paid 100% by the employee on a post tax basis.

-

Are there integrations available for managing benefits involving disability premiums?

Yes, airSlate SignNow supports various integrations that can help manage benefits involving disability premiums. You can connect with HR platforms and payroll systems to effectively track payments, especially since disability premiums are paid 100% by the employee on a post tax basis.

Get more for Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

- Oregon voter registration card form

- Oregon transfer firearm form

- Free oregon notary acknowledgment form pdf eforms

- Oregon notary guide form

- Oregon boat title registration form

- Register to vote faqdeschutes county oregon form

- Study guide chemistry boyertown area school district form

- Directors credentail form

Find out other Disability Premiums Are Paid 100% By The Employee On A Post tax Basis

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online